LKL - Evolving into something more

auntybones

Publish date: Tue, 02 Apr 2019, 07:09 PM

Dear all investors,

Today I want to to highlight to you a high potential stock, LKL Berhad (LKL 0182).

A bit of background on the company:

LKL is principally involved in the provision of medical/healthcare beds, medical equipment, composite dressing, medical peripherals and accessories. Customers include hospitals and medical centres, as well as other healthcare related facilities such as clinics and specialist institutions. Products and brand have been widely used locally and overseas, reaching 50 countries across 6 continents.

Now here are my thoughts on the potential of LKL:

1. Low Total Float

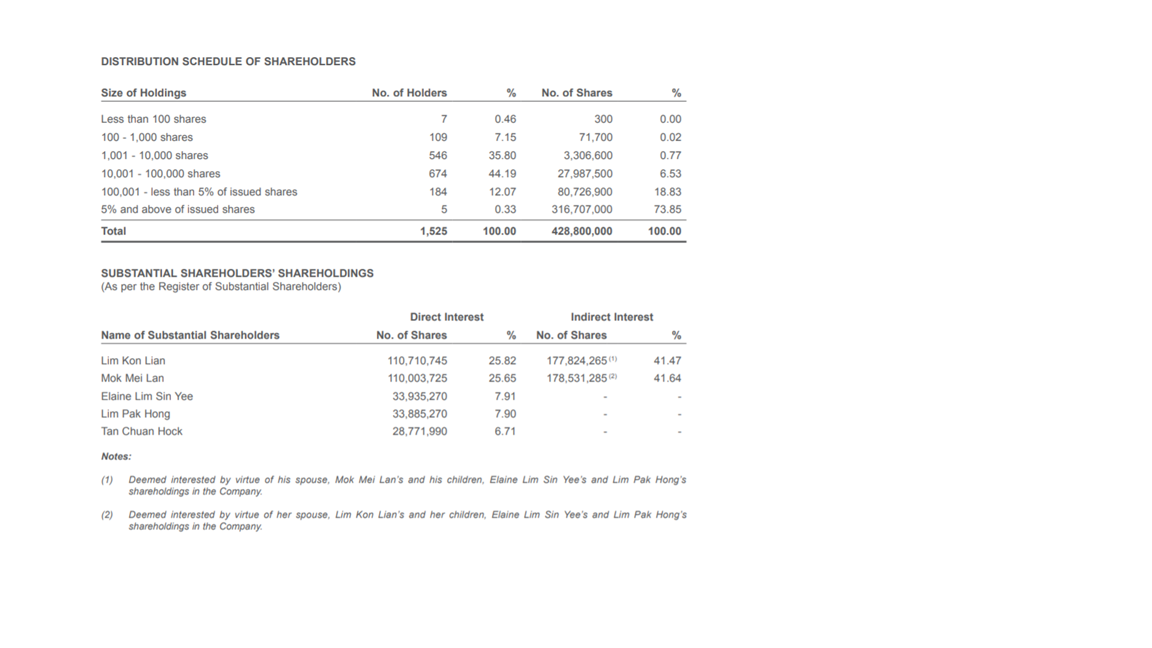

Here is an image taken from the 2018 Annual report for the list of top shareholders in the company:

Referring to the above, the total number of shares outstanding in the company is 428.8m. Seeing as the directors, Lim Kon Lian and Mok Mei Lan and their children, Elaine Lim Sin Yee and Lim Pak Hong holds 288.5m (67.3%) of shares in the company, the effective float of the company is at 140.3m (32.7%) as it is most likely that the family would retain their shareholdings in the company. This would mean that the relatively lower number of shares available for trading can make huge moves to the upside very quickly with a positive catalyst.

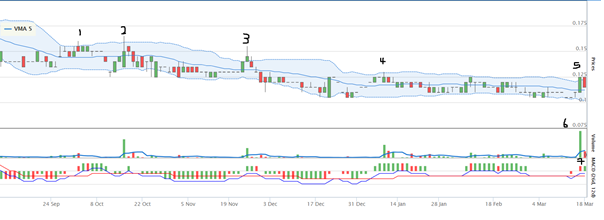

2. Technical Analysis

As we can see from the chart, LKL has been on a downtrend for about 6 months now and there were 4 failed attempts to break the downward trend (point 1-4). Since then it has relatively flatlined until point 5 when there was a breakthrough from the downward trend. This move is also supported by a crossing of the MACD in point 7 and the sharp increase in volume in point 6. From all the signs of the above, I am assuming that the stock is about to turn bullish.

