SERNKOU (KLSE: 7180) – Resilient Performance Despite Headwinds.

snowman95

Publish date: Fri, 03 Dec 2021, 01:14 AM

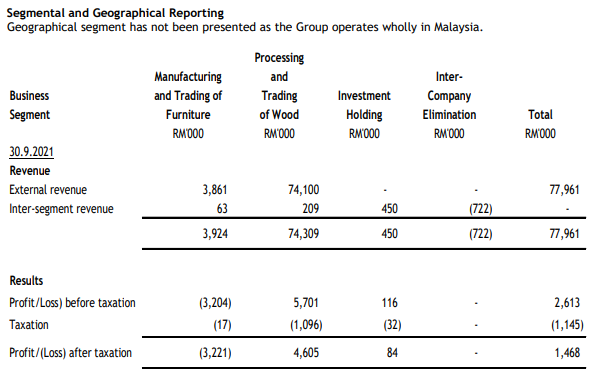

- Furniture makers are badly damaged in the MCO 3.0 and most of the players in the industry had suffered losses due to underutilization of facilities. SERNKOU moves beyond that category due to the unique proposition of the company.

- Despite dragged by limited operations of the group’s second revenue generator – manufacturing and trading of furniture, the processing and trading of wood had led the group to buoyant financial performance with a RM1.38 million PAT.

Unique Proposition of SERNKOU

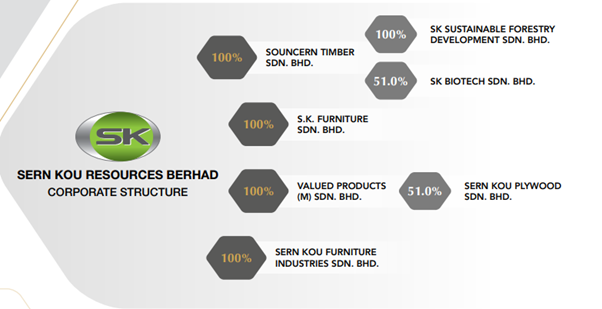

We noted that most investors in the market would categorize SERNKOU as a furniture maker, but in fact, the core revenue generator of the group comes from up and midstream of the industry, which is processing and trading of wood.

Just to recap, SERNKOU started as a furniture maker back in 1993, but expanded into the processing of rubberwood and timber, sawmill as well as plywood manufacturing. The unique proposition of the group allows them to benefit from the shift of orders from China to Southeast Asia after the trade war, and the group is expected to bag more demands from downstream furniture makers.

In 1QFYE2022, the group had reported a PAT of RM1.38 million mainly due to profit generated in the processing and trading of wood but was offset by the manufacturing and trading of furniture segment.

The group had highlighted that the operating results of manufacturing and trading of furniture were impaired due to the temporarily shutdown of operations as the surge of COVID-19 had triggered the government to implement MCO 3.0. The operations were disrupted as the group was only permitted by MKN to deliver finished goods and receive cargo for the purpose of export and import from overseas during the said period.

On the processing and trading of wood however, the operations of the division resumed as they receive the approval from MITI as Kelantan went into Phase 2 of the NRP. The group also mentioned that the revenue and net profit were results from increasing demand for tropical wood products. This is in line with our forecast as furniture makers are having backlog orders for Q4CY2021, which would further strengthen the demand for up and midstream wood products.

Unlocking Value

At this juncture, we could say that the worse is over for SERNKOU. Not only does the company benefit from the processing and trading of wood segment, but recovery of the manufacturing and trading of furniture is expected to have better results as 80% of the current workforce for the division was fully vaccinated, the company may expand their revenue base and profit due to the backlog orders.

Moreover, the increase of an additional sawmill production line (+1,000-ton/month) will increase the group’s processing and trading of wood division by 33%. We would like to highlight that the consumption of these products is driven by external parties as the inter-company transaction is on a minimal level. This would further allow the group to maximize the earnings from both segments.

We would also like to remind investors where SERNKOU is the only company in the value chain of furniture industry listed on Bursa Malaysia that is getting involve in sustainable forestry. From a friend of mine in the industry, they mentioned that SERNKOU is planning for seedlings for eucalyptus tree. While we wait for some official announcement from the company, do note that compare to some other tropical wood such as oak, birch and teak trees, eucalyptus tree only takes 5 years to mature, and could regrow for 3 – 4 cycles.

This would enhance the integrated positioning of the group in the industry, and when ESG comes into play, we liked SERNKOU due to their forefront positioning in the market.

SERNKOU remains as our top pick in the sector due to their resilient performance in 1QFYE2022, unique proposition and pioneering in sustainable forestry amongst its peers.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|