IPO - Techstore Berhad (Part 1)

MQTrader Jesse

Publish date: Mon, 03 Feb 2025, 03:41 PM

Tentative Date(s):

- Opening of application - 22 January 2025

- Closing of application - 04 February 2025

- Balloting of applications - 06 February 2025

- Allotment of IPO shares to successful applicants - 14 February 2025

- Tentative listing date - 18 February 2025

Company Background

The company was incorporated in Malaysia under the Act on 23 January 2024 as a private limited company under the name TechStore Sdn Bhd. On 6 June 2024, the company converted into a public limited company and assumed its current name. The company is an investment holding company. Through its subsidiaries, they are primarily involved in the provision of enterprise IT services, primarily involving IT security and automation solutions to support its customers’ operations.

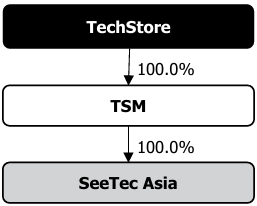

The company Group structure as at LPD is as follows:

Use of proceeds

- Working capital - 45.90% (within 24 months)

- Repayment of bank borrowings - 20.00% (within 6 months)

- Recruitment of business development personnel - 10.90% (within 30 months)

- Capital expenditure - 9.20% (within 24 months)

- Estimated listing expenses - 14.00% (within 1 month)

Working capital - 45.90% (within 24 months)

The company’s working capital requirements are expected to increase in tandem with the expected growth in the business. As such, the company Group intends to allocate the majority of its proceeds toward addressing the anticipated working capital requirements for future projects and employee-related costs. RM11.5 million is allocated for this purpose to be utilized over 24 months from the date of Listing.

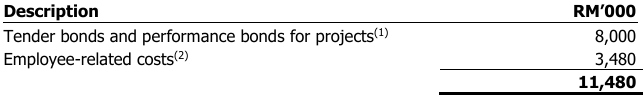

Based on internal management estimates, the allocation of the proceeds to be utilized to expand its working capital base for future projects and employee-related costs are as follows:

Performance bonds are typically issued as bank guarantees by financial institutions to ensure that contractual obligations, such as meeting project deadlines and requirements, are fulfilled. Tender bonds, on the other hand, are issued during the bidding process to assure the project owner that the bidder will undertake the contracted services if awarded. Once the contract is awarded, the tender bond is replaced with a performance bond; if the bidder is not selected, the tender bond is returned in full. The validity of a tender bond ends after the tender period, while performance bonds remain valid until the end of the DLP.

To issue bank guarantees for tender or performance bonds, companies are required to maintain security deposits amounting to 30%-50% of the bond value in fixed deposits with licensed banks. These deposits, known as the Security Margin, lock up a portion of the company’s working capital, thereby impacting liquidity. The bonds themselves are generally 5%-10% of the project value. The amount for Security Margin purposes is expected to increase in line with the growth of the business and the value of contracts awarded to the company.

Taking into consideration the Security Margin requirement as well as the value of contracts and potential contracts that the company is currently pursuing, they have earmarked RM8.0 million of the proceeds raised from its Public Issue to partially fulfill the Security Margin requirement of 2 years amounting to RM11.0 million. The remaining Security Margin requirement of RM3.0 million will be funded via internally generated funds and/or bank borrowings.

The allocation of proceeds raised from the Public Issue for the company's working capital requirements will allow the company to undertake more and larger projects concurrently.

Repayment of bank borrowings - 20.00% (within 6 months)

The company has allocated RM5.0 million to partially repay its bank borrowings which were mainly drawn down to finance the working capital and properties of the company Group.

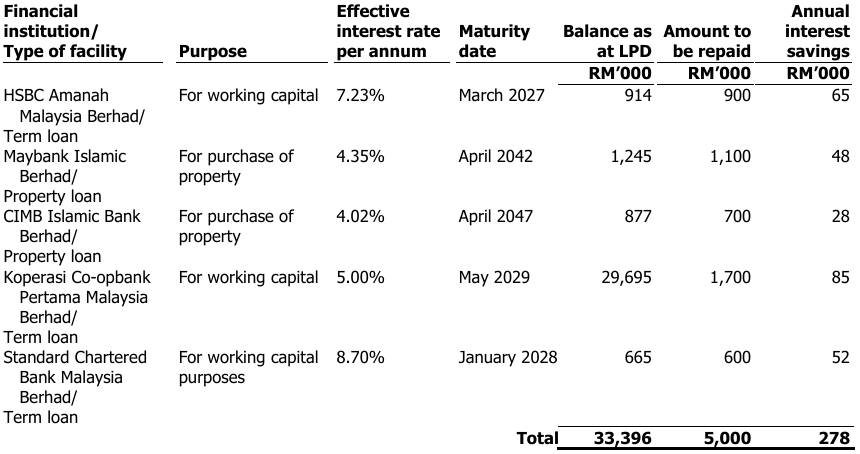

For illustrative purposes, the details of the company’s borrowings as at LPD are set out as follows, among which the company has indicated where the RM5.0 million repayment will be made to:

In relation to the facility provided by CIMB Islamic Bank, the company Group is subject to early settlement charges for repayment made during the lock-in period, being 3 years from the first disbursement date (i.e. May 2022). Save for the facility provided by CIMB Islamic Bank, there is no lock-in period and penalty for early repayment of the abovementioned loans. Nonetheless, it is envisaged that the early settlement charges may be avoided as the lock-in period is close to expiry. For the avoidance of doubt, the company Group is required to provide written notice and/or to obtain consent from respective banks for early release of the abovementioned loans.

