TYYAP- JAKS: Investors Must Know Secrets

tyyap

Publish date: Sun, 05 Jul 2020, 09:27 PM

TYYAP- 5th July 2020

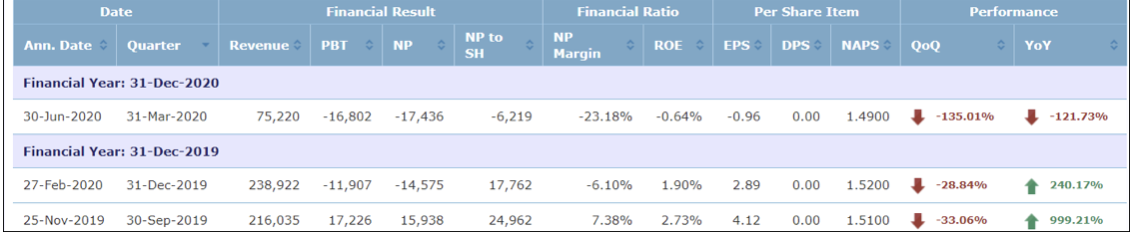

In Stock Investment, the 2 most basic fundamentals in stock selection are profit growth prospect and price chart. The table below shows this company has reducing profit for the last 3 quarters hence does not meet the first criteria mentioned above.

The price chart below shows that it is on a down trend, hence smart investors normally will not buy any down trending stock because you do not know when the company can start making more profit to change the trend.

The above 2 image is JAKS, hence there is no opportunity seen.

Moreover, this company has called for right issues before and now it is proposing right issues again. This shows that the company has too many unsold properties. I remember the CEO, Andy Ang’s personal company was in joint venture with JAKS to develop the Star land in Petaling Jaya. The joint venture company has to pay Rm 50 million to Star for late completion. Shareholders should find out if Andy Ang has sold his shares to JAKS.

Many investors bought JAKS in anticipation of its future profit from its coal power plant in Vietnam and has neglected its property development business which is currently bleeding cash.

Majority of the big power plant will have initial teething problem on the commissioning side. Even if the power plant is completed it will take some time to show profit. Hence, my personal view is inline with our legendary investor Mr Koon Yew Yin but I may look into this company again once the power plant show at least 1 quarters of increase profit with good prospect.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|