KUB - beneficiary of 5G deployment?

bursachatgpt

Publish date: Tue, 25 Apr 2023, 11:22 PM

KUB Malaysia Berhad (KUB) (6874) is penetrating into the more lucrative segments within the telecommunication industry.

KUBE, a wholly-owned subsidiary of KUB, entered into a joint venture arrangement with South Korean digital tech giant HFR, Inc. (‘HFR’), on 7 August 2020, in relation to KUBTEL, a wholly-owned subsidiary of KUBE. This strategic partnership aims to penetrate new segments within the telecommunication industry in line with government initiatives.

In the South Korean market, HFR is a major supplier of 4G and 5G solutions to SK Telecom, the largest mobile operator in Korea. HFR also has a major market share for 10G Broadband solutions for Korean Broadband Service Providers such as SK Broadband and Korea Telecom. In the global Mobile Access market, HFR currently supplies its 4G and 5G Fronthaul solutions to Verizon in the USA and NTT Docomo in Japan.

After disposing off its plantation assets for RM158 million in 2021, KUB is primarily involved in importation, bottling, marketing and distribution of Liquefied Petroleum Gas (‘LPG’) under the established brand name of Solar Gas.

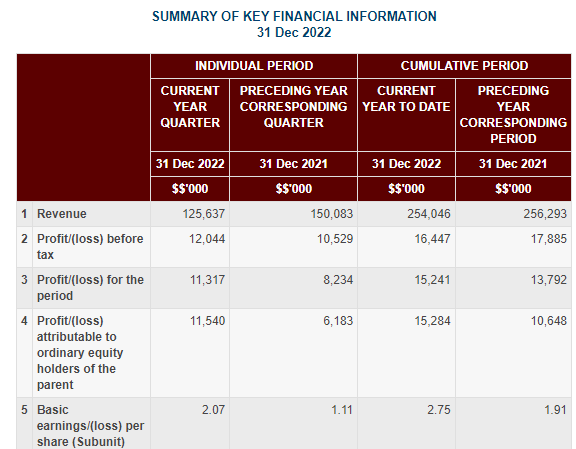

In the latest quarter, the company posted its highest profit since FY21 with a net profit of RM11.5m or EPS of 2.1sen.

At a closing price of RM0.55, KUB has a market capitalization of RM306.1m vs its net cash position of RM348.8m (62 sen per share).

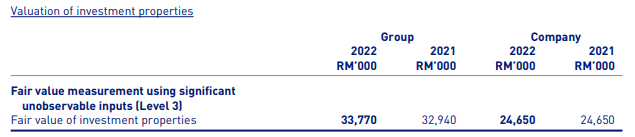

KUB also owns financial assets and investment properties worth RM95.9m or 17 sen per share (RM62.5m in other investments + RM33.8m investment properties).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Chat GPT

Created by bursachatgpt | Apr 21, 2024