Strong growth ahead for Dancomech; also beneficiary of O&G, Palm Oil

anarchysons

Publish date: Wed, 02 Mar 2022, 03:20 PM

With oil prices closing in on the US$110 level, its no surprise that oil & gas stocks have been providing excitement to the market.

Taking over the rally baton were palm oil stocks, as crude palm oil prices hit the RM7000 per tonne price recently. This was a high not seen since 2008.

One beneficiary of both higher activity in the oil & gas and palm oil sector is Dancomech Holdings Bhd.

Not surprisingly, the company announced solid results for its fourth quarter ended Dec 31, 2021 last Friday.

Its net profit increased 44.23% to RM5.55mil on the back of a 51.6% jump in revenue to RM64.24mil. For the full year, net profit was up 5.15% to RM16.59mil while revenue increased 72.93mil to RM205.39mil.

The company further announced a second interim dividend of 1.25 sen for FY21.

Thus based on a historical basis, Dancomech is trading at a price earnings ratio of 11.79 times with a dividend yield of 3.45%.

In a filing to Bursa, Dancomech said that despite the challenges posed by the Covid-19 pandemic, the group has managed to continue recording growth in revenue and profits in FY21 mainly due to the strong performances showed by its businesses, save for its Trading business.

“In addition, given the good performances showed by its acquiree companies, for example MTL Engineering Sdn Bhd and UTC Engineering Sdn Bhd post acquisition, the Group will continue to seek and explore opportunities for acquisitions and collaborations in order to enhance our profitability,” said Dancomech.

It is worth noting that since 2015, Dancomech has registered a compounded average growth rate of some 20%. From its net profit of RM10.99mil and revenue of RM68mil in FY15, this has now grown to a net profit of RM16.59mil and revenue of RM205mil.

This commendable growth rate has been achieved despite two years of Covid-19.

