Bright packaging bhd- the next master packaging.

masterpackaging

Publish date: Sun, 24 Nov 2019, 03:09 PM

Bright Packaging Industry Bhd is a manufacturer of aluminium foil laminate within Malaysia. The company is engaged in the manufacturing and printing of aluminum foil packaging materials mainly for the tobacco industry. It offers a range of services, including lamination, coating, slitting, and sheeting. Its products include aluminium foil and metallised film laminate to tissue/woodfree/board and inner frame, and they are exported to countries all over the world, including China, Thailand, Australia, UAE, and Germany.

Bright packaging products as shown below, most packaged products are popular consume:

http://www.brightpack.net/our-products.html

Bright Market capital now is RM 45million,

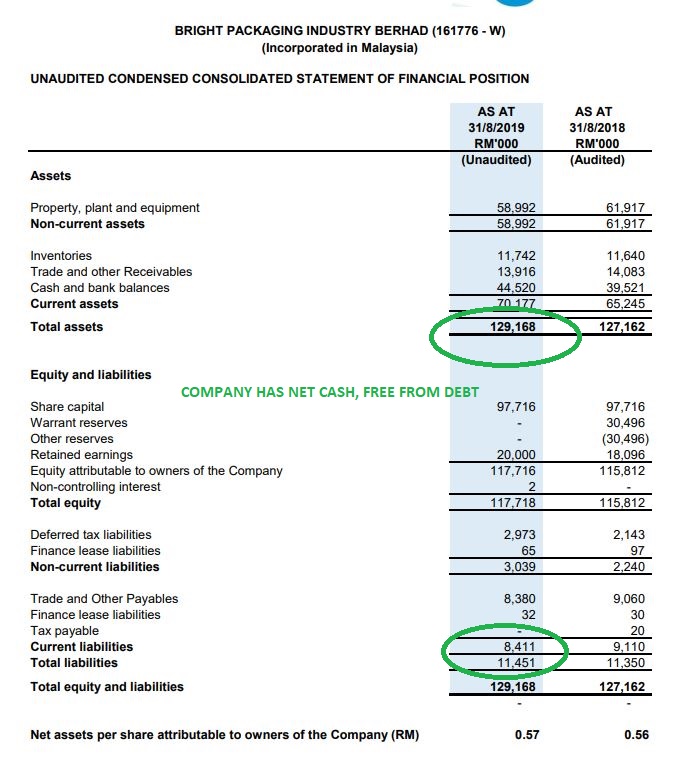

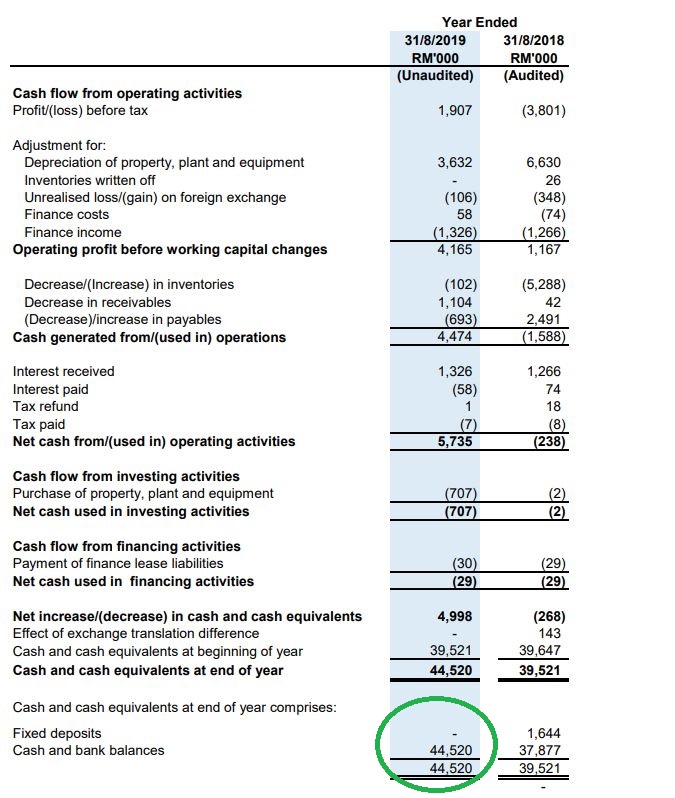

Bright now has cash RM44.520million balance in

bank!!