The repayment is expected to result in interest savings of RM0.3 million per annum based on the interest rates as stated above. Following the repayment of the bank borrowings, the company Group's pro forma gearing ratio is expected to reduce to 0.64 times (based on the total borrowings of RM36.5 million and pro forma total equity of RM57.4 million of the company Group after its Acquisition, Public Issue and utilization of proceeds raised from the Public Issue) as compared to 1.19 times (based on the company Group’s pro forma total equity after our Acquisition but before our Public Issue) as at 31 July 2024.

Recruitment of business development personnel - 10.90% (within 30 months)

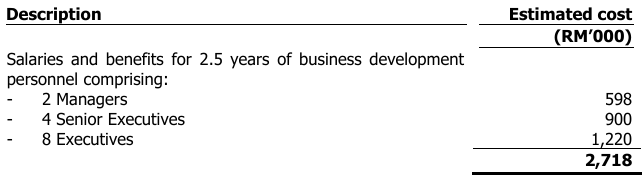

Aligned with the company’s objectives for business expansion, the company recognizes that enhancing its workforce is essential for sustained growth. Accordingly, the company Group intends to allocate RM2.7 million to expand its business development team by increasing the headcount from 6 as at LPD to 18. The business development team is responsible for planning and executing sales and marketing strategies, attending to inquiries from prospective customers, preparing detailed proposals and presentations to customers as well as preparation of tenders and quotations. The additional headcount will enable the team leaders to carry out the sales and marketing strategies more swiftly and effectively.

The total costs of the recruitment of business development personnel were arrived at based on the company’s salary records and estimates. These costs include the salaries and benefits for 2.5 years of business development personnel, which will be entirely funded from the proceeds raised from the Public Issue as set out below:

Any initial cost of the recruitment (such as hiring advertisement) will be funded via internally generated funds.

In the event that the allocated proceeds are insufficient for the recruitment of business development personnel, any shortfall will be funded via internally generated funds. Conversely, if the actual cost is lower than the amount budgeted above, the excess will be allocated for the company's working capital requirements.

Capital expenditure - 9.20% (within 24 months)

The company Group recognizes the increasing demand for technology applications and infrastructure solutions in all industries and the company wishes to strengthen its technology capabilities to maintain its competitiveness. The company proposes to install a rooftop solar photovoltaic system as part of the capital expenditure towards achieving its long-term environmental, social, and governance, which will also contribute to lower utility costs.

- Capital expenditure on equipment, computer and hardware, and IT software

The company Group intends to allocate RM2.0 million from the proceeds raised from its Public Issue to purchase equipment, computer and hardware, and IT software as follows:

The total cost of RM2.0 million was derived from the management’s estimates of the prices of the identified equipment and software after taking into consideration, amongst others, the quotations of equipment and the management’s research on the prices of the said equipment.

- Setting up a new branch office in Johor Bahru

The company Group intends to set up a new branch office in Danga Bay, Johor Bahru where the company is carrying out projects related to the RTS link between Singapore and Malaysia. The set up of a new branch office will allow the company to better carry out its business development and project management functions.

The company intends to allocate RM0.3 million from the proceeds raised from its Public Issue for the set up of the new branch office in Johor Bahru which has arrived at based on quotations from the contractor.

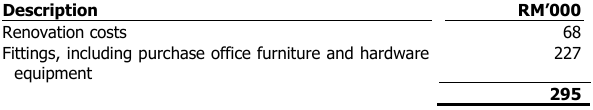

The proceeds will be used for renovation, purchase of furniture and fittings, and hardware equipment, details as follows:

The new branch office is expected to measure approximately 1,000 sq ft to 1,200 sq ft. The company expects to identify the required branch office unit, enter into the required tenancy agreement (which shall be funded internally), and commence the renovation process by the second quarter of 2025, which will take up to 3 months to complete.

In addition, the company Group intends to hire 8 additional employees for the new branch office in Johor Bahru using internally generated funds.

In the event that the allocated proceeds are insufficient for the company’s capital expenditure, any shortfall will be funded via internally generated funds and/or bank borrowings. Conversely, if the actual cost is lower than the amount budgeted above, the excess will be allocated for the working capital requirements.

Business Model

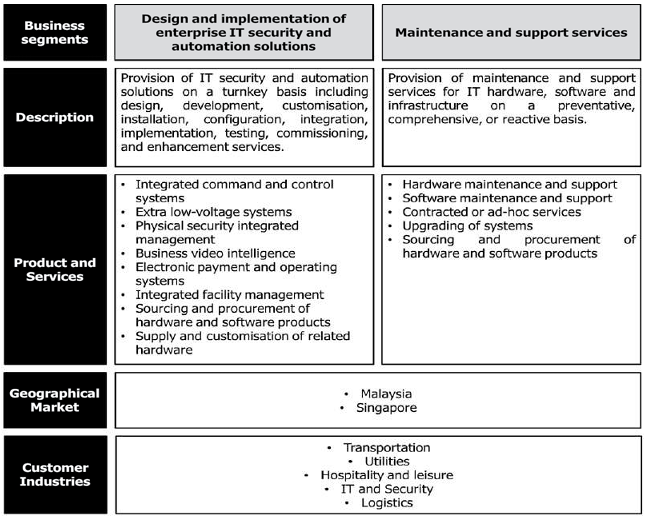

The diagram below summarises the company Group’s principal activities:

Click here to continue the IPO - Techstore Berhad (Part 2)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

More articles on Initial Public Offering (IPO)