Crescendo - Received balance disposal consideration of RM299 million from Microsoft. Are special dividends on the cards?

bursachatgpt

Publish date: Sun, 25 Feb 2024, 11:38 PM

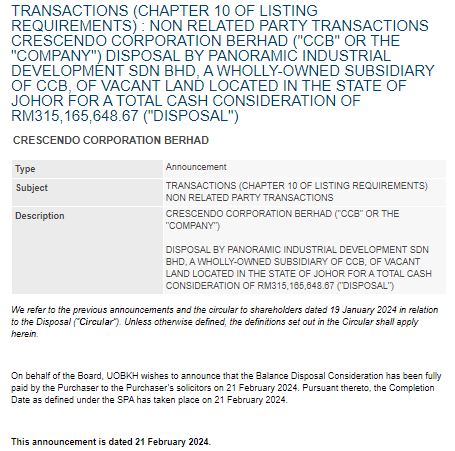

Balance disposal consideration has been fully paid by Microsoft to Crescendo on 21 February 2024.

"On behalf of the Board, UOBKH wishes to announce that the Balance Disposal Consideration has been fully paid by the Purchaser to the Purchaser’s solicitors on 21 February 2024. Pursuant thereto, the Completion Date as defined under the SPA has taken place on 21 February 2024."

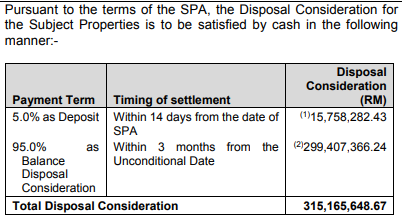

With the payment of the balance disposal consideration of RM299 million, Crescendo's cash level will increase by RM315.16 million this month.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=230558&name=EA_DS_ATTACHMENTS

RM315.16 million is 42% of its current market cap of RM751.64 million.

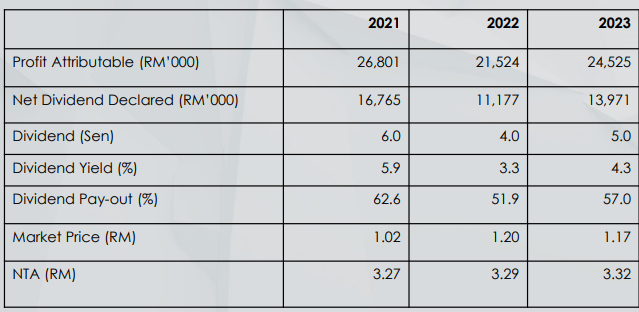

Are special dividends on the cards for Crescendo?

Looking at its track record, dividend pay-out ratio ranged from 52% to 63%.

Crescendo - Profit jumps 270% in third quarter. Launching a further RM500 million land for sale after clinching RM543 million sales in just 10 days. Best deal for 2024?

bursachatgpt

Publish date: Sun, 21 Jan 2024, 04:23 PM

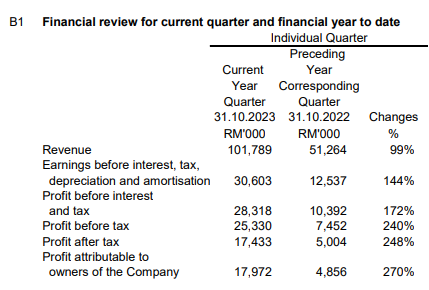

Crescendo (stock code: 6718) saw its net profit for the third quarter ended Oct 31, 2023 rise by 270% to RM17.97 million compared with RM4.86 million a year earlier, underpinned by higher properties sales compounded with high-margin industrial land sale. Quarterly revenue surged by 98.56% to RM101.79 million from RM51.26 million for the previous year.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=226437&name=EA_FR_ATTACHMENTS

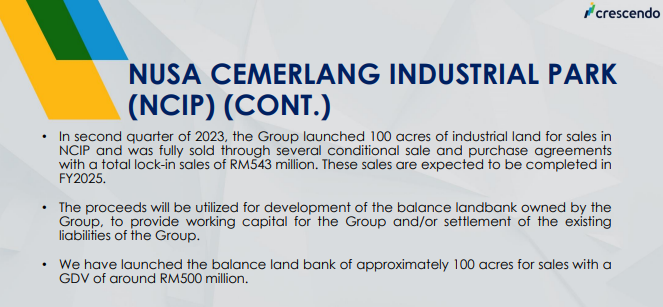

In second quarter of 2023, Crescendo launched 100 acres of industrial land for sales in NCIP and was fully sold with total lock-in sales of RM543.19 million.

