Why Malakoff is Worth a Look Despite Bleakness

zaclim

Publish date: Wed, 13 Dec 2023, 10:29 AM

Malakoff Corp Bhd may not be a stock worth investing in given it is expected to post a loss-making financial year ending Dec 31, 2023 after posting 3 consecutive quarters of losses. The negative sentiments are reflected in its share price, which fell some 3.8% in th past year.

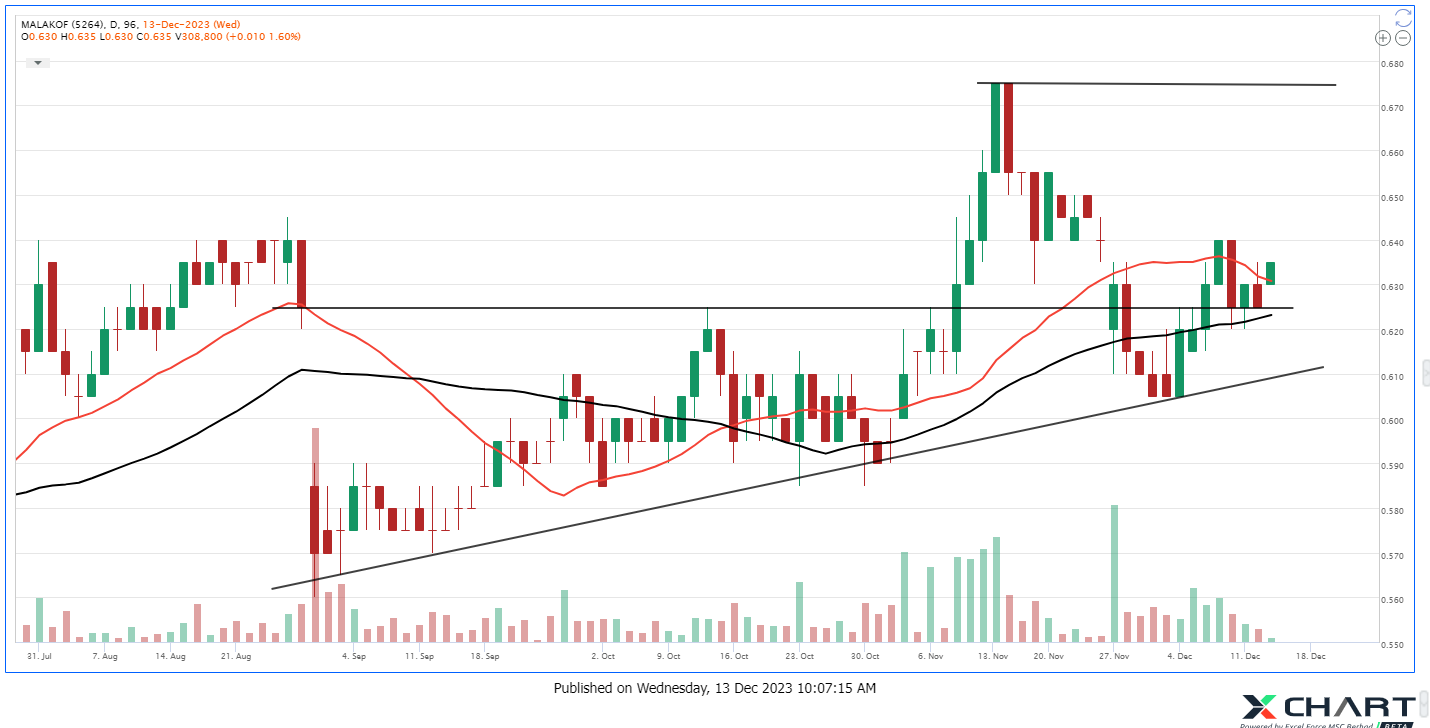

However, based on technical charts, the counter is on a bullish trend with gains on the back of rising volume. Does this translate to actual optimism on the counter or just an attempt to create a buzz?

Well, some analysts believe value has emerged following Malakoff’s 16% share price correction since mid-April 2023. The stock closed marginally higher at 63 sen on Dec 6 which is somewhat close to its all-time low of 57 sen in June. However, it is still far from its 52-week high of 74 sen seen in April this year.

According to CGS-CIMB, it finds valuations for Malakoff attractive at just 3.9x 2024 EV/EBITDA. The research house believes the company will show strong free cashflow generation once its earnings normalise on the back of more stable coal prices. And that is what the market has not factored in.

Another selling point is the ability of Malakoff to sustain dividend payouts of 95%, translating to a net yield of 7-8% based on the current share price. This dividend payout will be on par with the average payout of 95% between 2017 and 2022.

But CGS-CIMB does not deny that the company’s earnings delivery has been been disappointing this year, with the company reporting significant losses in 9M23. This was mainly due to the negative fuel margin arising from the mismatch between the calculations of energy payments and fuel costs.

We witnessed the coal prices falling by 68% from a high of US$413/MT in 3Q22 to US$134/MT and have since normalised to a large extent and the sharp movements appear to have moderated. The research house expects Malakoff to register a normalised net loss of RM534 million in FY2023 compared with its previous forecast of RM266 million net profit. On a positive note, Malakoff is expected to return to the black with a net profit of RM243 million in 2024 and RM262 million in 2025.

Beyond 2025, there is earnings upside potential from the 84MW mini-hydro plants in Kelantan, waste-to-energy facility in Melaka, gas-fired power plants and potential new solar projects.

As such, with the recovery in earnings, its operational cashflow is also expected to improve, meaning investors can look forward to share price upward movement and dividend payout to resume.

