Crescendo - Hits Record High after Second Land Deal with Microsoft. More to come?

bursachatgpt

Publish date: Sun, 21 Apr 2024, 12:18 AM

Crescendo (stock code: 6718) surged to a record high of RM3.93 after signing second land deal with US tech giant Microsoft.

Crescendo has sealed a deal with Microsoft Payments (Malaysia) Sdn Bhd for the sale of a vacant parcel of freehold land spanning 1.1 million sq feet (25.34 acres) in Pulai, Johor for RM132.47 million or RM120 per sq ft. The group expects to realise a net gain of RM80.83 million from this recent proposed land transaction.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=146088&name=EA_GA_ATTACHMENTS

Crescendo struck three land deals in 10 days last year!

7 Nov: First disposal - RM 117 million

15 Nov: 2nd disposal - RM 111 million

17 Nov: 3rd disposal - RM 315 million

Including the latest transaction, Crescendo has sold approximately 128 acres for data centre-related development, bringing in sales proceeds of more than RM675 million.

Will there be more upcoming land sales?

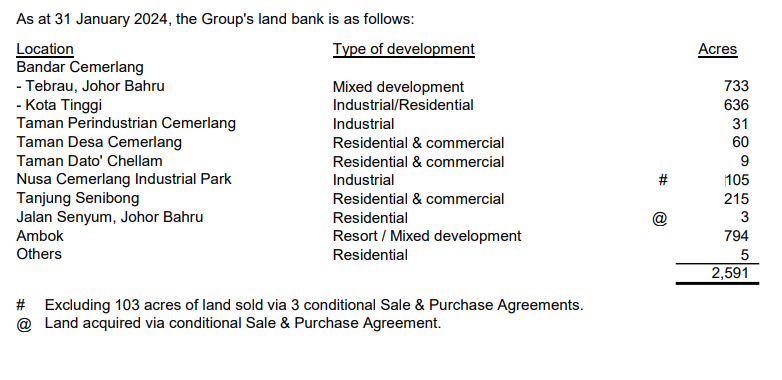

The Group has landbank at NCIP of approximately 105 acres as at 31 January 2024. Including the latest transaction with Microsoft, the balance landbank at NCIP is approximately 80 acres.

4Q FY24 results commentary:

The Group has further launched the balance landbank at NCIP of approximately 100 acres for sales with a GDV of around RM500 million.

The Group also intends to commence the main infrastructure work of the industrial park at Bandar Cemerlang in FY2025 as we plan to launch the first phase for sales within the next three years.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=227626&name=EA_FR_ATTACHMENTS

Approximately 526 acres of lands in Bandar Cemerlang are intended for industrial park development.

Crescendo seems to be the dark horse as the data centre and logistics play picks up in Johor. The company is not selling bare land, as the deals also involve Crescendo obtaining some basic approvals to facilitate the new owners to put up their buildings. https://theedgemalaysia.com/node/707288

The booming demand for lands in Johor coincides with the rising momentum in the Iskandar Malaysia property market, spurred by the proposed revival of the Kuala Lumpur-Singapore high-speed rail (HSR) project and plans for the Johor-Singapore Special Economic Zone.

According to market experts, major landowners are likely beneficiaries. Land prices are expected to escalate further given such momentum.

After sealing second land deal with Microsoft in less than 6 months, it will be interesting to see if Crescendo will continue to unlock the values of its huge landbank in Johor.

It owns more than 2,500 acres landbank in Johor which are mostly acquired in the 1990s and early 2000s. Current market values of these landbanks are multiples of its net book values. A revaluation of its landbank will boost its estimated net asset value (RNAV) to RM10 per share.

For example, the 215-acre prime waterfront land at Tanjung Senibong has not been revalued since 2006. The net book value for this prime asset is only RM18.60 per sq ft. The land cost at Senibong Cove, which is next to Tanjung Senibong, is currently selling at RM200 per sq ft.

https://www.propertyguru.com.my/residential-land-for-sale/near-senibong-village-seafood-3660/priced-under-2m-rm

Including the total net gains of RM390m from all the 4 disposals, its book value will surge to RM4.90 per share.

Compared to its current share price of RM3.70, Crescendo is trading at 25% discount to book value and 63% discount to RNAV of RM10.

What is the fair value for a premier developer of industrial property in Johor with huge undervalued landbank, consistent dividend payout of 50-60%, strong earnings visibility and a proxy to rising industrial land prices amid data centre boom and rising momentum in Iskandar Malaysia?

| Discount to RNAV (%) | Fair Value (RM) |

| 10% | 9.00 |

| 20% | 8.00 |

| 30% | 7.00 |

| 40% | 6.00 |

| 50% | 5.00 |

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|