In third quarter of 2023, Crescendo launched the balance land bank of approximately 100 acres for sales with a GDV of RM500 million.

What is the total land sales value for 200 acres in NCIP?

What is the current market cap of Crescendo?

What are the remaining land banks you get for free?

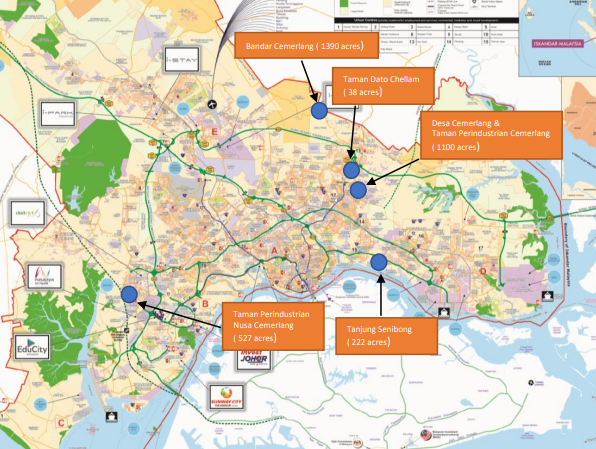

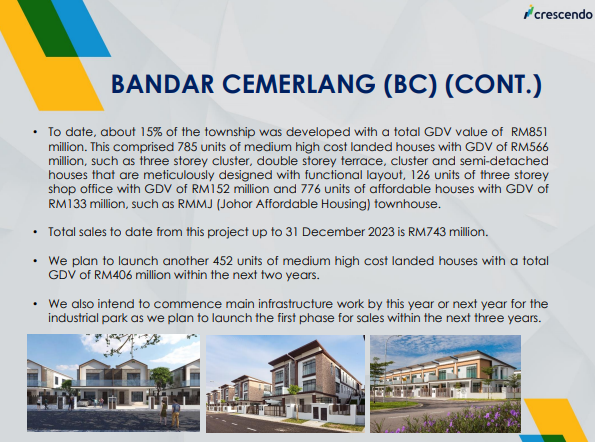

1. Bandar Cemerlang (1,390 acres) - Potential GDV of RM6 billion?

15% of the township was developed with total GDV of RM851 million.

2. Tanjung Senibong: Prime waterfront project within Iskandar Malaysia (221 acres) - Potential GDV of RM4.6 billion?

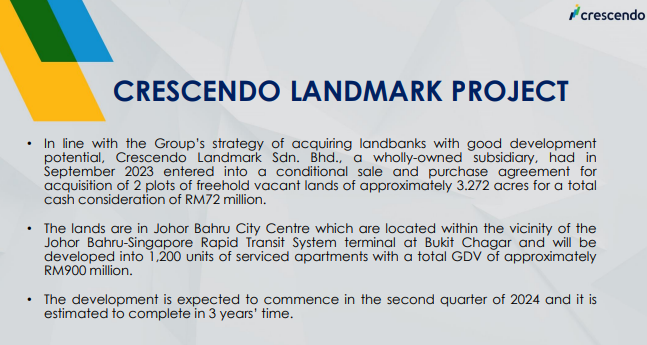

3. Crescendo Landmark project within JB- Singapore RTS - Total GDV RM900 million

And more...

https://crescendo.com.my/core-files/uploads/2024/01/CCB_Analyst-Briefing-2024-Q3-31122023.pdf

Is Crescendo the best deal for 2024?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Chat GPT

Created by bursachatgpt | Apr 21, 2024

PureBULL ...

CRESNDO

would be the next ytlpowr in the making n MORE...

its location pt on its fin mountain is like ytlpowr at 200 then on Oct 10th 2023,,

https://www.tradingview.com/x/kGNXUhOE/

https://www.tradingview.com/x/Fmku6T1k/

cresndo sold land to CINA DC, SIN DC n MSFT DC at high prices totaling $543 million cash.

its mkt cap now is so low VS its VALUE n cash on the book.

it still has large annex land for DC development on that Pulai plot after selling half away.

its land at Pulai is nearer to Forest City than Kulai.

all foreign tech experts will stay only at F City for SFZ with max 15% income tax.,.

https://klse.i3investor.com/web/blog/detail/bursastocktalk/2023-12-12-story-h-212493122-CRESNDO_Potential_Beneficiary_of_Data_Center_JB_Singapore_RTS

2024-02-26 05:59