[duit's] - Bursa's Stock in 2020 Tokyo Olympics Games # AYS Ventures (5021)

duitKWSPkita

Publish date: Thu, 31 Dec 2015, 05:40 PM

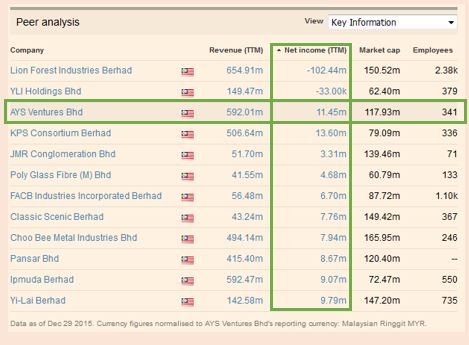

Key Information - (Peer analysis based on INDUSTRY but not SECTOR)

By performing peer analysis AYS recorded the highest NET INCOME among those Mark. Cap. From RM 100m-170m. It remains low profile if compare it with CSCENIC and YILAI.

Stock Performance - (Peer analysis based on INDUSTRY but not SECTOR)

By performing peer both PRICE/EARNINGS and PRICE/SALES remain attractive if compare with its peers. After the company turn things around, the share price will enjoy substancial upside as the P/S and P/E become more closely matched with those of it peers.

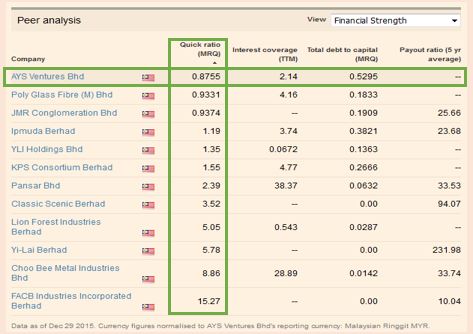

Quick Ratio - (Peer analysis based on INDUSTRY but not SECTOR)

By performing peer analysis AYS recorded the lowest Quick Ratio for FY 2015. The CA part has increased to RM 222mil from RM207mil but CL’s short-term debt increased to RM247mil from RM213mil.

Growth Rates - (Peer analysis based on INDUSTRY but not SECTOR)

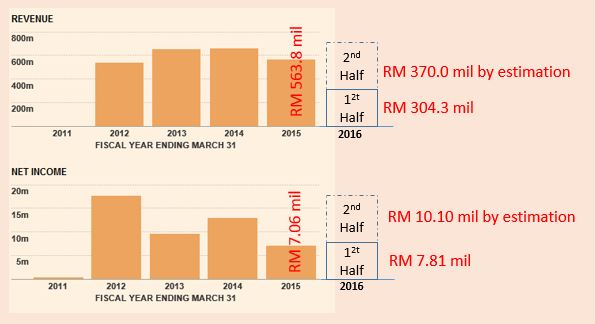

Growth rates of AYS are poor in last financial year. The key indicator such as Revenue and Net Profit decreased significantly with -14% and -45% respectively. However, the last two quarter figures showed great improvement and will be discussed in following part.

Net Profit

The first half net profit has achieved RM7.81 million which is already exceeded last financial year's RM7.06 million.

Earning Per Share (cent)

The EPS of AYS has recorded triple digits growth in the first and second quarters.

1Q16 (0.80) vs 1Q15 (0.33) = 145%

2Q16 (1.25) vs 2Q15 (0.57) = 119%

I believe 3Q and 4Q of 2016 will register triple digits and >35% respectively.

3) Catalyst

International market:

