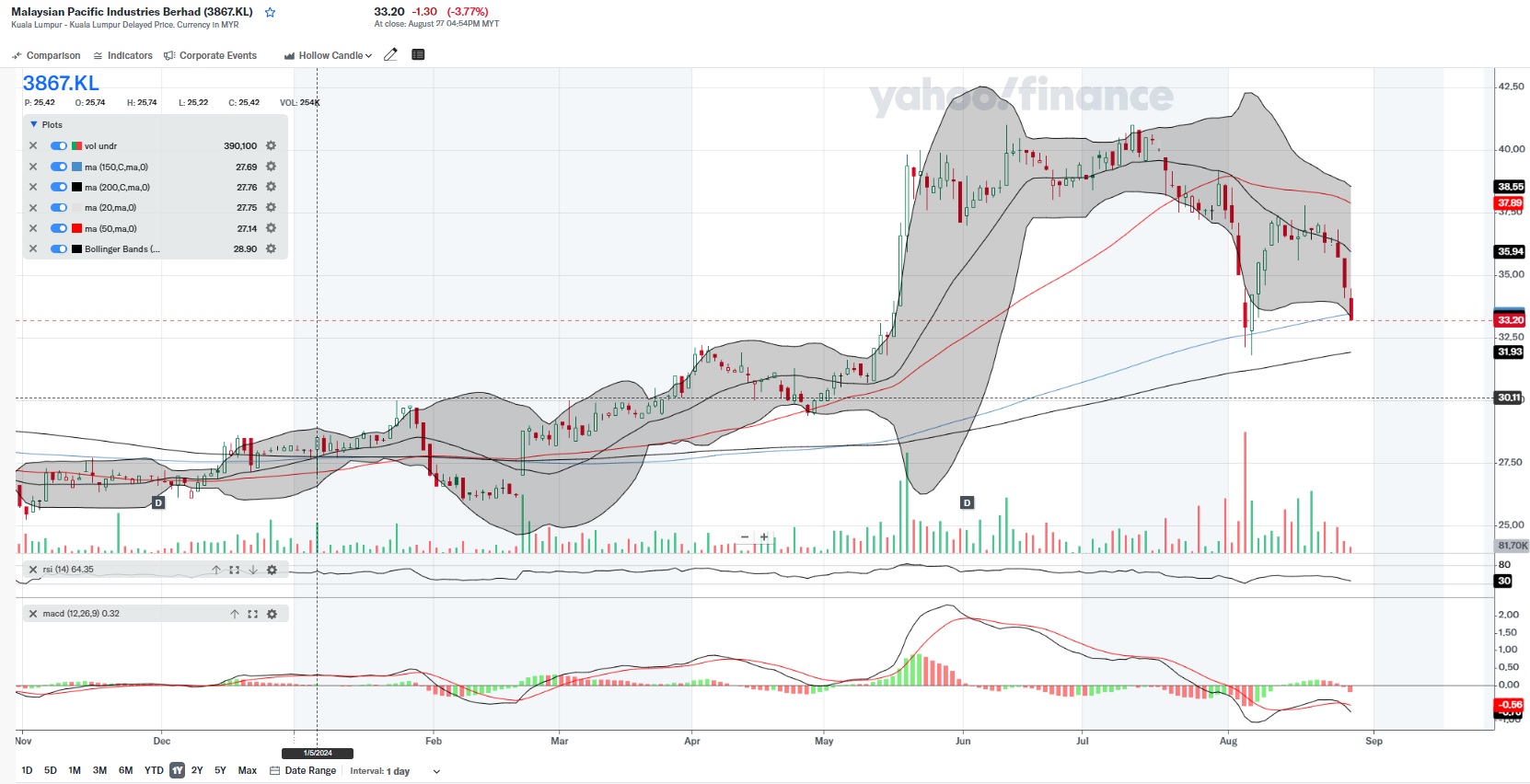

MPI: Finding Support At MA150 and Lower Bollinger Band (Downtrend but Oversold)

KingKKK

Publish date: Wed, 28 Aug 2024, 08:54 AM

TECHNICAL OUTLOOK

Technical Resistance: RM34.80 followed by RM37

Support: RM32 followed by RM30

Price Action: The stock experienced a significant uptrend from May to June, reaching a peak before correcting sharply in August. The current price is below the 50-day and 200-day moving averages, indicating a bearish trend.

Moving Averages: The stock is trading below the 20-day and 50-day moving averages. This is typically a short term bearish signal.

Bollinger Bands: The price has moved outside the lower Bollinger Band, indicating that the stock might be oversold in the short term. However, this can also suggest strong bearish momentum.

Volume: There was a significant increase in volume during the sell-off, which typically confirms the strength of the downward move.

MACD: The MACD is below the signal line, and the histogram shows increasing negative momentum, which supports the bearish trend.

Comment: The stock is oversold and is trying to find support at MA150 or RM33-RM33.50.

LATEST FUNDAMENTAL NEWS

1. According to The Edge, "Malaysian Pacific Industries Bhd’s (KL:MPI) saw its fourth quarter net profit surge nearly 11-fold year-on-year (y-o-y), thanks to higher revenue from its Asia and Europe market segments, as well as a reversal from its executive share scheme provision during the quarter. Commenting on its outlook, MPI said the business environment will remain uncertain due to ongoing geopolitical tensions and the China trade war."

Details

More articles on Stock Market Enthusiast

Created by KingKKK | Aug 27, 2024

Created by KingKKK | Aug 27, 2024

Created by KingKKK | May 13, 2024

.png)