TENAGA - Bursa Magnificent 7 stock with Uptrend Chart and strong Q2 earnings - KingKKK

KingKKK

Publish date: Fri, 30 Aug 2024, 08:55 AM

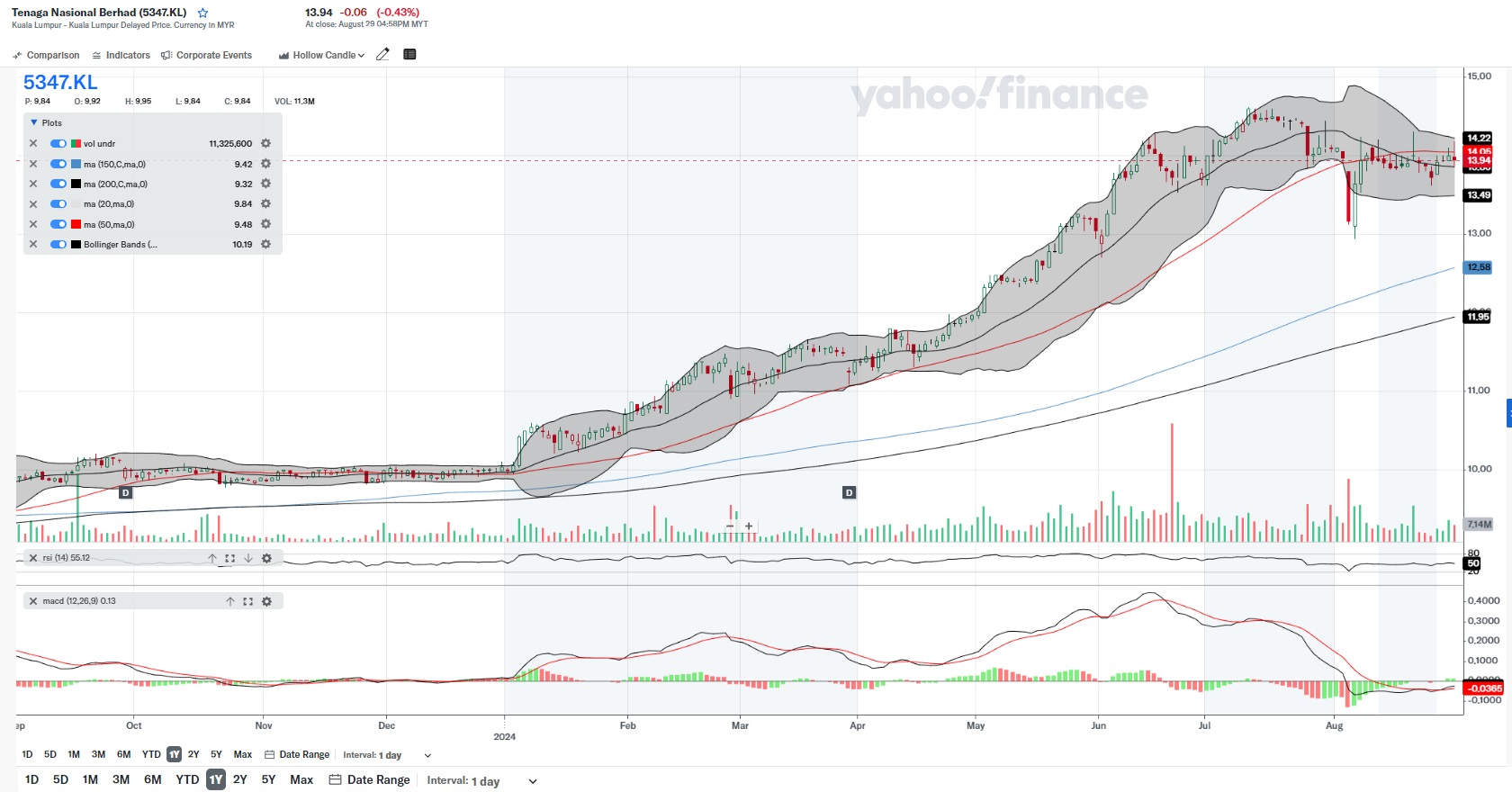

TECHNICAL OUTLOOK: Positive with possible MACD Crossover soon

Moving Averages:

The stock price is above the 150-day, 200-day, 20-day, and 50-day moving averages. This indicates that the trend is still bullish, with short-term averages above long-term ones, showing strength in the uptrend.

Bollinger Bands:

The price is currently near the middle of the Bollinger Bands, suggesting that the stock is not overly bought or sold at this moment. It’s in a consolidation phase after a strong uptrend. A break above the upper band could signal a continuation of the uptrend, while a break below the lower band could indicate a reversal.

MACD (Moving Average Convergence Divergence):

The MACD line is close to the signal line, indicating a possible crossover. A bullish crossover would support an upward move, but the current position suggests momentum might be weakening, so caution is warranted.

RSI (Relative Strength Index):

The RSI is at 55, which is in neutral territory. It’s neither overbought nor oversold, indicating that there’s room for the stock to move in either direction.

Volume:

There’s been a slight decrease in volume recently, which could mean that the upward momentum is slowing down. If the price moves up on higher volume, that would be a more positive sign.

LATEST FUNDAMENTAL NEWS on 29-August-2024

1. TENAGA's revenue improved 8.3% to RM14.37 billion in 2Q 2024 due to higher demand for electricity by 8.4%. This is in line with Malaysia's Gross Domestic Product (GDP) growth of 5.9% in the same quarter.

2. National Energy Transition Roadmap (NETR) story is intact and TENAGA will continue to be the most exposed stock to this theme.

3. The company announced a 25 sen dividend (39% higher than ast year's 18 sen).

DETAILS

1. Company announcement at Bursa

More articles on Stock Market Enthusiast

Created by KingKKK | Aug 30, 2024

Created by KingKKK | Aug 29, 2024

Created by KingKKK | Aug 29, 2024

Created by KingKKK | Aug 28, 2024

Created by KingKKK | Aug 27, 2024

Created by KingKKK | Aug 27, 2024

.png)