-

Partnership with WCT Holdings Berhad to construct Formula ONE in Middle East

-

Construction contract for EXPO 2020 in DUBAI

- Stadium construction work for 2022 Wirld Cup in DOHA

- 2020 Tokyo Olympic Games

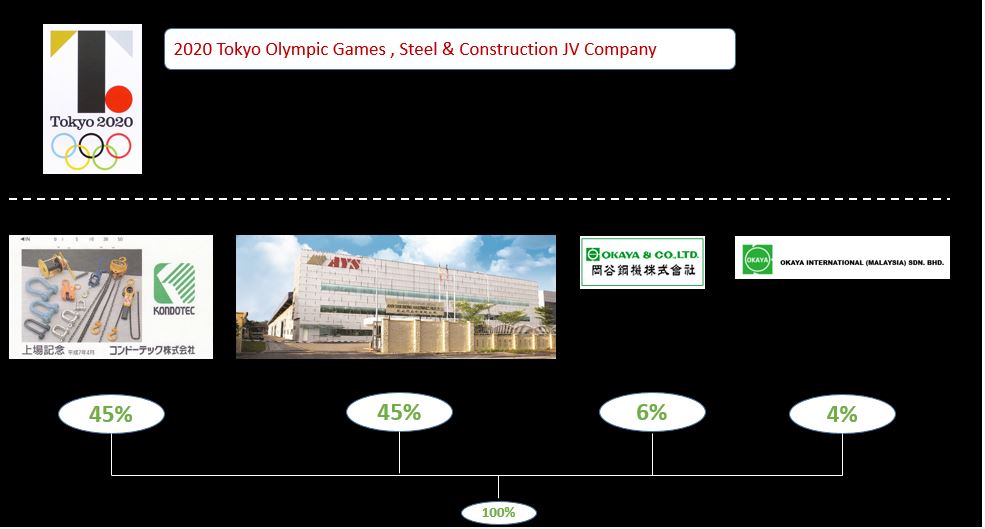

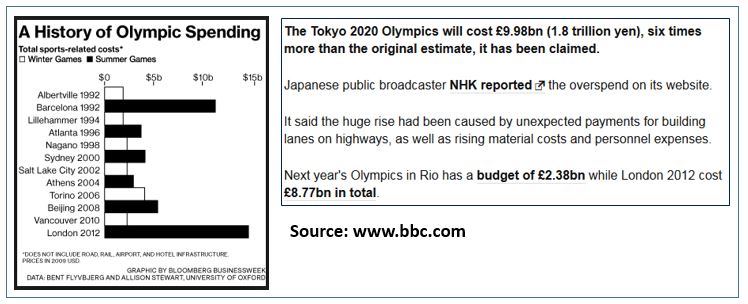

AYS Ventures Berhad owns 45% in the JV company which will cash in to the Japan's Olympics construction. The Japanese Olympic's construction is ranging from Government's budgeted cost of Euro 1.3 billion to historical normalized overun cost of Euro 9.98 billion. Based on previous Beijing, London and Athens Summer Olympic games cost breakdown usually construction consisted of 60%. The estimated earning by AYS Ventures will be as below:

Total budget around Euro 7.5 billion (RM 35.3 billion)

Construction cost = RM35.3 billion X 60% = RM21.15 billion

Estimated steel products and building material supply (60%) with profit margin (19%)

= RM21.15 X 0.60 X 0.19 = RM 2,411,000,000

Estimated Main Con Supplier (8 companies) ,hence AYS Ventures/KONDOTEC/OGAYA & CO will gain RM301million (RM2.411 billion/ 8 companies)

AYS Ventures will be getting 45% from JV company which is amounted to RM135 million (whole package).

Note: Discounted Cash Flow will not be presented in this write up

Local market:

-

Construction of MRT2 in 2016

-

Construction of LRT3 in 2016

- Construction of KL-SIN Fast Train railway

4) References

-

http://www.ays-group.com/index.php?option=com_content&view=article&id=24:corporate-profile&Itemid=2

-

http://klse.i3investor.com/blogs/rhinvest/81543.jsp (special thanks to Mr. RicheHo for reference)

-

http://www.thesundaily.my/news/1564848

-

https://en.wikipedia.org/wiki/Cost_of_the_Olympic_Games

5) Conclusion

In order to improve the company's profitability strength it should venture into higher margin differentiated product such as processed steels to minimise leverage the risk of volatile raw material. The company must also gear up production beside enhance on operational excellence. To remain as a global player in steel and building material industry it is on its right track to secure contracts from renowned projects such as World EXPO, World CUP, Formula ONE, Olympic Games etc. Competitiveness advantage can be created through company investment in Building Information Modeling (BIM) technology as well as to achieve Industrialised Building System (IBS) status.

This article is for LEARNING AND DISCUSSION PURPOSES only. OBVIOUSLY IT IS NOT A PROMOTION OR BUY CALL. Please dont let OTHER cloud your judgement.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Ah lui ko thanks for the heads up. Haha Sunday sharing is always great give time for us to study also. Thank you

2016-08-21 16:47

VenFx sifu,

The lovey feeling that I invest in AYS can be described through this song. https://www.youtube.com/watch?v=eRUDl-eiPaY

2016-08-21 16:49

Ah lui ko, don't worry at all. Jake and myself are equally busy from our side. Good to hear from you once in awhile, at least we know you are doing good health wise and wealth wise. Wishing you happy amd healthy all the time.

2016-08-21 16:51

World Game will stir up the profit margin due to the appetite for Engineered Building Design .

2016-08-21 16:51

No hurry, we don't expect Duit sifu to publish the contents at one go.

A following through article is a better sense and feel of the instantly development from AYS.

2016-08-21 16:54

Venfx sifu...as ulang sekali..watch enough NO PAO WIN!

I will trade. For silent stock cant be worse anymore so east to sell back at same price...... mean risk reward FANTASTIC & conducively! boleh menang 100% probability and 0% risk rugi teruk.....so tak akan dipatuk (like Eagle100 bro saying)....heheheh

2016-08-21 16:59

Same plan in NIHSIN after AYS...............

ALl welcomed to monitor NIHSIN... no need to trade... Let me trade alone will do.

duitKWSPkita 6 days to go for AYS Ventures.

How would be the changes? start to up or continue to register RED in account book? Let us see how colorful AYS next week.

The ROE and ROI are still in disappointing level which are 3.85% and 3.76% respectively.

However,at March 2016, its cash and short term investment stood at rm44.28 million, total debt at rm192 million. Book value per share at RM0.57.

New wind of RM0.530 like what happened to its brother Mr.Emetall???

21/08/2016 16:29

2016-08-24 08:59

Bro Duit, Nihsin there's a channel observing. Same view with you I suppose

2016-08-24 09:04

duitKWSPkita

6 days to go for AYS Ventures.

How would be the changes? start to up or continue to register RED in account book? Let us see how colorful AYS next week.

The ROE and ROI are still in disappointing level which are 3.85% and 3.76% respectively.

However,at March 2016, its cash and short term investment stood at rm44.28 million, total debt at rm192 million. Book value per share at RM0.57.

New wind of RM0.530 like what happened to its brother Mr.Emetall???

2016-08-21 16:29