Real Estate under inflationary era

DonkeyStock

Publish date: Tue, 27 Sep 2022, 11:00 AM

Six real estate sectors that are most likely to be resilient to inflationary pressures. These are: hotels, prime offices in key cities, rental properties on short-term leases, logistics assets, real estate in technology & innovation-linked hubs, and grocery-anchored retail parks.

Properties with contracted rents that are explicitly linked to an inflation index are also well-positioned to benefit from high inflation even during times of economic weakness, provided the tenants can maintain rental payments.

Finally, the private rental sector, student housing, senior living, and affordable housing all offer defensive characteristics for investors, with these rents most closely related to inflation levels.

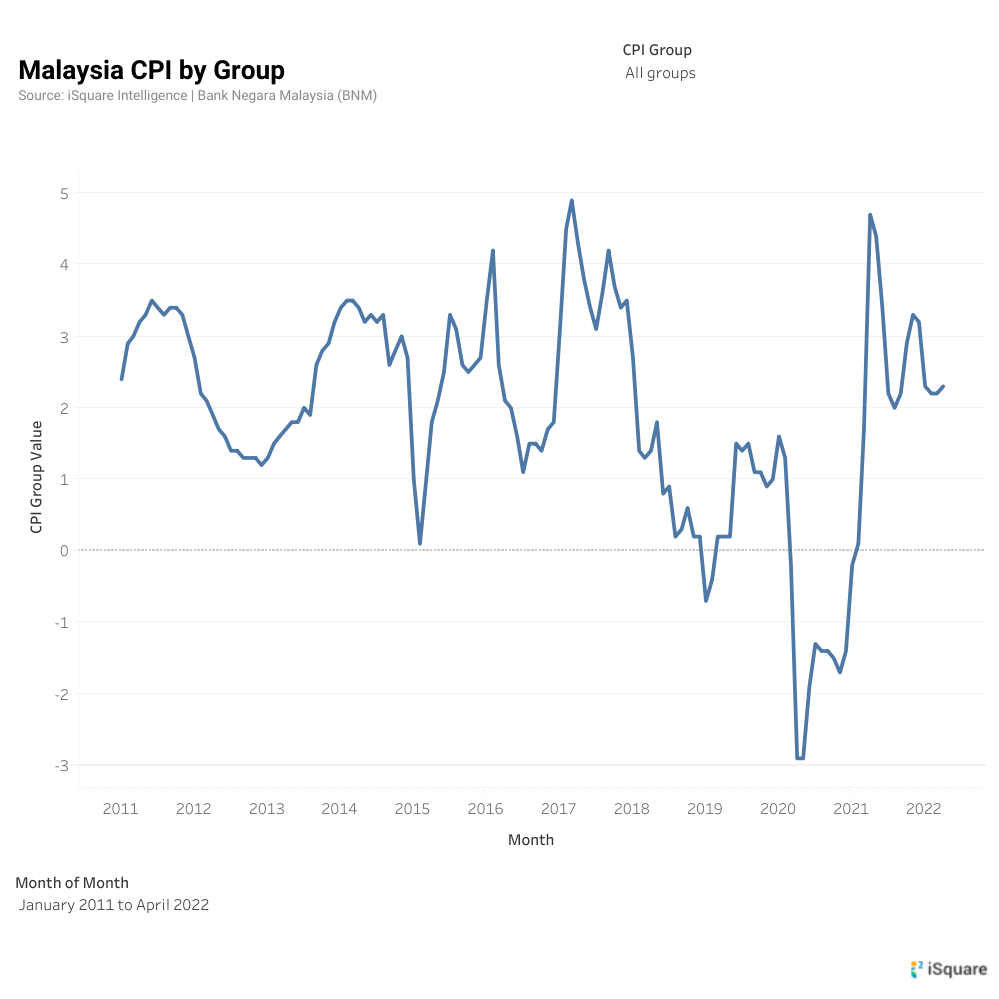

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.