Baltic Exchange Shipping Updates: Jan 31, 2025

edgeinvest

Publish date: Tue, 04 Feb 2025, 10:50 AM

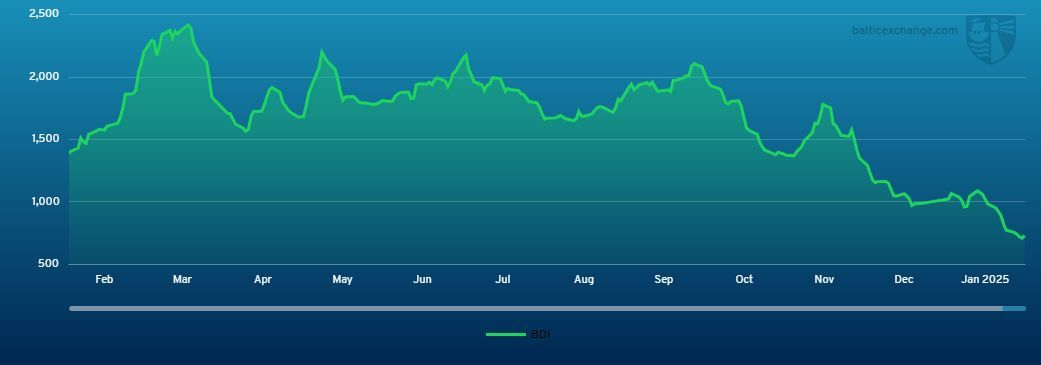

A weekly round-up of tanker and dry bulk market (Jan 31, 2025)

This report is produced by the Baltic Exchange.

The Baltic Exchange, a wholly-owned subsidiary of Singapore Exchange, is the world's only independent source of maritime market information for the trading and settlement of physical and derivative contracts.

Its international community of over 650 members encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic.

For daily freight market reports and assessments, please visit www.balticexchange.com.

Capesize

The Capesize market faced a subdued week, with the BCI 5TC steadily declining from US$7,946 on Monday to reach US$6,977 by Thursday. However, a modest recovery towards the weeks end lifted the 5TC to US$7,252. The Pacific market remained under pressure, exacerbated by the Chinese New Year holidays, which significantly reduced fresh cargo availability. While a handful of miners were active, fixtures remained sparse, and rates softened. However, late in the week, the market saw a slight rebound as two miners re-entered the market, lifting the C5 index up to close at US$6.220. The South Atlantic showed more resilience, with a steady flow of cargo early in the week. Reports of firmer bids emerged, particularly later in the week, although this was not enough to bolster the market. The C3 index saw marginal movements, hovering around the low US$17.00s. Meanwhile, the North Atlantic faced a thinning cargo list and a lengthy tonnage supply, which led to declining rates across C8 and C9 routes.

Panamax

A lethargic week, with the market being curtailed by the Asian holidays. In the Atlantic, a North/South divide prevailed, with EC South America claiming the headlines as activity slowly picked up for March arrivals. Basis February arrival, index type tonnage fixing at between US$12,200 plus US$200,000 and US$12,750 plus US$275,000 ballast bonus achieved several times basis delivery arrival load port EC South America redelivery Singapore-Japan. By comparison, demand in the North was slow with little trans-Atlantic demand playing out and many of the ballasters continuing to price competitively for NC South America grain business. In large parts of Asia, it was a shortened week which created a little confusion. However, as we approached the end of the week, firm sentiment had slowly returned with a mix of rates seen for the different trips including reports of a scrubber fitted 82,000-dwt delivery Korea for a NoPac round trip at US$7,250. Limited period rumours but included an 85,000-dwt delivery China fixing basis one year index linked at 117% to the BPI timecharter average.

Ultramax/Supramax

With the widespread Lunar New Year holidays during the week, it was a very lacklustre affair. Rates dropped in most areas as vessel supply outweighed demand. Although in the Atlantic, some felt a bottom may have been reached as the week closed, but it remains rather positional. A 58,000-dwt was heard fixed delivery US Gulf for a trip to India at US$11,000. For trans-Atlantic runs a 56,000-dwt fixed delivery US Gulf redelivery Morocco at US$9,000. Elsewhere the market struggled to find traction, a 57,000-dwt fixing delivery Egypt for a trip to West Africa at US$4,750. Asia also felt the lack for demand and very little activity surfaced. Rates struggled in the Indian Ocean, despite being relatively active. A 63,000-dwt fixed delivery Saldanha Bay for a trip to China with a flat rate of US$10,000. Whilst a 58,000-dwt fixed delivery Salalah trip to Vietnam at US$6,000. Period activity remained limited; a 61,000-dwt open China end January fixed for 12 months redelivery worldwide at US$10,750.

