Debt and Companies to avoid

DonkeyStock

Publish date: Tue, 01 Nov 2022, 12:10 PM

Between 2000 and 2018, the global gross domestic product (GDP) rose from US$33.5 trillion to US$80 trillion, giving the impression of economic growth.

Over the same period, global debt grew even faster, rising from US$62 trillion to US$247 trillion. In other words, it took the world four dollars of debt to achieve every dollar of growth.

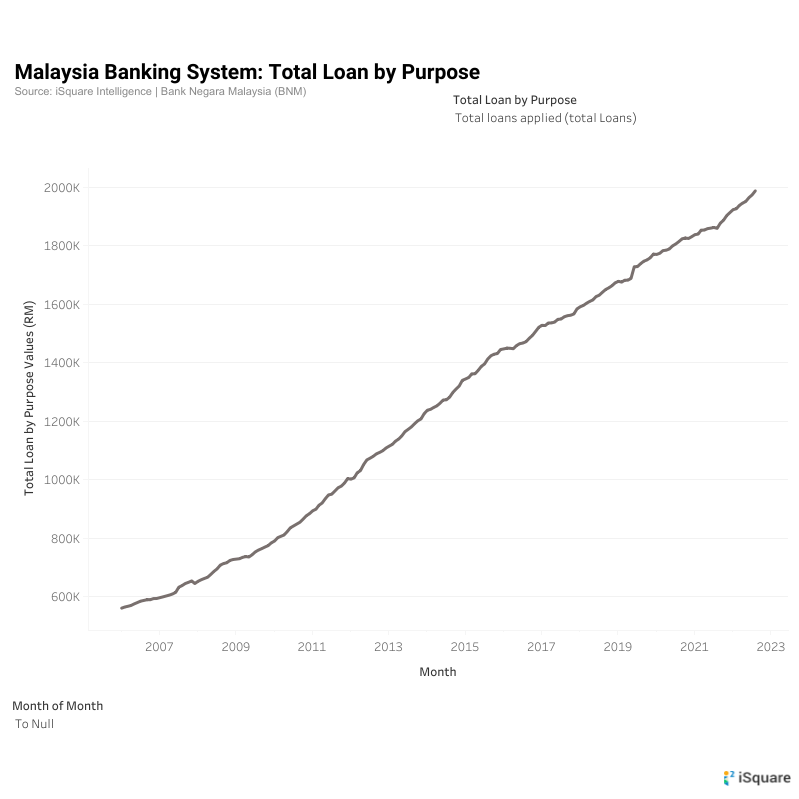

Same for Malaysia Situation. From Jan 2006 to Aug 2022, our total loan in the banking system grows from RM 560 billion to RM 1.98 trillion, a growth of 355%. In the same period, our GDP only grow by 229%.

Economies are increasingly leveraging themselves to drive growth but unproductive debt makes growth harder to achieve because borrowings need to be repaid.

As growth slows and obligations rise, the risk of default increases.

Avoid these companies:

1) Debt increase faster than revenue and asset

2) Cost of debt is higher than Return on Asset (ROA)

3) Mismatch between the currency composition of liabilities and revenue where the revenue is denominated in RM while the liabilities are denominated in USD

The market is rebounding but the bear is not ending. This window period serves as a good opportunity for you to balance your portfolio.

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.