MMode - Severely undervalue Cash company

BaggerHunter

Publish date: Mon, 11 Jun 2018, 08:56 AM

Market cap : RM46m

TP (6-12months) : RM0.52

After GE14, we could see that retail inflows are very strong despite foreign outflows. Sentiment for investment has greatly improved after GE14 and people on the street are looking for good shares to buy and invest.

Before its diversification of business into construction. Mmode used to be Forbes Asia Pacific Best 200 Under A Billion and Top 100 Most Valuable Brand in Malaysia, supplying data content services to telcos. However, as mobile contents has become saturated, a new management has taken over the business and did a silent RTO.

Celcom, Mmode’s main client has migrated into new Content Management Platform, which results in revenue loss in FY2017. Therefore, you could see that Mmode was making losses before FY2017. Subsequently the company has also disposed its non profit making digital business and had also cut down its operating expenses by reducing staff cost and marketing cost in IT segment and the founder, Dato Lim has sold its business to Covina and Mr Ong Chee Koen, the current executive director of Mmode. Since then, the company ha also secured deal with Axiata to reach out to other markets in Asian region. IT business has recovered to profitability and has been stable and is still generating good profits due to the contents and cash they have in the company.

Latest shareholding structure

Covina Sdn Bhd - 31%

Ong Chee Koen - 6%

Construction business via E&J Builders

Before May 2017, E&J Builders was set up and soon, new management has taken over Mode. Mr Ong Chee koen has joined Mmode since 2017. He has more than 38 years of experience in construction industry. The management has completed notable projects like Calvary Convention Centre in Bukit Jalil, Casa Green in Bukit Jalil and Octagon in Ipoh. Within a year, E&J has won 3 contracts from Titijaya namely:

26 May 2017 - RM180m contract awarded by Titijaya PMC. Expect completion date 31 December 2018.

2 Nov 2017 - RM6.64m of Earthworks and Ancillary Sitework from Titijaya PMC Sdn Bhd.

8 June 2018 - RM260.6m of award from Titijaya PMC of construction works for 24 storey mixed commercial development in Kota Kinabalu. Expect completion date May 2021.

After deducting RM53m revenue from construction, outstanding order book is now RM305m. Chanel checks revealed that Titijaya has strong ties with Mr Ong, but that does not stop E&J from getting other contracts from other developers as Casa Green, Calvary Convetion centre and Octagon are not projects under Titijaya.

Profit estimates next year would be close to RM10m if we use historical profit margin of Mmode for its first project, which only values the company at below 4.5x P/E, reasonable for a smallish construction company, but not reasonable FOR A COMPANY THAT HAS NET CASH OF RM50.4m and IS SELLING AT ONLY RM46m market cap, in our opinion.

The company mentioned in its annual report it is in the midst of tendering for few projects and sources revealed that tender book is a billion still. Note that on 5th of June, the company has also set up a JV with Construkt (m) Sdn Bhd, which is a construction company based in Sabah. Looks like there are more construction jobs for Mmode in Sabah going forward and in this case, we have not take into account any future wins.

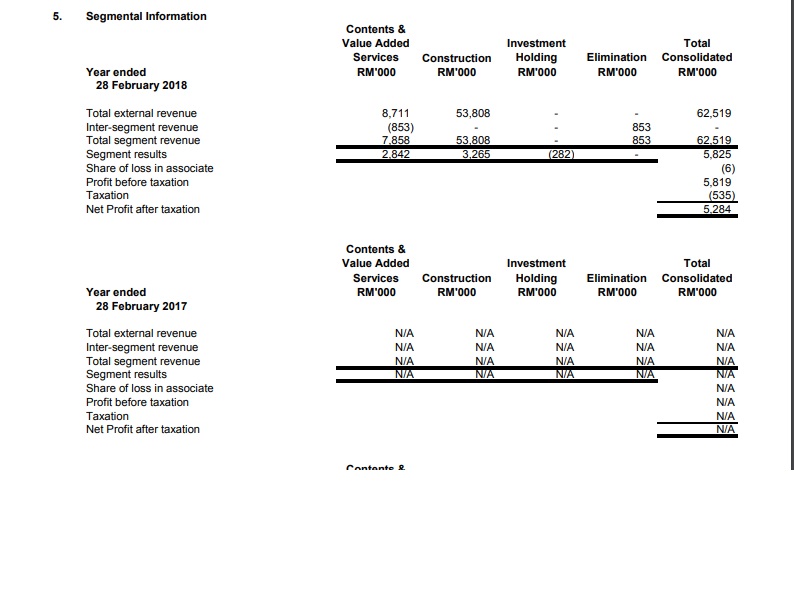

Financial analysis

From this 9 months results, we can see that Mmode's construction PBT margins was about 6% despite start up cost and low economies of scale. With a new project in hand, 6% PAT margin assumption will be conservative and FY2019's construction revenue will breach RM100m with a minimum of RM6m PAT. Thus, coupling with cash on hand and technology business, a PAT of RM10m is kind of in the bag already.

The Sum-of-Part valuation (SOP) for MMode’s existing business are:

Net cash with 0 debts = RM50.4m (net cash of RM47m + RM3.4m other investment which includes money market fund and equity fund)

IT business = RM3m profits every year x 5x P/E = RM15m

Construction outstanding order book (RM305m) x 6% = RM18.3m

Total value of MMode = RM84m

MMode has total 162.7m shares, conservatively we think that Mmode is worth RM0.52 assuming they don’t win anything going forward (which is quite impossible). This provides an upside of 83%.

If we assume Mmode is able to win RM200-300m contract every year going forward, FY2019’s earning could hit RM15m, which only values the company at 3x P/E, ridiculous cheap!

Technical analysis

Mmode hit a high of RM0.44 after they reported a good results last year on Q1 FY2018 for the cash they have at that time too. But it slowly retraced down to even a low of RM0.25, and after 6 months, its cash has increased from RM46.8m to RM50.4m, which proves that the selling down was irrational.

Looks like downtrend will be ended today when the price broke RM0.32 and sustain above that. To unlock this gem, if the company could win another RM100-200m worth of contract, to hit RM0.52 will be just within this year. Note that all time high was RM0.80.

Immediate resistance: RM0.36 and RM0.40.

Immediate support at RM0.25 and RM0.30.

See you at RM0.50 in this year

By Bagger Hunter

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bagger Hunter Series

Discussions

Looks like this stock could reach RM0.80 again if you have the holding power, DBT at RM0.57 has proven this stock's value

2018-06-23 10:56

Primeinvestor

Finally somebody recognise how undervalue is mmode, new blogger?

2018-06-11 10:16