Based on daily chart, Malakoff is showing short term uptrend with price trading above the previous gap down. This suggest potential and buyer is dominating the current trend. The pullback volume also showing healthy with price drop with low volume and upbar higher volume. This indicate the demand higher than supply at the moment.

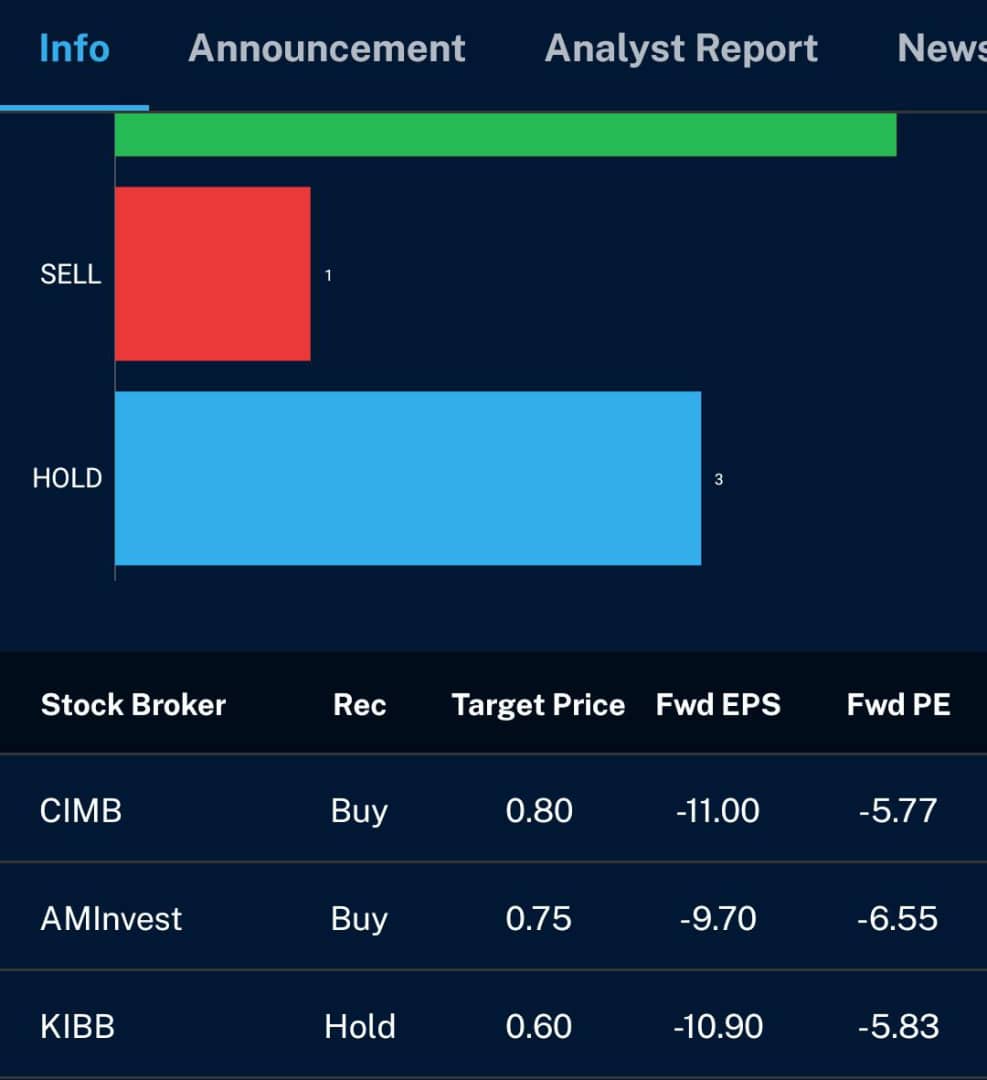

The analyst’s Target Price suggests that Malakoff has room for growth. According to the latest Analyst Recommendation from CIMB and AMInvest, the Target Price for Malakoff is RM0.80 and RM0.75 respectively . This means that there is a potential upside of 25% and 18% based on the current price of RM0.635

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Nov 21, 2024

Moving forward, investors are excited on prospects of retailers such as Aeon as it stands to gain from renewed sentiment following the announcement of Budget 2025.

Created by zaclim | Nov 19, 2024

Analysts are also optimistic on Kelington’s margin improvement bolstered by a significant increase in higher-margin UHP projects

Created by zaclim | Nov 18, 2024

PGF Capital Bhd is starting to show a sustained upside after closing at RM2.24 recently. Will the counter be able to surpass its 52-week high of RM2.24?

Created by zaclim | Nov 18, 2024

Unique Fire Holdings Bhd appears to be moving upwards on the back of strong buying signals. How high can it go?

Created by zaclim | Nov 18, 2024

Dufu has seen challenging times especially when the revenue strengthened against the USD. But the situation has somewhat stabilised and the counter could head for some gains.

Created by zaclim | Nov 15, 2024

Clean energy specialist Solarvest Holdings Bhd is back on investors’ radar to close at RM1.66 on Nov 14. Can the counter repeat or even surpass its high of RM1.83?

Created by zaclim | Nov 13, 2024

KJTS Group Bhd Is having a positive upturn with its share price likely to surpass its high of 85 sen.

Created by zaclim | Nov 11, 2024

Moving forward, the healthcare operator plans to expand regionally once the local market reaches saturation.

Created by zaclim | Nov 11, 2024

AGX Group Bhd has gone to new highs since making its debut on the ACE Market in February this year. How high can it go?

Created by zaclim | Nov 07, 2024

PMB Technology Bhd seemed to be rebounding from its recent low in October. What are the factors that will catalyse its share price further?