Handysize

As anticipated, the market has seen very limited activity across the Atlantic and Asian basins due to holidays in Asia. Market sentiment in the Continent and Mediterranean regions remained largely unchanged, the downward trend still prevailing. A 34,000 fixed delivery Otranto trip redelivery Tema with fertiliser at US$7,100. The US Gulf and South Atlantic saw some fresh demand but it remains insufficient to absorb the excess tonnage in the region, with rates still pressured below the last done. A 39,000-dwt heard fixed delivery SW Pass trip redelivery West Coast South America at US$12,000 and a 34,000-dwt fixed delivery ECSA trip redelivery Continent at US$10,250. With the Lunar New Year in full effect this week, activity in the Asian market has been minimal. As nearly all players are away from their desks, the market appears to be on hold across all loading areas. A 40,000 heard fixed delivery Fukuyama 4/7 Feb trip redelivery Pasir Gudang with slag at US$3,250.

Clean

LR2

The MEG LR2’s continued their downward trajectory this week, a fall of WS11.11 pushed the TC1 75kt MEG/Japan route to WS126.39, then looking West the TC20 90kt MEG/UK-Continent fell by US$415,625 publishing at US$3.45 million.

West of the Suez on the LR2 TC15 route there was some more bullish sentiment pushing rates up by US$98,833 to publish at US$3,358,333.

LR1

The TC5 55kt MEG/Japan dropped for the second week running losing WS10 points to take the index to WS123.75. TC8 MEG/UK-Continent fell as well, but not by as much dropping early in the week to finish flat at US$2.557 million.

In the Continent, TC16 60kt ARA/West Africa climbed WS3.61 to WS129.44 finishing the week off with some more life after a slow start.

MR

TC17 35kt MED/East Africa was more muted this week after a tumultuous week prior, the route dropped WS2.14 to finish at WS183.57.

A large correction for TC2 37kt ARA/US-Atlantic coast this week with the index shedding WS18.44 and publishing at WS143.75, TC19 nearly mirroring the TA run with ARA/West Africa losing WS18.43 and dropping to a final publication of WS166.88.

Across the Atlantic, the MR’s all saw bearish movement, and the TC14 38kt US-Gulf/UK-Continent marked down WS3.93 closing at WS118.93. TC18 on 38kt the Gulf/Brazil index dropped WS4.64 and closed at WS167.5 while the TC21 Caribbean run ex-US Gulf continued its drop from the week previously shedding nearly US$20,000 to publish at US$528,571.

The MR Atlantic Triangulation Basket TCE went from US$25,803 to US$23,012.

Handymax

What goes up must come down, and after a particularly bullish week, the gains made were all but fully reversed as the TC6 index fell by WS43.61 to close at WS163.06. Up on the Continent, TC23 30kt Cross UK-Continent avoided as much of a bloodbath losing WS15 to finish at WS176.67.

VLCC

Despite the Lunar New Year festival in the Far East this week, there has been a good level of activity and owners have taken the opportunity to push rates back up after last week’s decline in rates. The 270,000 mt Middle East Gulf to China trip (TD3C) clawed back about eight points to WS60.15 giving a daily round-trip TCE of US$38,212 basis the Baltic Exchange’s vessel description.

In the Atlantic market, the rate for 260,000 mt West Africa/China (TD15) rose almost four points to WS61.44 (corresponding to a round voyage TCE of US$39,968 per day), while the rate for 270,000 mt US Gulf/China (TD22) collapsed early in the week, however by Thursday had rebounded to end up US$180,000 firmer week-on-week at US$8,855,000 (which shows a daily round trip TCE of US$45,906).

Suezmax

The Suezmaxes have had a busy week in the West, not so much in the East. The 130,000 mt Nigeria/UK Continent voyage (TD20) regained four points to WS80.94, meaning a daily round-trip TCE of US$29,948 while the TD27 route (Guyana to UK Continent basis 130,000 mt) climbed three points to WS74.44 which translates into a daily round trip TCE of US$25,568 basis discharge in Rotterdam. For the TD6 route of 135,000 mt CPC/Med, the rate remained around the WS89-90 level (showing a daily TCE of a little over US$28,300 round-trip). In the Middle East, the rate for the TD23 route of 140,000 mt Middle East Gulf to the Mediterranean (via the Suez Canal) slipped about four points to just below WS92.