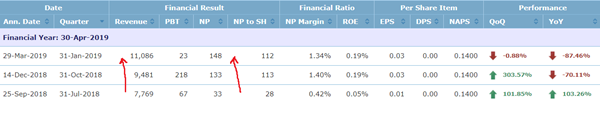

3. Financial Analysis

We can also see that LKL has recorded an increase in revenue (highest ever quarterly revenue recorded for 2018 and 2019) and that the company’s NP has also increased from the previous quarter. The company’s revenue increased by 16.9% or RM1.605m to RM11.086m as compared to RM9.481m in the preceding quarter due to the higher sales from both their trading and manufacturing segments, specifically the higher sales of medical/healthcare beds, peripherals and accessories (total sales from manufacturing segment – RM7.438m, increase of 10.1% from preceding quarter and total sales from trading segment – RM3.648m, an increase of 33.8% from preceding quarter). However, the Group posted a PBT of RM0.023m as compared to RM0.218m from the previous quarter due to lower gross profit margin as a result of the product mix sold and intense market competition. However, the Group posted a NP of RM0.148m as opposed to RM0.133m in the preceding financial quarter which was in tandem with the higher revenue recorded.

In addition, the company has added dermaPACE by Sanuwave Health Inc, which is an advanced medical device used for treating acute and chronic wounds to their product portfolio. Together with the Nihon Kohden products, the inclusion of dermaPACE has expanded the company’s medical device portfolio further which is in line with their commitment of broadening its product offerings and strengthening its position as a comprehensive supplier of medical/healthcare beds, peripherals, accessories and medical devices. The company also has plans to identify opportunities to increase its overseas distributors and agents to grow its market presence as contributions from overseas market only contributed to 15% of the total revenue of the company (extract taken from the latest financial report).

LKL expects their performance to continue improving in the coming quarters with the addition of new medical devices under their portfolio.

4. New Distributorship Agreement with BenQ (What we should focus on)

On 19 March 2019, the Group has recently made an announcement on Bursa pertaining to the distributorship agreement between Medik Gen Sdn Bhd, a wholly-owned subsidiary of LKL and BenQ Medical Technology Corporation to carry out the business of distributing BenQ’s ultrasound system, surgical light and surgical table and its related spare parts and software in Malaysia.

A bit of background on BenQ:

BenQ is a Taiwan-based company principally engaged in the manufacturing, processing, installation and trading of medical equipment. The company provides various medical consumables and medical equipment to major medical institutions in Taiwan and internationally.

Based on the salient terms of the Agreement:

- Medik Gen appointed as BenQ’s distributor to carry out sales activities in Malaysia and can appoint resellers to market and sell the products in Malaysia.

- Agreement shall remain in force for 2 years and expires on 28 February 2021.

What this means to LKL

The distributorship agreement complements the Group’s existing business in the healthcare sector and would allow the Group to broaden its product offerings to its customers via the distribution of the new products from the agreement and allow the Group to expand its customer base in Malaysia. It is highly expected that this would contribute positively to the future financial performance of the Group.

Conclusion

LKL has significant room to grow due to the reasons mentioned above:

a) Low float – ability to make huge upsides quickly with the right catalyst (in this term it would be the increasing portfolio of medical devices)

b) Bullish chart – current breakthrough from the downward trend and MACD crossing along with the spike in increase in volume;

c) Strong quarter results – higher revenue, and net profit along with good prospects in the company; and

d) New distributorship agreement awarded that is expected to increase future financial performance of the Group.

It is my belief that LKL is slowly evolving their business into being a higher value medical supply company with the addition of new products and medical equipment covering the whole spectrum of the industry. Also to add, with the current medical inflation and the constant demand for more hospitals and clinics (which in turn would require medical equipment and peripherals), it is safe to say that LKL at its current share price, has much room to grow.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

abang_misai

Family run business. Heard management got issues.

2019-04-02 20:53