7070 VIZIONE - Qoq 31/08/2016

Olga

Publish date: Wed, 26 Oct 2016, 12:12 AM

A Review of Quarterly Report 31/08/2016

Quarterly rpt on consolidated results for the financial period ended 31/08/2016

Review of performance – Quarter 1, FY 2017 vs Quarter 1, FY2016

The Group recorded revenue of RM8.61 million, a decrease of 16% over the preceding year’s corresponding quarter, mainly due to the lower billings from the building projects as some of them already completed in quarter 4, FY 2016. The turnover for the current financial quarter was contributed by the construction activities in Tawau and Kota Belud.

The Group’s pre-tax profit for the current quarter stood at RM0.29 million, an increase of 134% as compared to the preceding year’s corresponding quarter, and this is mainly due to the discontinued of loss making electronic manufacturing services after the disposal of subsidiary, Singatronics (Malaysia) Sdn Bhd on 29 January 2016.

Material changes in the profit before taxation for the current financial quarter ended 31 August 2016 as compared with the immediate preceding quarter:-

Increase in sales revenue for the current financial quarter compared to the immediate preceding quarter was due to the higher progressive claims for the construction activities in Tawau and Kota Belud. The Group’s pre-tax profit for the current quarter is 58.73% lower than the immediate preceding quarter was mainly resulting from the absence of the other revenue in current quarter

Future prospects

The Group continue to register encouraging financial results after the improved performance for the financial year ended 31 May 2016. The existing Tawau and Kota Belud projects are expected to contribute positively to the earning of the Group moving forward. This is in line with the Group’s strategy to strengthen its financial position. Arising thereof and due to the favorable outlook of the Program Perumahan Rakyat (PPR) projects, the Group views the venture into PPR projects as promising and wishes to increase its involvement in PPR projects.

The Group will continue to seek and secure new business opportunities and to expand its existing business in the construction and development sectors. The new subcontract works demonstrates the Board’s initiative in pursuing continuing growth in its construction business. The Board believes the new subcontract works will lead to an expansion of the Group’s existing construction activities and contribute positively to the Group’s future financial performance.

Corporate Proposals

The Proposed Capital Reorganisation would serve to rationalise the financial position of Astral by reducing the accumulated losses which would better reflect the value of the Group as represented by available assets. The Board is of the view that as part of the on-going efforts to strengthen the Company’s financial position, it is imperative that the accumulated losses be set-off which will enable the financial position of the Group to be more closely reflective of the value of the underlying assets of Group and to meet its objective of attaining a better financia lposition moving forward.

Additionally, the Group intends to raise funds from the Proposed Rights Issue with Warrants to, amongst others, undertake more sub-contract works for PPR Projects as part of its turnaround plan. The Board is of the view that the PPR Projects would contribute positively to the future earnings of the Group based on our experience in the Melaka PPR Projects’ contribution to the improvement of the Group’s financial performance as well as the favourable outlook for PPR Projects.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | NPM (%) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) | |

|---|---|---|---|---|---|---|---|---|---|---|

| TTM | 35,064 | 1,067 | 3.04 | 0.35 | 36.86 | 0.20 | 1.54 | 0.0560 | 6.30 |

|

| 2016-05-31 | 36,708 | 113 | 0.31 | 0.04 | 312.50 | 0.00 | 0.00 | 0.0556 | 0.72 |

|

| 2015-05-31 | 0 | 0 | - | 0.00 | 0.00 | 0.00 | 0.00 | 0.0552 | - |

|

| 2013-12-31 | 8,993 | -10,081 | -112.10 | -3.49 | -5.44 | 0.00 | 0.00 | 0.1114 | -31.33 |

|

Quarter Result:

A Look into The News..

Vizione posts net profit of RM121,000 in 1Q

by TheEdge, Tue, Oct 25, 2016

KUALA LUMPUR (Oct 25): Vizione Holdings Bhd posted a net profit of RM121,000 in the first quarter ended Aug 31, 2016 versus a net loss of RM833,000 a year ago.

Revenue rose to RM8.6 million, versus RM10.25 million.

The group’s pre-tax profit for the current quarter stood at RM0.29 million, an increase of 134% as compared with the preceding year’s corresponding quarter, and this is mainly due to discontination of loss making electronic manufacturing services, after disposal of its subsidiary, Singatronics (Malaysia) Sdn Bhd, on Jan 29, 2016.

The group continues to register encouraging financial results, after the improved performance for the financial year ended May 31, 2016. The existing Tawau and Kota Belud projects are expected to contribute positively to the earning of the group, moving forward.

This is in line with the group’s strategy to strengthen its financial position. Arising thereof and due to the favourable outlook of the Program Perumahan Rakyat (PPR) projects, the group views the venture into PPR projects as promising, and wishes to increase its involvement in PPR projects. The group will continue to seek and secure new business opportunities and to expand its existing business in the construction and development sectors. The new subcontract works demonstrates the Board’s initiative in pursuing continuing growth in its construction business. The Board believes the new subcontract works will lead to an expansion of the group’s existing construction activities and contribute positively to the group’s future financial performance.

