This Company Hits Highest Revenue in 10 Years!! But the Share Price is Down?

Roman828wood

Publish date: Wed, 28 Aug 2024, 05:48 AM

Let me introduce you to Systech Berhad (KLSE: 0050), a company that has made a name for itself as a provider of Internet of Things (IoT) solutions, software services, Information Technology (IT) services, and Big Data Analytics services which is concluded as Corporate Services (CS) segment, cybersecurity, and e-Logistics solutions.

Despite its impressive credentials and recent financial achievements, there’s a surprising twist in its story that has left many investors scratching their heads.

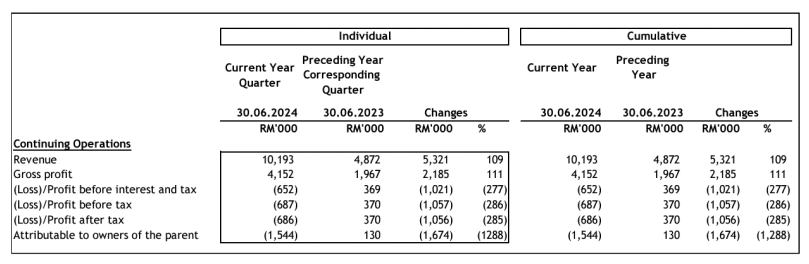

Systech just announced its Q1 FY2025 financial results, and here’s the big news: the company achieved a record-breaking revenue of RM10.19 million.

This is a significant leap from RM4.87 million in Q1 FY2024, driven by strong demand for its services, especially those provided by a newly acquired subsidiary of Systech (more on that shortly).

Following this revenue surge, Systech also reported a gross profit of RM4.15 million, marking an extraordinary 111% growth compared to the RM1.97 million recorded a year ago.

However, despite these impressive figures, the company posted a loss before tax (LBT) of RM0.69 million, a stark contrast to the profit before tax (PBT) of RM0.37 million in Q1 FY2024.

So, what’s going on here?

A closer look at the quarterly report reveals the reasons behind this unexpected loss. Systech incurred significant corporate exercise expenses related to several key initiatives:

1) Employee Share Scheme. The company implemented a scheme allowing up to 15% of the total issued shares to be distributed among employees.

2) Share Issuance. Systech issued 144 million new shares to seven new investors, raising RM51.84 million in the process.

3) Acquisition of Wilstech Sdn Bhd (Wilstech). The company completed the acquisition of 552,255 ordinary shares in Wilstech Sdn Bhd for a total of RM20 million in cash and the issuance of 152.78 million new shares at RM0.360 per share.

4) Bonus Warrants. To reward its shareholders, Systech also issued new bonus warrants.

These corporate exercises significantly increased administrative expenses, which in turn impacted the bottom line. However, if we exclude these one-off expenses, Systech’s PBT would have been much stronger.

It’s also worth noting that Systech’s revenue increased by 41% compared to Q4 FY2024, and the company’s LBT narrowed by 82% thanks to the strong revenue contributions, particularly from Wilstech, which is the newly acquired subsidiary of the company.

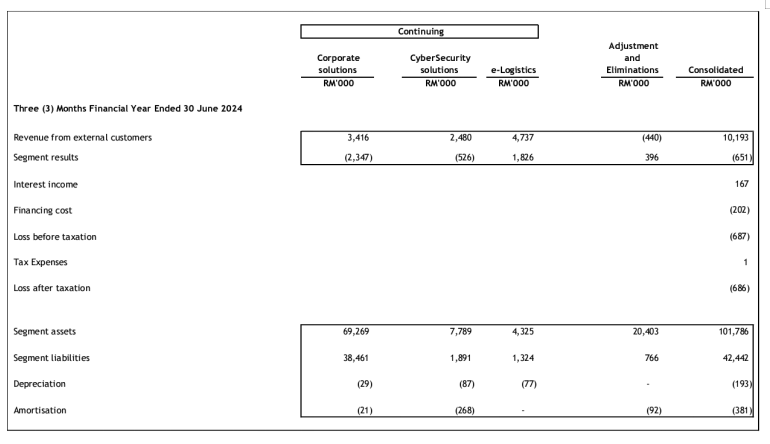

To give you a clearer picture, here’s a breakdown of Systech’s revenue segmentation moving forward.

Overall, despite the temporary dip in profitability due to increased administrative costs from corporate exercises, Systech has delivered a stellar performance this quarter with record revenue.

With promising developments in the IoT segment on the horizon, we believe Systech is poised to be a top-performing technology stock.

Given the company’s strong fundamentals and growth potential, we are re-rating Systech as a “BUY”.

Disclaimer:

This article is intended for informational purposes only and does not constitute financial advice. The opinions expressed in this article are those of the author and do not reflect the official position of any financial institution or advisory firm. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The information provided is based on publicly available data and is believed to be accurate at the time of writing, but no guarantees can be made regarding the accuracy or completeness of the content. The author and publisher are not responsible for any losses or gains resulting from the use of this information.

.png)