KSL land expansion plan, Moya Holdings Privatisation, Impact of Russia oil selling price cap

DonkeyStock

Publish date: Wed, 21 Sep 2022, 02:11 PM

Here's what we have for the week

Significant Event

- Chin Teck Plantation Berhad is acquiring 5,000 acres of palm oil plantation in Gua Musang, Kelantan for around RM 9,000 per acre.

- RMB is breaking a critical level.

- Ethereum completed The Merge

Real Estate Industry

- Mah Sing Group Bhd is selling a 3.384 acre land located in Georgetown, Penang for RM 66.33 million.

- KSL Holdings Bhd, a Johor based property developer, is buying 53.89 acres of land located in Gelang Patah from Tropicana Corp.

- Ascendas Reit is acquiring cold storage logistics facility at 1 Buroh Lane in Singapore from A3 Lux Alpha S.a.r.l for $196.2 million.

Infrastructure/Logistics

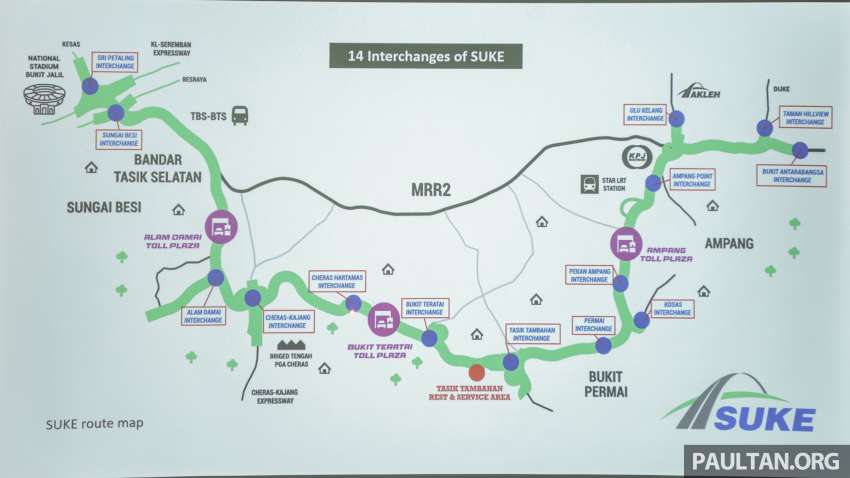

- Suke Highway Phase 1 commenced operation from 16 Sept 2022.

Cash Call/ Debt restructuring/Restructuring/Proposed Listing

- G Neptune Bhd’s shareholders had approved a proposal for the Guidance Note 3 company to buy a construction management services firm as part of its regularisation plan. G Neptune plans to acquire Southern Score Sdn Bhd from Super Advantage Property Sdn Bhd for RM252 million, to be satisfied through the issuance of 1.68 billion shares.

- Asdion Bhd is issuing 7.67 million new irredeemable convertible preference shares at four sen per share and 171.27 million settlement shares at eight sen per share to pay off RM16.41 million owed by the company to Kingdom Saga Sdn Bhd and Million Saint Consultancy Sdn Bhd.

Privatization

- Moya Holdings Asia has received a Voluntary conditional general offer to acquire all shares from Tamaris Infrastructure @ SGD 0.092 per share.

- Singapore Medical Group has received a Voluntary conditional general offer to acquire all shares from TLW Success @ SGD 0.37 per share.

- Frasers Hospitality Trust’s unit holders are opting to not go with the trust’s scheme of arrangement to privatise the hospitality trust.

* Products of FGV Dairy

Company Expansion Plan/ Capex Plan

- FGV Dairy Farm Sdn Bhd targets to increase its milk supply to 90,000 litres a month from 40,000 litres under its flagship dairy brand, Bright Cow.

Users can filter the companies' activities via industry or nature of activities via using our tool for Malaysia companies and Singapore companies via the link.

Users can get access to all the major transactions of offices, lands, and factories in Malaysia via this tool.

Daily Insights

- The selling price cap on Russian oil will change the landscape of the oil tanker industry. Here are the top 10 players in this industry. (Read Full Story)

- Better wheat harvest from Australia will help to cover the shortfall from Ukraine's wheat export. (Read Full Story)

- Massive Opportunities for Flood and Coastal Management Providers in Malaysia. (Read Full Story)

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.