“Our tenderbook is 100% from housing. Infrastructure and property development are in our pipeline,” managing director Dato’ Ng Aun Hooi said.

However, the group’s future plans are subject to earnings from a rights issue, with warrants slated for September 2016, which will hopefully raise between RM30-40 million, according to Ng.

Its current orderbook, which consists solely of construction projects, stands at RM140 million and will sustain the company for two years, according to chief financial officer Simon Lim.

Property is expected to account for 20-30% of the group’s revenue stream, going forward.

Vizione is currently pursuing five Program Perumahan Rayat (PPR) projects, two of which are located in Sabah and the other three in Kedah, Terengganu and Kelantan respectively.

The company has also signed a joint venture with Paragon Residencia for the development of 28 storey apartments in Seri Kembangan.

According to a circular on its rights warrants, the project has a gross development value of RM152.22 million, 80% of which Vizione is entitled to, via its subsidiary, ASD

Vizione Optimistic Of Remaining Profitable In FY17

Managing Director Datuk Ng Aun Hooi said the confidence was based on secured contracts, as well as, future bidding for new projects, particularly in the government's affordable housing projects.

"The group will continue to seek and secure new business opportunities including government projects to expand its existing business in the construction and development sector," he told reporters after the company's annual general meeting here Tuesday.....

Looking at its latest quarterly report 31/08/2016, it is evident that my expectation of Vizione's turnaround plan to be driven by its construction segment, mainly involved in the Projek Perumahan Rakyat (PPR); which is fairly in line with the latest Budget 2017 where Affordable Homes has been the main concerned. And of course its termination in its manufacturing segment.

Going forward with that, the company failed to announced its future projects in PPR.. meaning no new projects are successfully obtained. The latest Kota Belud PPR projects are ongoing projects, we do not see a replenishment or a consistensy in the winning of projects.

Besides PPR, they announced a HOA - Head of Agreement in the Seri Kembangan property project which will be dependent on the Right Issue.

With the Capital Reduction which will be soon to take place, i am assuming the rights issue will follow after.

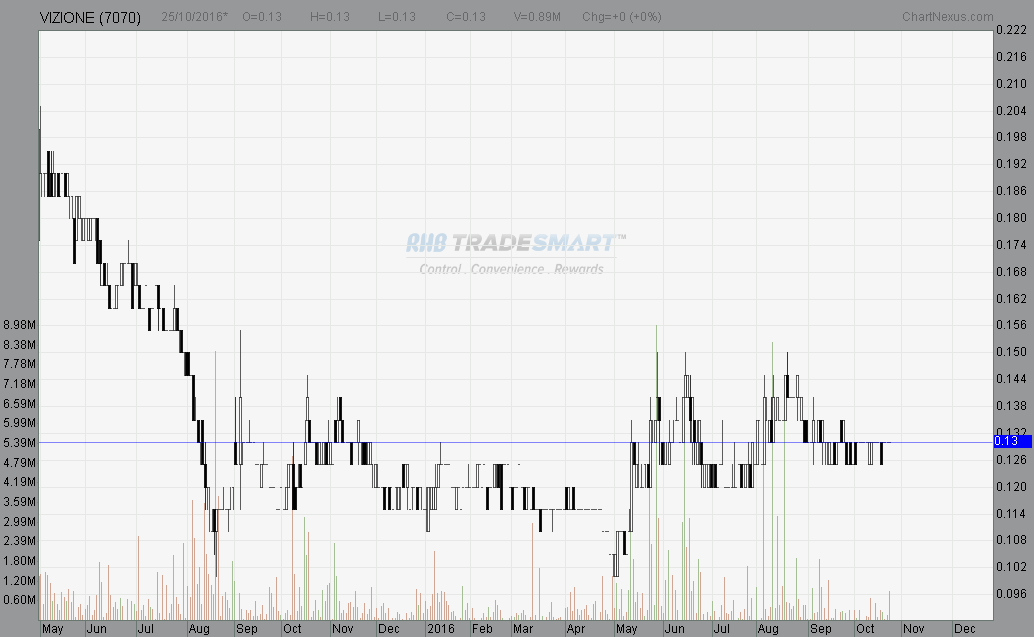

With the latest quarterly report 31/08/2016 its performance is below my expectation. Although news are optimistic about it, but i personally feel its earnings are too little. On top of that, with the lack of new projects, i do not see the demand to subscribe for its rights issue. Looking at the chart, volume is small indicating a lack of buying interest. Perhaps a surge in volume with a drop in price might just indicate things are worst still for Vizione as investors are selling off after its quarterly report 31/08/2016.

Hence, i do not see much in Vizione at the moment.

The above statements are merely my personal opinion.

http://landofinvestments.blogspot.my/2016/10/vizione-qoq-31082016.html

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Olga

7070 VIZIONE - A Turnaround Company in Affordable Homes

http://klse.i3investor.com/blogs/astralsupremebuyingvolume/106977.jsp

2016-10-26 00:24