[Infographic] An overview on crude oil and refineries

DonkeyStock

Publish date: Wed, 19 Jul 2017, 12:02 AM

Visit https://www.facebook.com/donkeystock/ or http://www.donkeystock.biz/ for more infographic.

Subscribe us to get a free copy of e-book on Investment Guides all in infographics.

You may be interested in:

Sector Rotation: What is sector rotation and how can you deploy the strategy.

Stock Picking Guides: A guides on what type of stock suit you the best.

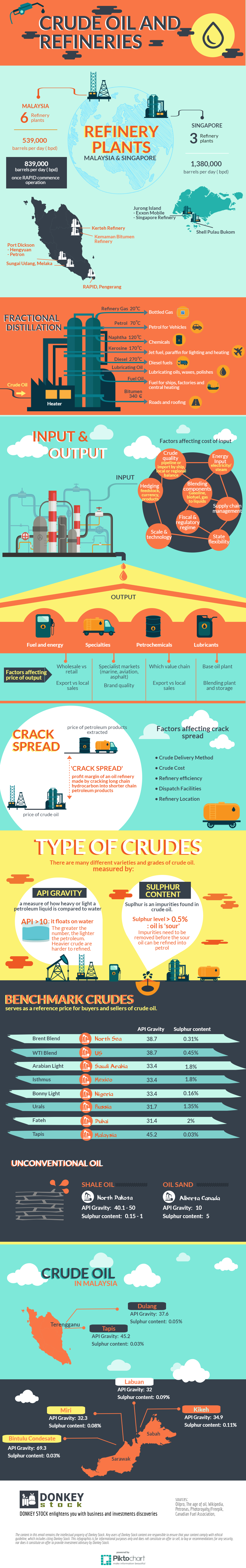

There are 6 refinery plants in Malaysia and 3 refinery plants in Singapore. The current refining capacity of Malaysia plants stands at 539,000 barrels per day (bpd) and is expected to add another 300,000 bpd capacity once RAPID commence operations. The refinery in Malaysia are located in Kerteh and Kemaman in Terengganu, Sungai Udang Melaka, Pengerang Johor and 2 refinery in Port Dickson Negeri Sembilan. The current refining capacity of Singapore stands at 1,380,000 bpd. Shell operates a refinery in Pulau Bukom while Exxon Mobile and Singapore Refinery operates refinery at Jurong Island.

Crude oil undergoes a process called fractional distillation in the refinery plants. Crude oil is being heaten to crack down to shorter hydrocarbon chain under different temperature. The major by products are refinery gas, petrol, naphtha, kerosene, diesel, lubricating oil, fuel oil and bitumen.

Here are some of the factors that affects the cost of input for a refinery plant:

· Crude quality (Transport method, local region demand and supply)

· Energy Inputs (Electricity, steam)

· Blending components (Gasoline, biofuel, gas, liquids)

· Supply Chain management

· State flexibility

· Fiscal and regulatory regime

· Scale and technology

· Hedging (Feedstock, currency, products)

And here are some of the factors that affects the price of output for a refinery plant:

Fuel and energy

· Wholesale or retail sales

· Export or local sales

Specialties product

· Specialist market (Marine, Aviation, Asphalt)

· Brand Quality

Petrochemical

· Value chain of the petrochemical

· Export of local sales

Lubricants

· Base oil plant

· Blending plant and storage

However, a huge chuck of refinery profit relies on crack spread, which is the profit margin of an oil refinery made by cracking long chain hydrocarbon into shorter chain petroleum products. Some of the factors that affect crack spread includes:

· Crude Delivery Method

· Crude Cost

· Refinery Efficiency

· Dispatch Facilities

· Refinery Location

Different type of crude oil affects the profitability of refinery plant. Here are some of the technical term you need to know before delving further

· API Gravity is a measure of how heavy or light a petroleum liquid is compared to water. If API gravity is greater than 10, it floats on water. The greater the number, the lighter the petroleum. Heavier crude are harder to refined

· Sulphur content: Sulphur is an impurities found in crude oil. When sulphur level is more than 0.5%, the oil is called sour. Impurities need to be removed before the sour oil can be refined into petrol

And here is a list of benchmark crude oil, unconventional oil and crude oil produced in Malaysia

|

Crude Name |

Major Production Area |

API Gravity |

Sulphur Content (%) |

|

Benchmark Oil |

|

|

|

|

Brent Blend |

North Sea |

38.7 |

0.31 |

|

WTI Blend |

US |

38.7 |

0.45 |

|

Arabian Light |

Saudi Arabia |

33.4 |

1.8 |

|

Isthmus |

Mexico |

33.4 |

1.25 |

|

Bonny Light |

Nigeria |

33.4 |

0.16 |

|

Urals |

Russia |

31.7 |

1.35 |

|

Fateh |

Dubai |

31.4 |

2 |

|

Tapis |

Malaysia |

45.2 |

0.03 |

|

Unconventional Oil |

|

|

|

|

Shale Oil |

North Dakota |

40.1-50 |

0.15 - 1 |

|

Oil Sand |

Alberta Canada |

10 |

5 |

|

Malaysia |

|

|

|

|

Bintulu Condensate |

Bintulu, Sarawak |

69.3 |

0.03 |

|

Dulang |

Terengganu |

37.6 |

0.05 |

|

Kikeh |

Sabah |

34.9 |

0.11 |

|

Labuan |

Labuan |

32 |

0.09 |

|

Tapis |

Terengganu |

45.2 |

0.03 |

|

Miri |

Miri, Sarawak |

32.3 |

0.08 |

More articles on Stock Infographics

Created by DonkeyStock | Dec 05, 2024

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

forgive my ignorance.. can you please enlighten me on the difference between the refineries mentioned here and the plants under Lotte Chemical in Johor or under BASF-Chemicals in Terengganu?

Thanks!

2017-07-20 14:15

Different refineries has different complexity. Nelson Complexity Index (NCI) is an index to determine its complexity. A more complex refinery can produce more products and can use more type of crude oil as input. Here is Lotte Titan product:http://www.lottechem.my/products/productGuide_view.asp?code=C201 and here is Petronas BASF product http://www.basf-petronas.com.my/products. You can say BASF Petronas has a more complex output product, but its not a guarantee of profitability. Profitability still depends on the crack spread margin between input price and output price

2017-07-27 23:54

Thanks for your explanation. However since your infographic mention MY only have 6 refinery, shouldn't the number be more?

2017-07-27 23:59

Hi, I have read your blog and found it very informative.You pointed out several things that I will remember for years to come. I look forward to reading your next informative work. Thanks!

2021-08-13 14:51

Flintstones

Good

2017-07-19 07:25