Strong and sustainable growth ahead

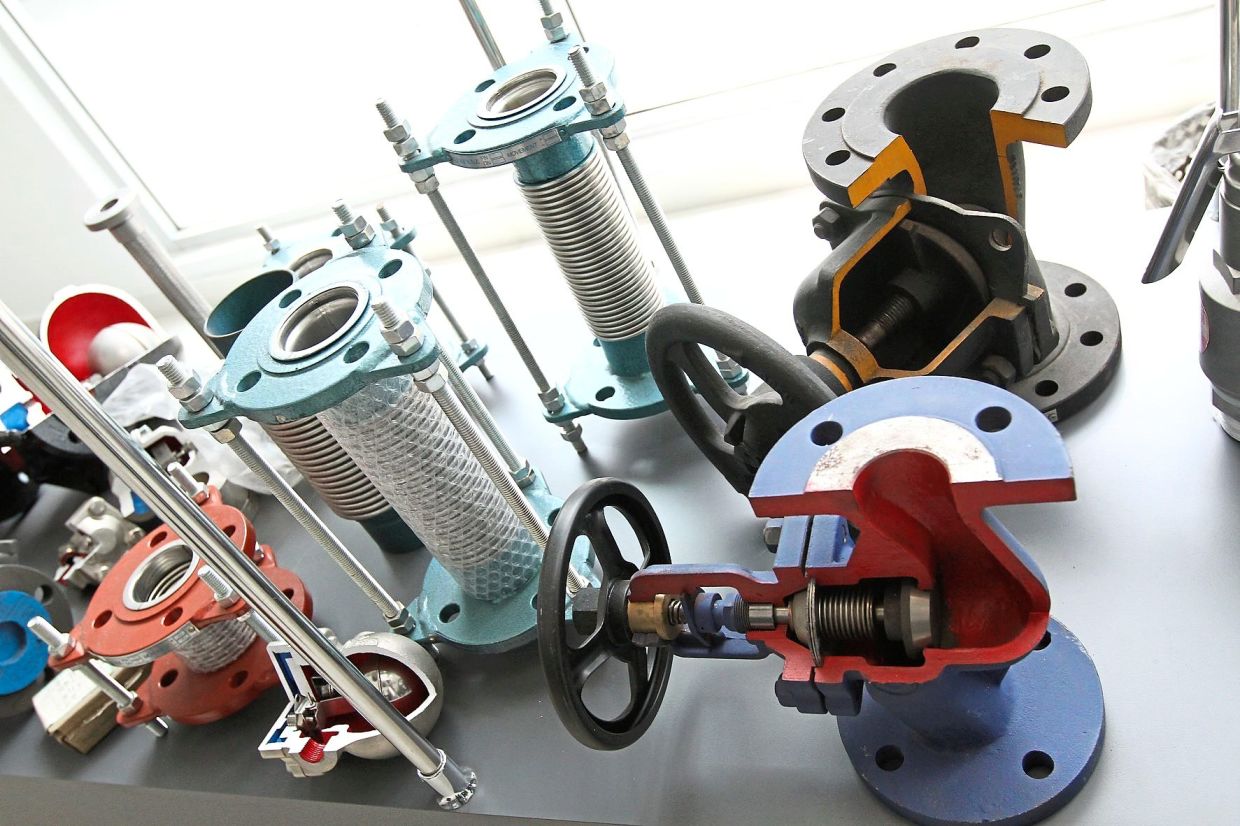

Dancomech is involved in the trading and distribution of process control equipment and measurement instruments and industrial pump.

Their customers are mainly from the palm oil and oleochemicals, oil and gas, and water and wastewater industries.

Currently, they are the market leader in the valve business and their consistent ability to deliver has enabled them to command attractive gross profit margins at some 40%.

Fundamentals and earnings wise, this company is solid.

This is a net cash company, that trades at a single digit PE, pays dividends every year and has NEVER registered a loss.

Dancomech has a 30% dividend payout ratio policy and pays dividends twice a year.

It has cash of about RM70.38mil and debts of about RM12.42mil currently.

Guess what? This cash level is about to increase close to RM100mil.

You see, Dancomech’s 109.86 million warrants are going to expire on May 22, 2022, and as seen from Bursa filings, shareholders have started converting the warrants.

If all 109.86mil warrants are to be converted, the company will come in to another RM32mil.

At cash of RM100mil, and assuming all warrants are exercised, Dancomech shares will be backed by cash per share of 22 sen on a fully diluted basis.

The heavy conversion could be due to a few reasons:

Firstly, the warrants are in the money, in fact even at a discount, at its exercise price of 30. As of Tuesday morning, the warrants were trading at 24 sen while the mother share was at 55.5 sen.

Secondly, shareholders who convert the warrants will be entitled to the second interim dividend that will be paid out in March.

Thirdly and most importantly, Dancomech is expecting a much better 2022, contributed by the new businesses it acquired, particularly in its metal stamping business.

Dancomech made two acquisitions during the pandemic in 2020 and 2021 – it acquired a 70% stake in MTL Engineering Sdn Bhd on Aug 3 2020 for RM23.8mil, and a 55% stake in UTC Engineering Sdn Bhd on April 15, 2021 for RM2.75mil.

Prior to this, MTL Engineering on its own consistently generated net profit of RM5mil to RM6mil per year.

With the 70% stake it owns in MTL, Dancomech should be able to roughly recognize some RM3mil to RM4mil in net earnings per year.

Meanwhile, UTC comes with a profit guarantee of roughly RM458,000 per year for the next six years.

Without MTL and UTC, Dancomech has been consistently making roughly RM15mil net profit per year.

Thus just organically, Dancomech can deliver some RM20mil in earnings for FY22.

We have yet to take into account Dancomech’s RM100mil war chest and the new acquisitions it is looking to make.

Perhaps we needn't wait that long for the market to recognize Dancomech's market value.

More articles on AnarchySons - Stock Ideas

Created by anarchysons | Sep 19, 2022

Citaglobal

Created by anarchysons | Feb 15, 2022

Created by anarchysons | Jan 25, 2022

Created by anarchysons | Nov 19, 2021

Created by anarchysons | Sep 10, 2021

Created by anarchysons | Aug 23, 2021