[Infographics] Favelle Favco, lifting your portfolio up

DonkeyStock

Publish date: Thu, 01 Dec 2016, 08:24 AM

Visit http://www.donkeystock.biz/or https://www.facebook.com/donkeystock/ for more interesting infographics.

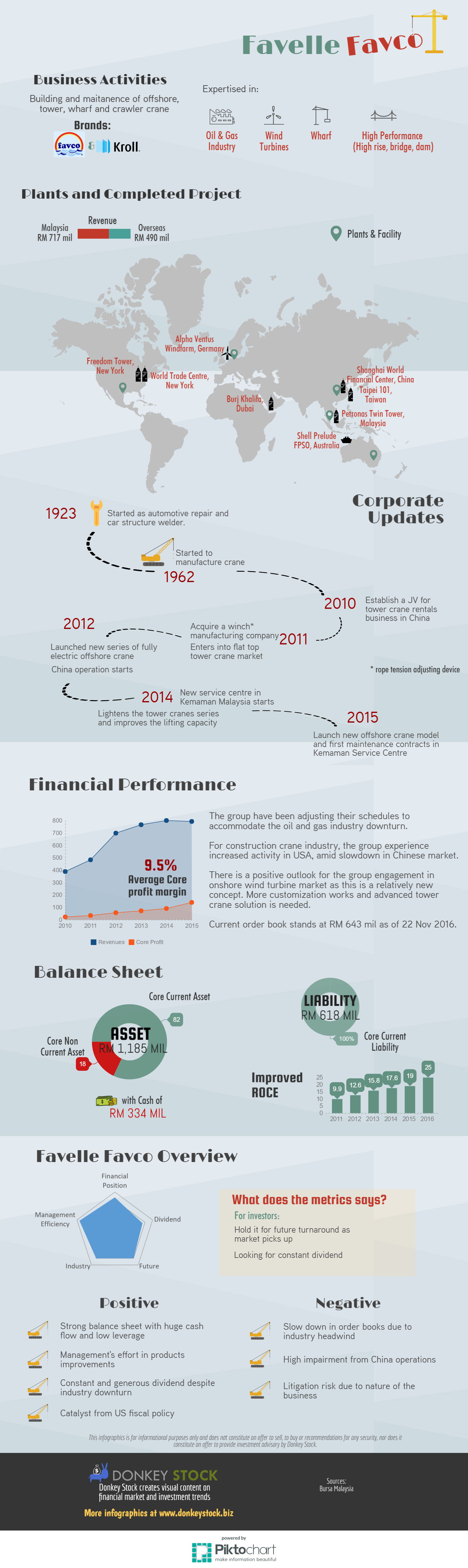

Favelle Favco is a company involved in building and maintenance of off shore crane, tower crane, wharf crane and crawler crane. Two brands under Favco are “Favco” and “Kroll”. Favco has a great track record and expertise in oil & gas industry, wind turbines, wharf and providing crane service for high performance structure such as high rise tower, bridges and dam.

Favco has a global existence with manufacturing facilities in United States, Denmark, China, Malaysia and Australia. Some of the notable projects done by Favco are Freedom Tower in New York, Alpha Ventus Windfarm in Germany, Burj Khalifa in Dubai, Shanghai Financial Centre in China, Taipei 101 in Taiwan, Petronas Twin Tower in Malaysian and Shell Prelude FPSO in Australia.

Favco started as an automotive repair and car structure welder in 1923. In 1962, Favco started to manufacture crane. Here is a recent update of Favco corporate update:

2010: Establish a joint venture for tower crane rentals business in China

2011: Acquire a winch manufacturing company and enter into flat top tower crane market

2012: Launch a new series of fully electric offshore crane and commenced operation in China

2014: Start a new service centre in Kemaman, Malaysia and conducted development of a lighter crane and increasing current model lifting capacity

2015: Launch a new offshore crane model and commence the first maintenance contracts in Kemaman Service Centre.

Favco has been adjusting their schedule in order to accommodate the oil & gas industry downturn. The recent increased activity in United States has help Favco to maintain its top line despite a slowdown in China market. There is a positive outlook for Favco engagement in onshore wind turbine market and customization works for advanced tower crane solution. Favco has an order book of RM 643 million as of 22 November 2016.

Favco has experienced a good track record of revenue and profit growth, alongside with its increasing return on capital employed (ROCE). With a cash balance of RM 334 million and strong balance sheet, Favco is sure to withstand the current headwind.

Favco is suitable for investors who will hold Favco for future turnaround as market picks up and investors who are looking for constant dividend.

Positive:

· Strong balance sheet with huge cash flow and low leverage

· Management effort in product improvement

· Constant and generous dividend despite industry downturn

· Catalyst from US fiscal policy

Negative:

· Slowdown in order books due to industry headwind

· High impairment from China operations

· Litigation risk due to nature of business

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.