5 Things I Learned From Shangri-La Hotels (Malaysia) Annual Report 2023 (KingKKK)

KingKKK

Publish date: Mon, 13 May 2024, 04:29 PM

These are five things I learned from Shangri-La Hotels (Malaysia) Berhad 2023 Annual Report.

1. Mainly a hotel operator. Shangri-La Hotels (Malaysia) Berhad, a Malaysian investment holding company, operates hotels, beach resorts, a golf course, and manages investment properties. Listed on the Bursa Malaysia, it's part of the Shangri-La Group. Their portfolio includes renowned brands like Shangri-La Hotels, Traders Hotels, and JEN Hotels. You might recognize their iconic Shangri-La Rasa Sayang Resort in Penang.

Shangri-La Rasa Sayang Resort in Penang (picture from Annual Report)

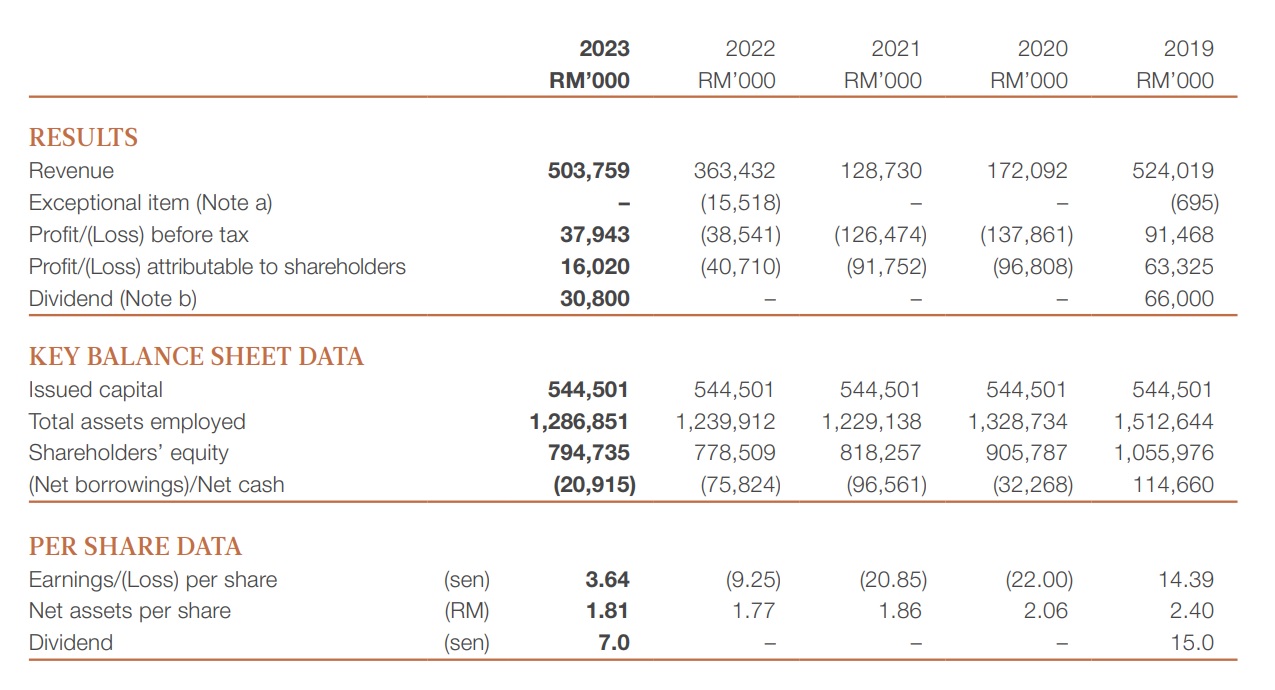

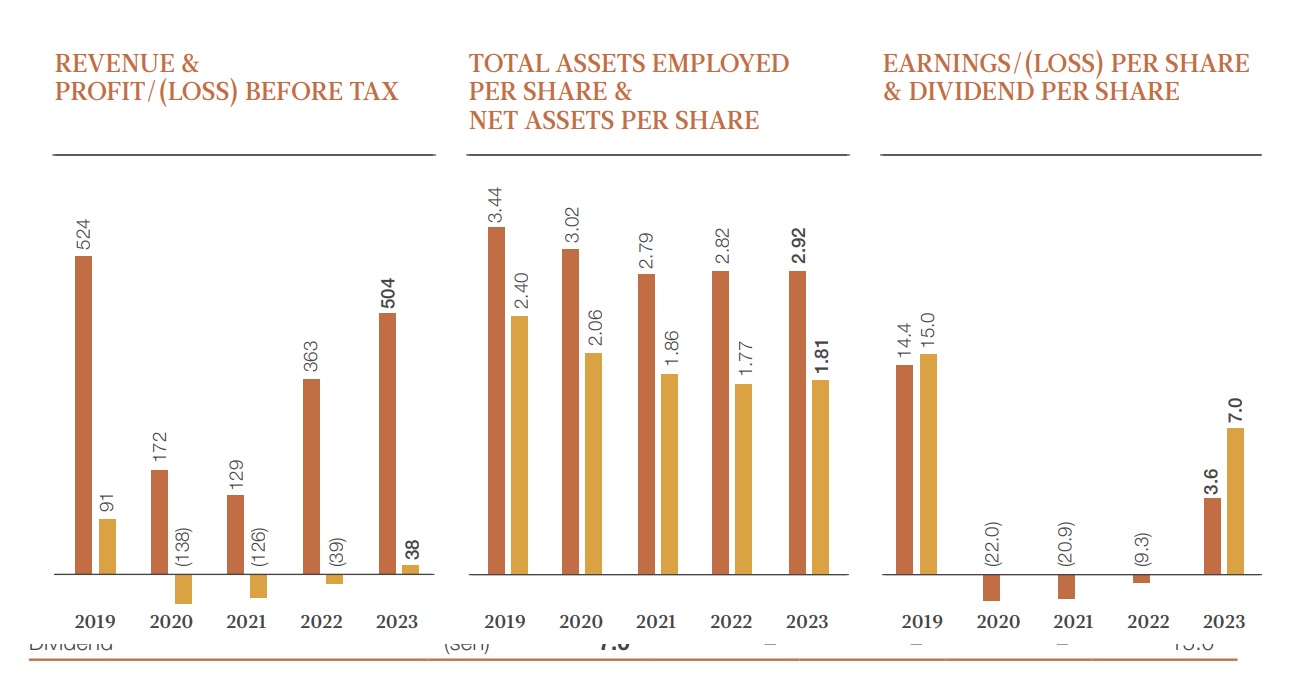

2. Turnaround in 2023. Earnings per share turned positive to 3.64 sen from -9.25 in 2022. This is because net profit is now RM16.02 million as compared to RM40.71 million in 2022. Revenue has surged 39% to RM503.8 million from 2022's RM363.4 million. The underlying reason is that more people are willing to travel now, causing better demand for hotels. Balance sheet also strengthen as net borrowing was down to RM20.9 million against RM75.8 million in 2022.

3. The worst seems to be over in 2021. Due to COVID, the company's revenue and profit have been affected. We can see that the lowest revenue was in 2021, with the worst loss per share in 2020.

4. 2024 likely a much better year. Management believes that travel demand will be resilient through 2024. This is despite an uncertain global economy and ongoing geopolitical tensions. SHANG's hotels and resorts aim to capture rising momentum across the key leisure and corporate travel markets. The recent implementation of the visa-waiver program for visitors from China to Malaysia seems to be the catalyst for all this to happen.

5. To resume dividend payment. SHANG will hold their Annual General Meeting on 29 May. One of the resolutions is to propose a dividend of 7 sen for 2023. This is good news because there were no dividends in 2020, 2021, and 2022. I think that the dividend payment shows that management is confident about its cash flow condition for 2024 and is therefore willing to distribute dividends to shareholders. Q1 2024 earnings will be announced on the same day, May 29. I think it will be a good one, just my guess.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Market Enthusiast

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024