STOCK PRICE NOW AT RM0.22, while company

holding cash of RM0.22 per share!!!!

And the company has no debt!! Are you kidding!?

Which mean you can take over this company for

freeeee after you cash out the bank balances!!!!(if you

can collect all

shares at RM0.22)

Now let us compare with his competitors, MASTER packaging

As what we realise, BRIGHT Technical Chart showing fish head, it is a sign to swim all the way upwards like Master packaging

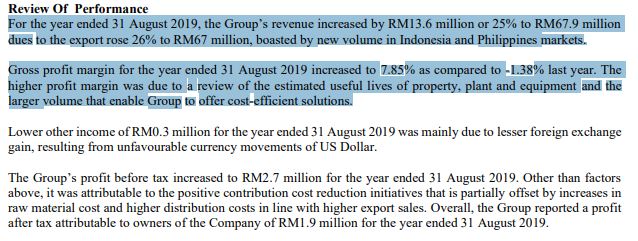

Thanks to Indonesia and Philippines economics , Bright will be the next MASTER!!!!

Based on our Fundamental and technical analysis

Bright has more than 200% potential gain

We are targeting RM1 at the moment

Summary

-Bright packaging products are popular, eg: marlboro, panadol, kitkat and etc

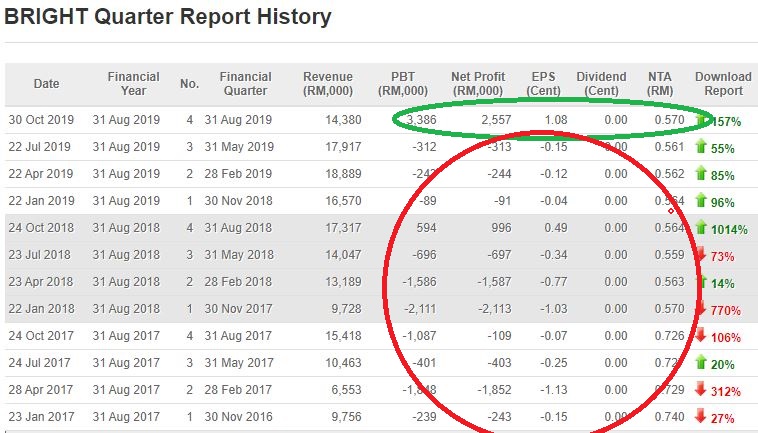

- Bright Profit before tax hit historical high, show same signal as early Master Bhd

-Bright bank balance has RM0.22 per share, now stock price at RM0.22, cheapest of all time

-Bright TA will move like Master TA

-Bright TP is RM1

Disclaimer

At this point of time the writer has a position in BRIGHT. This article is purely meant for educational purposes only and it’s not BUY/SELL recommendation. Please consult your remisier /dealer before making any decision

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on brightpackaging

Created by masterpackaging | Nov 25, 2019

Discussions

if you compare overall revenue 19 to 18, it's improved, the profit margin will continue to improve due to enabled cost efficient ,as you can read in prospect.

2019-11-24 15:58

the revenue only drop for one qr, for long term view, the company successfully enable cost efficient, we believe 2020 company will boost up volume and revenue.no point to achieve higher volume without controling cost

2019-11-24 16:00

Bright customers are msotly tobacco, look at bat, koyak, and they reviewed their depreciation policy, so got negative gains on that

2019-11-25 07:49

Jengacam n Primeinvestor is correct. Surge lately is due all packaging stock rally.

2019-11-25 22:25

Bright Packaging, massive growth 2025 by UK market journal

https://klse.i3investor.com/blogs/brightpackaging/239899.jsp

2019-11-25 23:06

This goreng stock la. U refer back qr. Sometime good sometime bad. No expansion.

2019-11-27 13:25

last quarter they write back their depreciation, only stupeed people will buy bright

2020-01-21 23:50

newbie911

Better buy orna and pphb...more consistent in earning.

2019-11-24 15:25