Freight Management (7210.KL) - Where connectivity brings wealth

DonkeyStock

Publish date: Thu, 20 Oct 2016, 02:23 AM

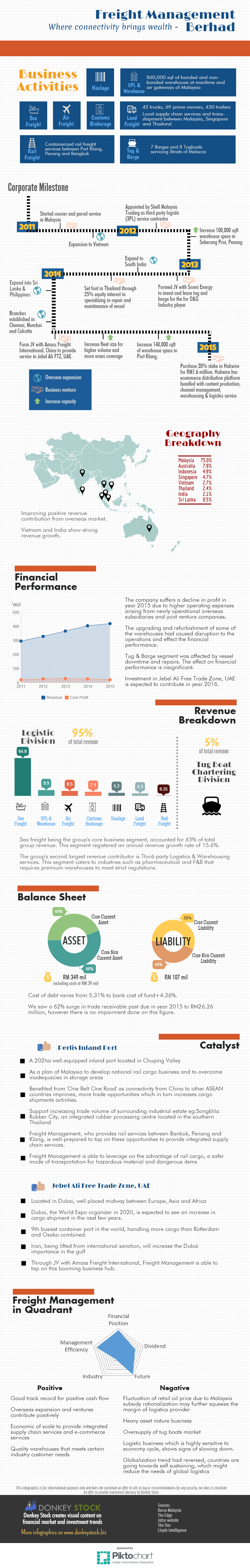

Freight Management Berhad (FMB) is a company that involved in both logistics and tug boat chartering business. The logistics segment made up majority of FMB revenue, amounting to 95% while tug boat chartering division made up the remaining 5% revenue. FMB logistics division focuses mainly on sea freight, warehousing and air freight services. Alongside with these three main contributor, it also involved in customs brokerage, haulage, land freight and rail freight.

FMB owns 860,000 square feet of bonded and non-bonded warehouse at various maritime and air gateway. It plans to provide a higher value-added warehousing service to pharmaceutical and F&B industries in the near future. With 42 trucks, 69 prime movers and 430 trailers, FMB has a strong land transport capacity serving the Peninsular Malaysia, Singapore and Thailand. Its rail freight division provides containerized rail freight services between Port Klang, Penang and Bangkok. Nevertheless, it owns 7 barges and 8 tugboats servicing the Straits of Malacca.

Over the past 5 years, FMB had recorded a strong expansion overseas.

· 2011: Expand to Vietnam

· 2011:Started courier and parcel service

· 2012:Appointed by Shell Malaysia Trading as third party logistic (3PL) service contractor

· 2012:Increase 100,000 sqft warehouse space in Seberang Prai, Penang

· 2013:Purchase 25% equity interest in YKP-FM Global Shipyard, a Thailand based company specializing in repair and maintenance of vessel

· 2013: Expand to South India

· 2013: Formed JV with Scomi Energy to invest in tug and barge for the purpose of leasing to O&G Industry player

· 2014: Increase 140,000 sqft of warehouse space in Port Klang, reaching a total of 860,000 sqft. New warehouse with 9-tier racking aiming to provide premium 3PL services such as food industry, expand fleet side (higher volume and more coverage areas)

· 2014:Branches established in Chennai, Mumbai and Calcutta

· 2014: Expand into Sri Lanka & Philippines

· 2014: Form JV with Amass Freight International, China to provide service in Jebel Ali FTZ, UAE. Revenue expected to start from 2016

· 2015: Purchase 20% stake in Hubwire for RM1.6 million. Hubwire has ecommerce distribution platform bundled with content production, channel management, warehousing & logistics service

FMB has successfully expanded its footprint to Australia, Indonesia, Singapore, Vietnam, Thailand, India and Sri Lanka. Malaysia, being FMB home market still contribute 75% of the revenue.

In 2015, the company suffers a decline in profit due to higher operating expenses arising from newly operational overseas subsidiary and Joint Venture Company. The upgrading and refurbishment of warehouse, vessel downtime and repair has affected FMB latest financial performance. However, the investment in Jebel Ali Free Trade Zone (FTZ) is expect to contribute positively in year 2016.

The company assets and liabilities currently stands at RM349 million and RM107 million. However, there has been a surge in trade receivables past due recorded in year 2015 but not impaired yet. FMB cost of debt varies from 5.31% to bank cost of fund + 4.36%

We expect the proposed Perlis Inland Port and the operation in Jebel Ali FTZ may be an earnings catalyst to FMB in the future.

Perlis Inland Port

A 202 Hectare inland port located in Chuping Valley. It is also a plan for Malaysia to develop national rail cargo business and overcome storage inadequacies problem. Due to storage inadequacies in Northern Malaysia, cargo are currently stored in Southern Thailand before transporting to Penang Port. Perlis Inland Port is expected to solve this issue. In addition, the development of Songkhla Rubber City in southern Thailand is expected to increase trade and shipment volume. FMB is expected to benefit from the ‘One Belt One Road’ plan as the connectivity between China and other ASEAN countries will be greatly improved eventually increasing freight volume. With experience in rail cargo, FMB is well-prepared for this upcoming opportunities and also leverage on the advantage of rail cargo, which is a safer mode of transportation for hazardous material and dangerous items.

Jebel Ali Port

This port is well located in the middle of Europe, Asia and Africa. Dubai, being the international business hub, has huge volume of logistics and shipments activities take place. It hosts many big firms from all over the world, due to its attractive business incentives. Its strategic locations made Jebel Ali Port an important re-exportation hub, mainly to Iran and India. Iran is expected to increase its importance in the Gulf after the sanctions removal. Besides, Dubai is organizing the World Expo in year 2020, where we expect an increase in cargo shipment in the next few years. Through JV with Amass Freight International, FMB is able to tap on this booming business hub, which is currently the 9th busiest container port in the world.

Positive

· Good track record for positive cash flow

· Overseas expansion and ventures contribute positively

· Economic of scale to provide integrated supply chain services and e-commerce service

· Quality warehouse that meets certain industry customers’ need.

Negative

· Fluctuation of retail oil price due to Malaysia subsidy rationalization may further squeeze the margin of logistics provider

· Heavy asset nature business

· Oversupply of tug boat market

· Logistic business, which is highly sensitive to economy cycle, shows signs of slowing down

· Globalization trend had reversed, countries are going towards self-sustaining, which might reduce the needs of global logistics.

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.