SUNWAY (One of Bursa Magnificent 7 stock) - Strong Q2 earnings with Uptrend Intact - KingKKK

KingKKK

Publish date: Thu, 29 Aug 2024, 09:45 AM

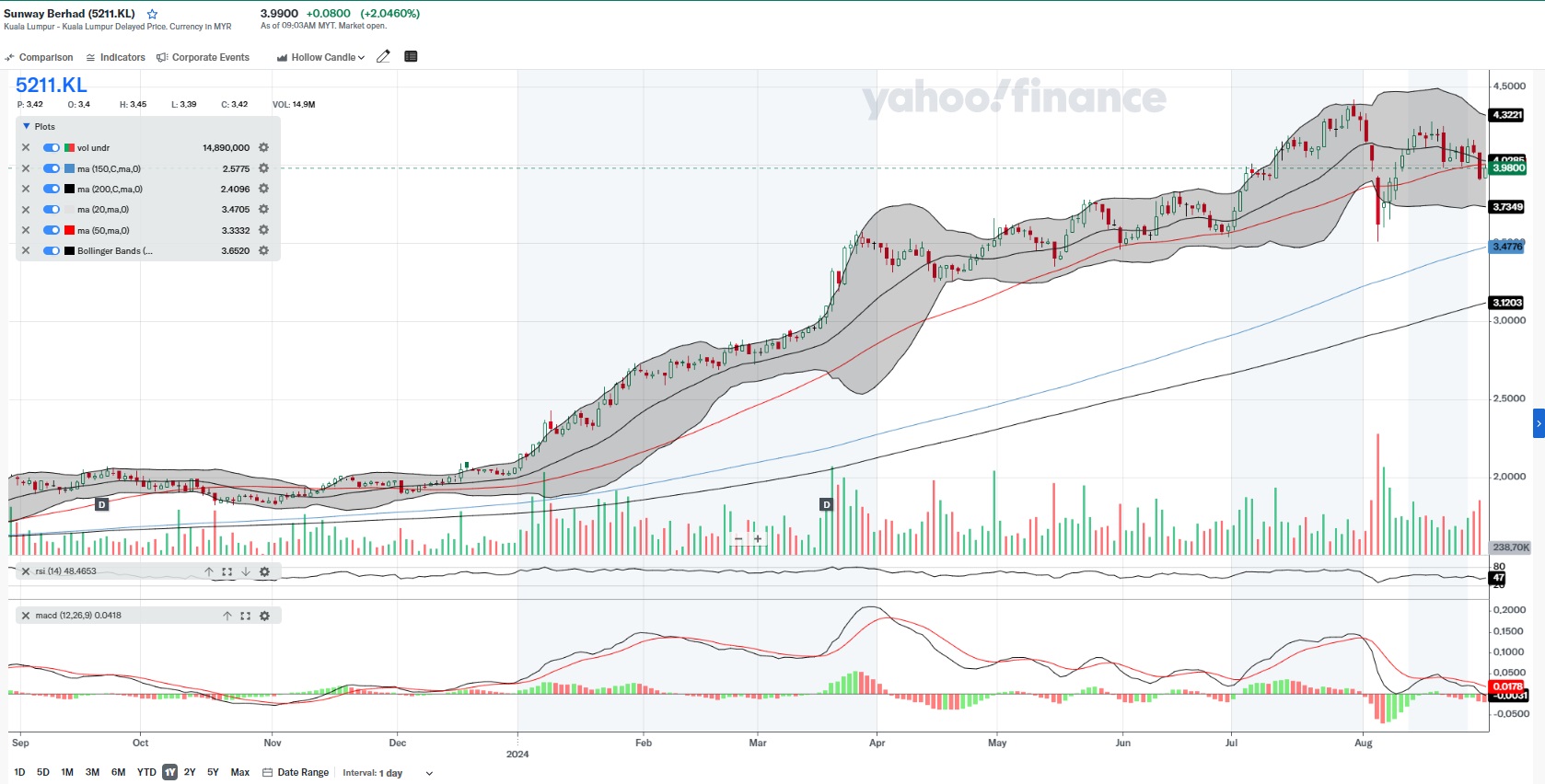

TECHNICAL OUTLOOK

Technical Target: RM4.20 followed by RM4.50

Moving Averages:

The stock price is above the 200-day and 150-day moving averages, suggesting a bullish trend. However, it is near the 50-day moving average, indicating a potential consolidation phase. It is possible that the next surge will be after resting at the 50MA for a while.

Bollinger Bands:

The stock price is within the Bollinger Bands, and the bands are relatively wide, indicating increased volatility. The price has pulled back to the middle band, which could act as support.

Relative Strength Index (RSI):

The RSI is at 47, which is neutral. It neither indicates an overbought nor oversold condition, suggesting there isn't a strong momentum in either direction currently.

MACD (Moving Average Convergence Divergence):

The MACD histogram is below the signal line, indicating bearish momentum. The lines are relatively close, so a crossover could occur if bullish momentum builds up.

Volume:

There is a significant spike in volume recently. This can imply accumulation or distribution. Since the price has not drastically fallen, it might suggest consolidation or a potential build-up for a move.

LATEST FUNDAMENTAL NEWS on 28-August-2024

1. Sunway's revenue improved 7.6% to RM1.58 billion in 2Q 2024 due to better performance from most of its business segments. Profit before tax (“PBT”) jumped 68.0% to RM341 million. This is supported by solid operating performance across all business segments as well as gain from the redemption of an investment.

2. Property sales remains strong at RM773 million in 2Q, higher than MYR498 million last quarter in 1Q 2024.

3. The company announced a 2 sen dividend (similar to last year).

DETAILS

1. Company announcement at Bursa

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-29

SUNWAY2024-08-29

SUNWAY2024-08-29

SUNWAY2024-08-29

SUNWAY2024-08-29

SUNWAY2024-08-29

SUNWAY2024-08-28

SUNWAY2024-08-28

SUNWAY2024-08-27

SUNWAY2024-08-27

SUNWAY2024-08-26

SUNWAY2024-08-23

SUNWAY2024-08-23

SUNWAY2024-08-23

SUNWAY2024-08-22

SUNWAY2024-08-22

SUNWAY2024-08-22

SUNWAY2024-08-21

SUNWAY2024-08-21

SUNWAY2024-08-21

SUNWAY2024-08-20

SUNWAY2024-08-20

SUNWAY2024-08-20

SUNWAY2024-08-19

SUNWAY2024-08-19

SUNWAYMore articles on Stock Market Enthusiast

Created by KingKKK | Aug 28, 2024

Created by KingKKK | Aug 27, 2024

Created by KingKKK | Aug 27, 2024

.png)