Vis Dynamics - the FORGOTTEN tech BABY

BaggerHunter

Publish date: Tue, 19 Jun 2018, 02:05 PM

Market cap: RM72m

TP (6-12 months): RM0.80

Vis staged a 700% return last year, which is considered one of the darling stock and peaked at RM0.90 late last year, and it crashed to a low of RM0.30, and investors has forgotten this tech baby for long.

Business model

Similar to ViTrox, Vis is involved in semiconductor equipment market, supplying standardised inspection equipment to Outsourced Semiconductor Assembly and Test (OSAT) companies. What are OSAT then? In simple words, they package and test IC chips made by the foundries/ integrated device manufacturers. Maybe you should google it to know more. From the site, we could see Vis has 2 types of machines, namely Gravity and Tray handlers.

What is the similarity and differences between Vitrox and Vis?

Vitrox has 4 main products (MVST, MVSS, ABI and ECS). The only relevant product of Vis is MVST. I am no expert of these products but a dig into their tray handlers, it looks like similar to me, but one thing differs - their gross margin (GPM). Vis' GPM is almost double of Vitrox. According to channel checks, Vitrox' machines are priced lower than Vis, therefore their margins are lower as well. So why Vis' machines could sell at such a premium, it tells you something. Maybe they are the specialist in this segment or their machines' production efficiency are perhaps, better. Nevertheless, Vitrox's MSVT machines only 15% of its revenue, and Vis is no match of Vitrox in terms of their core machines, 3D or X-ray AOI machines.

Who are Vis' clients?

China and Phillipines based OSATs. As you see from here, Vis has been selling to companies in South East Asia and North Asia. With the development of China’s domestic semiconductor industry, much of the growth in OSAT revenues is expected in China. In 2006, there were no China OSATs listed in the top 10 supplier rankings. Ten years later there are three: JCET (acquired STATS ChipPAC), Huatian (acquired FlipChip International), and Tongfu Microelectronics (formerly Nantong Fujitsu). China's plan is to have home-made chips used in smartphones to make up 40% of the local market by 2025, helping cut heavy reliance on imports. This bodes well with Vis for the next few years as they are mostly exporting their machines to China, South Korea and Philippines.

Financial analysis

Vis Dynamics has the highest gross profit margin (GPM) amongst its peers. The beauty about high GPM is that a higher growth company will see a higher operating leverage effect to its bottom line especially for companies that have minimal capex like the equipment makers.

Vis reminds me of Elsoft back in 2013, when market cap was just RM70m. Elsoft too, has a high GPM back in 2013. When their revenue grew by 80% in 2014, share price starts to rerate and after 5 years, Elsoft is worth 10x of what its original market cap was, with very good dividends. The only difference back then was Elsoft has a higher amount of cash to play with, hence, higher income also results in higher profits, and lower tax plays a part too. That does not mean Vis will not hit there eventually.

With current inventory of RM18.4m (highest achieved ever) in Q1 2018, we know that order book of Vis is likely to be all time high, to be delivered over the next 10 months. Inventories in this case are raw materials or machines that are work in progress/ finished goods and most of them were still recognised as cost. From this, we could deduce that Vis could easily hit RM50m revenue in FYE October 2018, and profit of more than RM10m, based on our forecast. Lets wait for results of Q2 2018, either this week or next week, and we will show you whether RM10m is achievable or not.

Valuation

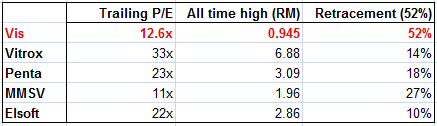

Vitrox is trading at very huge premium compared to its peers. Unlike Vitrox, Vis could potentially grow by more than 50%, and this gives you a PEG of less than 0.24x compared to Vitrox which only gives you about 20-30% growth with a PEG of about 1x. Using 15x P/E, Vis could easily trade up to RM0.80, which gives you a whopping 90% upside if they could deliver RM10m.

You could argue that MMSV only trades at 11.3x trailing P/E, but according to Maybank IB's report, MMSV's profit would fall by 15% this year compared to last year. So who will buy a company that has falling profits with cheap valuation?

Note that highest price achieved last year was RM0.90 when some of the funds invested in Vis, and Vis was trading more than 20x P/E back then.

Look at the retracement. Retracement for Vis is too sharp (52%) from all time high. With all time high order book and 52% retracement, at RM0.44, risk reward ratio is too good to be ignored.

Technical analysis

Vis has completed a downtrend wave 5, and it is consolidating now, waiting for a meaning breakout to start a new uptrend wave. A break above RM0.46 will be an uptrend wave for Vis, and RM0.54 will be the next resistance. Support at RM0.37.

See you at RM0.80.

By Bagger Hunter

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

VenFx

Give u a BIG LIKE

for this warmest regard.

VIS the next Good Huat again :)

2018-06-19 14:25