Chinese Tea - Stock pick 2014 review

chinesetea

Publish date: Fri, 02 Jan 2015, 05:36 AM

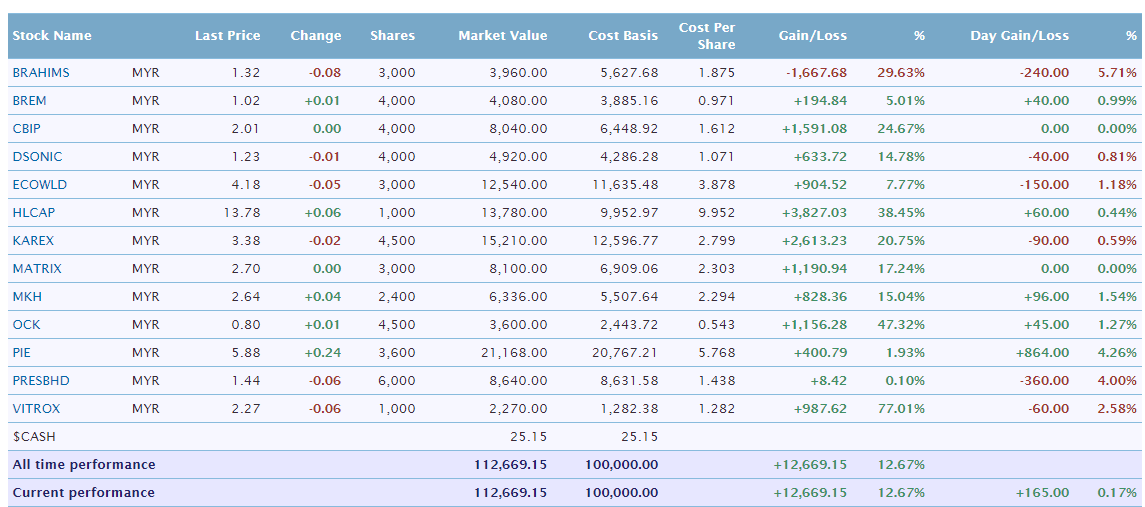

Last year I tried to pick some stocks that I considered undervalue and invested 100,000 by spreading the investment amongst 13 stocks.

http://klse.i3investor.com/servlets/pfs/26956.jsp

I have not kept tracked of the dividend of all the stocks. At the closing date of 31 of December 2014, The portfolio has made a profit of 12.67% and I believe roughly 5% more if including dividend. At some point of the year, the performance was well above 40%. Average performance is 18.5 %. Of course my pick is nothing compared to several sifu in i3 like kcchongnz and otb. Hopefully I can learn more the coming year. My main technique is to focus on the business potential, some basic fundamental analysis couple with my half baked technical analysis :-)

This is only used as a study to find out whether we can make money by investing stocks that are undervalued and without buying and selling for the whole year. In reality, I would have sold stock like Brahim when I heard about the sad news of missing MAS plane. There are only one stock that is making a lost – Brahim. The loss of Brahim was unpredictable because of incident of lost MAS plane. The best performing stock to date is Vitrox.

Few of the stocks have impressive return at the first half of the year including DSonic, Mkh, Presbhd and Ecoworld and some exceeded 100%. Unfortunately the recent sell down has wiped out almost half of the proft. Overall I am satisfied with the pick as 8 out of 13 stocks has made more than 15% return that beats the FD and overall KLCI with quite a big margin. Another interesting thing is 9 out of these stocks has issued or proposed bonus and right issue.

There are other stocks that I have recommended or discussed with other members that are not recorded in the list including KSL, Tekseng, Jobstreet, Inari, Myeg, Ifcamsc, Pmetal, Gtronic, Digi, Cmsb,Digi, Mitra, Success, Karex, Timecom, Latitude that have been performing quite satisfactory. There are many more that I have missed and cannot list them all in here.

There are also some stock that I recommended or discussed went south after short rallying or become stagnant, including coastal, kssc, seal, leonfb,yinson, hovid. So this serve as a warning of those following that there is always a risk and as usual buy and sell at your own risk.

