Can you beat the dealer? Or would you be the dealer?

lifeisajourney

Publish date: Sat, 08 Aug 2020, 10:12 PM

Background

With the recent price surge in our share market, a lot of renown investors has call this madness. Of course, at least the good thing that came out from this "madness" is that everyone is earning money (I sincerely hope you are).

Many compare this madness as to gambling. As flocks of "investors" buying shares that they've no knowledge of or have no idea what the company is venturing into, many experience traders/investors call it gambling.

For all of you that frequent Genting Casino, i'm sure that you know that there is a dealer and the gambler. For those of you who does not know, the Dealer in this case would be Genting, while the gambler would be people that placing the bet. For all of the pots that exist in Genting, we all know that the odds are against us as the Dealer would definitely have a slight edge of winning (elements of FengShui aside).

With the camparison of our local bourse as a gambling den, can we then be the dealer and have the winning edge?

As Bursa Malaysia itself is listed on the stock exchange, it provides a platform for investors to invest in the company (For more information, you may read up on For-Profit Stock Exchanges. Some of the examples include Nasdaq, NYSE etc). Hence, if you wish to be the dealer, you can choose to do so.

Financials

The main profit for Bursa Malaysia is when investors buy and sell shares (in which Bursa will charge a fees on every trade that is matched).

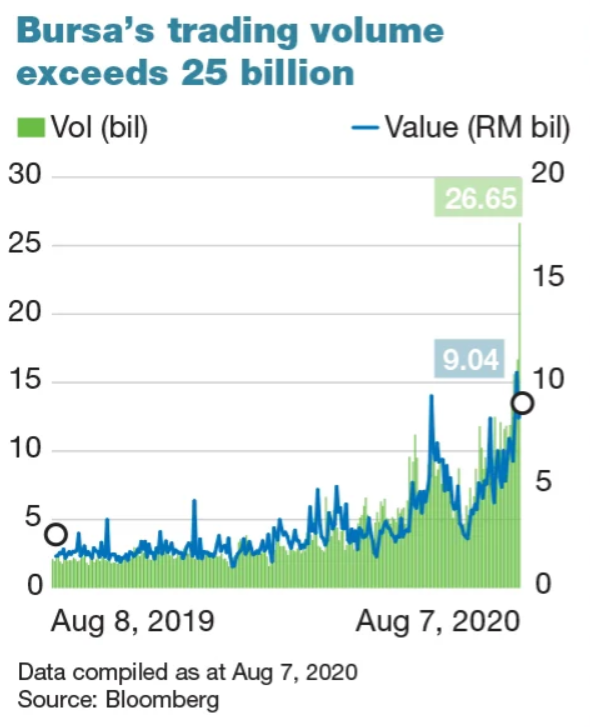

Market has seen a record volume last friday (7th Aug 2020), in which market turnover was at 26bil, the total value traded was at RM 9 bil. (Bursa Clearing Fees is at 0.03%, based on this calculation, the revenue would be approximately RM2.7mil in just one day)

With the recent spike in market volume, Bursa is definitely on track to make good profit this year. This is shown on the latest quarter 3 report in which Bursa has reported record revenue since its listing (RM 179 mil), with a y-o-y spike of 86%.

Below show an example of revenue calculation for Bursa for the month to come:

Assumptions:

Value Traded - RM7 bil/day

Trading Days - 20 days (no holiday)

Calculations:

RM 7,000,000,000 x 20 days x 3 months x 0.03% clearing fees = RM 126 mil

(This is just turnover revenue for Bursa for Q3. You may use the same assumption to calculate the revenue for Q4)

Based on 2018 and 2019 data, turnover revenue generates approximately 60% of the revenue earned. I would say that Bursa is definitely on track to make record profit. (Q1 and Q2 gross revenue has already reach RM 429 mil. Previous record revenue is only at RM 556 mil).

Thus, by adding Q1, Q2 revenue and my assumption of Q3 revenue, the revenue would already be at RM555mil. Please bear in mind that the month of August is the release of QR for multiple companies, hence we would expect a higher market volume for the month to come. That said, I would think that the future is bright for Bursa, in terms of revenue.

Technical Chart

Bursa Malaysia has spike 100% from its 2020 low of RM4.50. As per 7th Aug 2020 closing, Bursa is currently trading at RM 10.36.

The current price is well above its 7,14,100 days moving average. Volume trading in Bursa is also spiking as well. All these indicators seems to showing that Bursa has more room to go.

With QR reuslts of several companies releasing this month, i would expect Bursa Malaysia to reach new high and break the RM11 resistance (just a matter of when). This would further push the price of Bursa up to new uncharted waters.

Bursa would definitely be something interesting to watch out for next week.

*I'm just a newbie in this field and this is just my thoughts. My views are not a buy/sell call. This is just my 2 cents on this counter.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-17

BURSA2024-07-17

BURSA2024-07-17

BURSA2024-07-17

BURSA2024-07-16

BURSA2024-07-16

BURSA2024-07-16

BURSA2024-07-16

BURSA2024-07-15

BURSA2024-07-15

BURSA2024-07-15

BURSA2024-07-15

BURSA2024-07-15

BURSA2024-07-12

BURSA2024-07-12

BURSA2024-07-12

BURSA2024-07-11

BURSA2024-07-11

BURSA2024-07-11

BURSA2024-07-10

BURSA2024-07-10

BURSA2024-07-10

BURSA2024-07-10

BURSA2024-07-10

BURSA2024-07-09

BURSA2024-07-09

BURSA

justforfun

Clearing fee is paid by both buyer and seller.

2020-08-10 08:39