Outlook for Oil Crops

DonkeyStock

Publish date: Mon, 21 Nov 2022, 03:48 PM

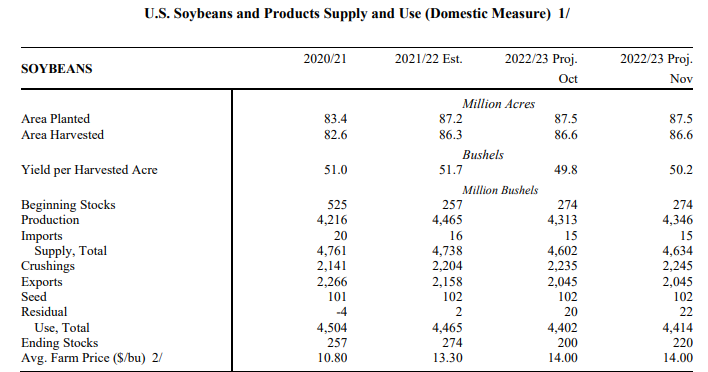

From the World Agricultural Supplies and Demand Estimates (WASDE) Report published by the US Department of Agriculture, here's a summary of the outlook of soybean, a competitor of crude palm oil.

The U.S. soybean outlook for 2022/23 is for increased production, crush, and ending stocks.

Soybean production is forecast at 4.35 billion bushels, up 33 million on higher yields. (<1% increase)

Soybean crush is raised 10 million bushels on an increased domestic soybean meal disappearance forecast.

Exports unchanged (China is the largest importer of soybean).

Soybean ending stocks (Inventory level) are raised 20 million bushels to 220 million due to exports unchanged. (10% increase).

In short, this is a bearish scenario for soybean, one of the most important agricultural commodities. Among all the commodities, agricultural commodities are the only categories that still trading at a higher range. This could spark the end of the commodities boom.

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.