As many stock’s valuation has increased a lot, it is hard to repeat the same performance in 2015 considering crude oil price and GST will affect the overall market. I have to thank to several members particularly asamlaksa, matrix, zoom, ln1792 that have given me suggestions, encouragement and critics that help me to pick the best stocks and went through many storms with me and hold my nerves. I also like to thank a person behind me : very well respected old remisier and uncle.

At last but not the least, everyone that has asked questions in our thread (apologise for not able to answer every one of them) that help us to think. Oh, yes, unclez, though he has never joined our thread, I have to thank him for all the messages that has posted to keep us well informed and for all his stock picks. Although the price of his stock pick has dropped a lot, I hope he doesn't feel responsible as a lot of the reason behind is beyond his control. Keep up the good work. In the nearly future.

I wish to publish my new pick and hopefully we will find more undervalued stock in the turbulent market. In a volatile market, it is not good for investor but it create a very good opportunity to buy good stock at discount price.

Wish everyone a happy new year. May peace be with you.

Chinese Tea

Discussions

Thanks for your kind comment and I know you are humble man and you are definitely winner by choosing one stock. I have learned a lot from your article and hope one day you can publish a book by consolidating all your article in one and perhaps your course work. I understand you run some course and if it is in UK, I would have joined as I live in London.

Yes, I have a diversified portfolio for long term pick. Sometimes, I have doubt whether it is the right method. I don't lose big but I cannot win big either. As shown in the portfolio, if I pick any of the 8 winning stock I can achieved 15% and more. Of course only if I knew ahead of time, lol.

The most profitable period was when I own only few stocks takaful, cbip, inari, dsonic in my own portfolio

Currently, in my real life strategy, I have several stocks for long term and use some money to punt on hot stock. I also keep some cash to pick bargain during sell down.

I have to agree 'most' crony stock don't share profit and is normally growth stock with headline news that push the price up and of course some money went to their pocket. It has its down and upside and we only can live with the flow. There is always some uncertainty with such stock and hence you see big swing in their price. In 2015, I will focus more on dividend stock.

2015-01-02 07:26

Winning great return in bull nothing to shout. Lets see if you can still outperform during bear like 2008.

2015-01-02 08:08

That's very true. It will be very difficult. In bull everyone can be sifu and expert

2015-01-02 08:28

Tht's the case, that is why who can still consistently outperform after 20 yrs are hard to come by

2015-01-02 09:47

Thanks for sharing Chinesetea, learn a lot from you, hope you have a wonderful 2015

2015-01-02 11:15

ctea, Happy New Year and congrats on your 2014 portfolio earnings, as you have mentioned better than FD return.

For 2015, at least for the 1st Quarter, will be looking closely @ GST related counters. Yes, at least I'm quite sure you know one of it(IFCAMSC).

Not sure how far its true that their 2014 YTD profit has hit Rm100 mill(as being mentioned in i3).

All the best ctea and rest of the gang for 2015.

2015-01-02 16:33

kcchongnz is a man, whom teach you how to fish (and fish systematically) for free in i3investor ...

where to find this kind of people ? God bless him.

2015-01-02 19:47

Chinesetea,great job.May i suggest you add trailing stop to your stocks so that you can protect most of your profits next time.Cheers.

2015-01-02 21:44

Well done...but only after 3 bear cycles, or at least 15 years of investing...only then we shall really know...

Wishing all happy and profitable investing!

2015-01-03 10:40

Thanks to all those generous, sincere & kindhearted sifus from whom only I learned a lot of investment fundamentals.Sifus such as uncleZ,

Kiasu,OTB, Chinesetea & more. May your FORCE be always with us!

2015-01-03 10:59

In case someone missed out. I posted by stock pick for 2015 around 5th of January

2015-01-21 21:28

kcchongnz

Chinese Tea,

You did very well last year, definitely better than me. Well done.

Allow me to make some little comments.

Looking at your stock list, you are a growth investor. Those companies you have invested do have good growth potential. You also have a diversified portfolio of very good stocks, except I don't like just one crony stock because in my opinion, even if they make money, I doubt they will share with minority shareholders.

I am sure you will do well with your portfolio of growth and some steady earnings stocks. I will be looking at some of your stocks to invest in.

Happy New Year.

2015-01-02 06:26