Aframax

In the North Sea, the rate for the 80,000 mt Cross-UK Continent route (TD7) weakened slightly, easing by 2.5 points to WS107.5 giving a daily round-trip TCE of US$19,344 basis Hound Point to Wilhelmshaven.

In the Mediterranean market, the rate for 80,000 mt Cross-Mediterranean (TD19) fell almost five points to WS119.67 (basis Ceyhan to Lavera, that shows a daily round trip TCE of US$27,892).

Across the Atlantic, the market has started to bounce back. The 70,000 mt East Coast Mexico/US Gulf route (TD26) and the 70,000 mt Covenas/US Gulf route (TD9) saw rates recover 6.5 points to both end up at the WS120 level, which shows a daily round-trip TCE of around US$21,000 and US$18,600 respectively. The rate for the trans-Atlantic route of 70,000mt US Gulf/UK Continent (TD25) rose 13 points to WS128.61 (giving a round trip TCE basis Houston/Rotterdam of US$27,165 per day) which is unlikely to encourage ballasters from Europe for the time being.

LNG

The LNG market has seen a further decline in rates, driven by an ever-growing supply of available tonnage and a limited number of cargoes to cover.

The BLNG1 Gladstone–Tokyo route for both 160k cbm TFDE and 174k cbm 2-Stroke vessels saw declines, with rates falling by US$432 and US$803, respectively. The 160k cbm TFDE index closed at US$4,199, while the 2-Stroke index ended at US$11,790. In the Atlantic, the BLNG2 route showed mixed movements, improving slightly for 160k cbm TFDE vessels but decreasing for 174k cbm 2-Stroke vessels. Meanwhile, BLNG3 route rates declined for both vessel types.

For the BLNG2 Sabine-Isle of Grain route, the 174k cbm 2-Stroke index fell by US$883, closing at US$3,558, while the 160k cbm TFDE equivalent rose by US$2,895 to settle on US$1,100, indicating a slight market correction compared to the negative rates seen earlier in the week. The BLNG3 Sabine–Tokyo route recorded the largest decline of the week, with the 174k cbm 2-Stroke index dropping by US$2,211 to US$7,370, and the 160k cbm TFDE index falling by US$391 to close at US$2,634.

The term market also saw decreases in rates, particularly for shorter term fixtures. Six-month rates decreased by US$2,950, settling at US$22,250. One-year rates fell by US$1,375, closing at US$29,350, while three-year rates saw a minimal drop of US$50, closing at US$48,200. These rate decreases reflect the current spot markets bearish sentiment for the near future.

LPG

The LPG market has experienced minor improvements this week, witnessing upward pressure on rates and TCE earnings on two key routes. BLPG1 Ras Tanura to Chiba saw a rate increase of US$4, closing at US$52.33, while associated TCE earnings rose by US$4,201, closing at US$32,217. This uptick highlights a slight demand growth for vessels on this route.

In the Atlantic, both BLPG2 and BLPG3 were impacted by the weak arbitrage seen in the previous week and adverse weather conditions, particularly fog that closed Houston on Tuesday morning. BLPG2 Houston–Flushing saw a slight drop of US$0.75, closing at US$52.50, with daily TCE earnings falling by US$1,029 to US$48,190. Meanwhile, BLPG3 Houston–Chiba saw a minimal decrease of US$0.08, with the final published rate settling at US$97.33 and TCE earnings at US$33,275.

Disclaimer:

While reasonable care has been taken by the Baltic Exchange Information Services Limited (BEISL) and The Baltic Exchange (Asia) Pte. Ltd. (BEA, and together with BEISL being Baltic) in providing this information, all such information is for general use, provided without warranty or representation, is not designed to be used for or relied upon for any specific purpose, and does not infringe upon the legitimate rights and interests of any third party including intellectual property. The Baltic will not accept any liability for any loss incurred in any way whatsoever by any person who seeks to rely on the information contained herein.

All intellectual property and related rights in this information are owned by the Baltic. Any form of copying, distribution, extraction or re-utilisation of this information by any means, whether electronic or otherwise, is expressly prohibited. Persons wishing to do so must first obtain a licence to do so from the Baltic.

Source: TheEdge - 4 Feb 2025

More articles on CEO Morning Brief

Created by edgeinvest | Feb 04, 2025

Created by edgeinvest | Feb 04, 2025

Created by edgeinvest | Feb 04, 2025

Created by edgeinvest | Feb 04, 2025

Created by edgeinvest | Feb 04, 2025