Don't FOMO in this market

DonkeyStock

Publish date: Mon, 21 Nov 2022, 03:59 PM

The terminal interest for this round of interest rate hikes is expected to stay at around 5%. This has led to a strong rebound across all asset classes except cryptos.

To be honest

1) Strong rebound only happens in a bear market.

2) Asset with a long duration such as property and bonds are sensitive to interest rates.

3) Equities market requires an environment with ample liquidity, which means it needs a lot of money to make the stock market move higher.

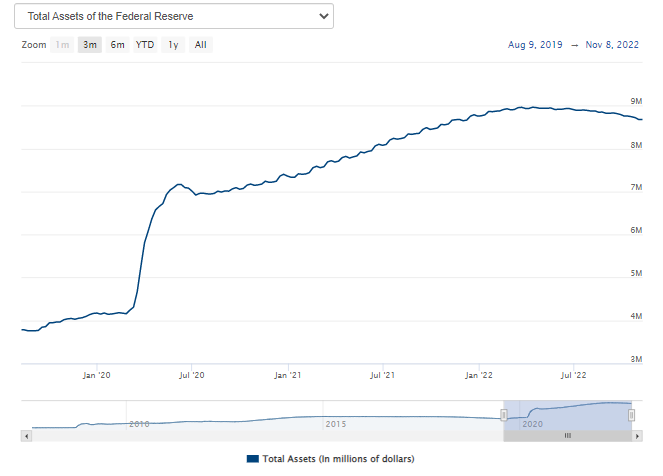

4) Although the interest rate hike cycle is ending, the Quantitative Tightening (QT) action is not. Federal Reserve is still shrinking its balance sheet. (Unprinting money)

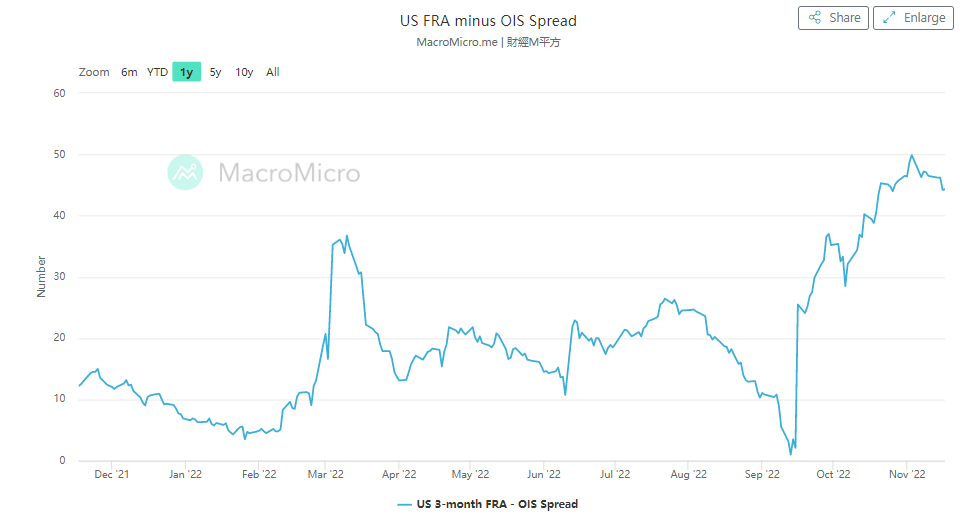

5) If we look at FRA-OIS spread, US Dollar is getting scarce. (The higher it is, it means investors outside of the US need to pay more to get US)

6) P/E ratio may be low, but earnings are expected to fall too.

There is always a risk in investing. The market still hasn't reached a once in a lifetime opportunity stage. Don't FOMO.

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.