WANT TO CATCH THE NEXT TRIPLE LIMIT UP?

EWCIMB

Publish date: Sat, 30 Sep 2017, 11:13 PM

The probability of catching a limit up is almost next to nothing. If I had to take a guess, it would be less that 0.1%. Not many people would have the privilege of experiencing even one of them in their lives. What about a double limit up, well the probability is 0.1% X 0.1% or 0.0001%. What about a triple limit up, well you get the point.

What was the last triple limit up you remembered? For me it was Focal Aims Berhad ("Focal Aims"). Sounds familiar? The reason is because it goes by a new name today, Eco World Development Group Berhad ("EWB").

This was Focal Aims during the triple limit up before it continued to uptrend to a height of RM5.50. At that time it had already changed its name to EWB.

So what happened? It was because the rock star property business tycoon TS DS Liew Kee Sin ("LKS") decided to reverse takeover the company and the market gave it the premium it deserved.

Our next triple limit up is also none other than Eco World Development Group Berhad ("EWB"). Now I know your question is, how can this be since the deed is done and it has already flown, this is old news. Don't lie to me with your triple limit up bull shit.

Well, that is because the next stage is approaching.

Before that, let us establish what are EWB's magic and the problem with EWB today. EWB's magic is that it can take pieces of empty land and use its magic to develop houses and condos etc and be able to charge people an absurd amount of money for a the properties, and the thing is that people pay. Actually, this is the magic of LKS.

The problem is that because EWB is so famous, it is difficult for them to acquire land. When they try to undergo a land banking exercise, the land seller will not give the land to them cheaply because they know EWB is able to sell properties at a premium.

This brings us to the latest development which is the acquisition of Sime Darby's Property arm. Sime Darby is a giant government conglomerate which is poorly managed with lack of innovation and motivation. This year, it embarked on an exercise to break apart its property and plantation divisions.

The Chairman of Sime Darby's property arm is none other than Tan Sri Abdul Wahid Omar ("Wahid") who is on good business terms with LKS. Wahid is one of those rare government business leaders who is very competent at what he does.

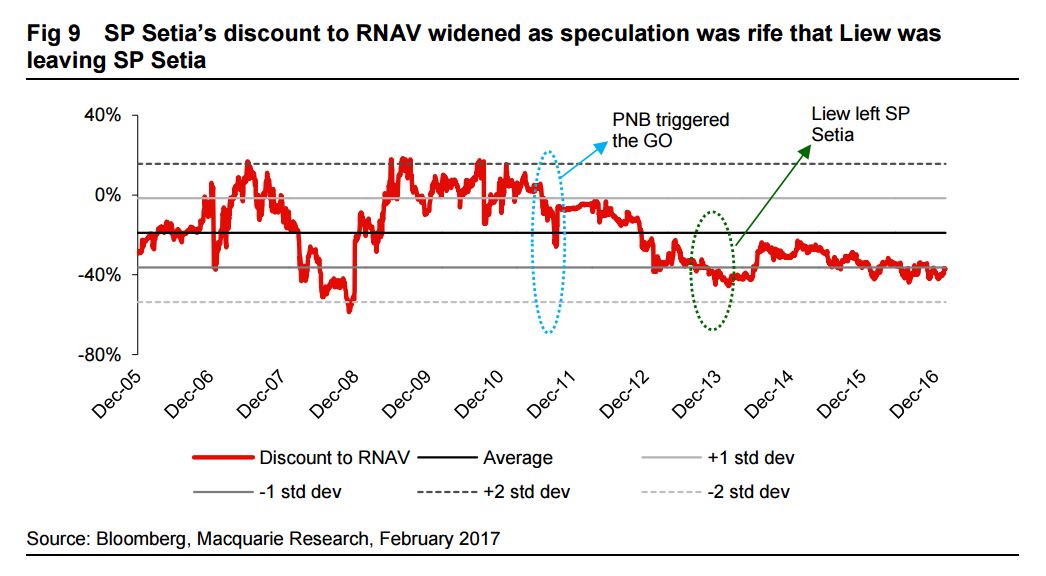

Sime Darby is also controlled by PNB whose chairman is also Wahid. If you remember, PNB was the one who took control of SP Setia from LKS, and therefore their obsession of taking over well run Chinese businesses.

The other major shareholder of SP Setia is also EPF who's CEO (Datuk Shahril) is very good friends with LKS. They have done many jobs together such as the Battersea and Bukit Bintang City Center (this together with Sime as well) project.

So why would LKS let EWB be SP Setia #2? While most people think that PNB bastardized SP Setia and robbed LKS, they forget that LKS walked away from the SP Setia deal with a pocket load of cash which enabled him to start EWB and Eco World International ("EWI"). Not to mention all the unnamed non-listed companies which owns other assets.

But why would LKS want to risk EWB being SP Setia #2? Well, it is because he has a strong exit plan should the new entity turn sour for him. One is that he is a property behemoth magic machine which can replicate SP Setia, EWB and whatever else he wants. The second reason is because if he is bought out, he can use this opportuinity to exit Malaysia.

That being said, LKS still has strong incentives to see EWB reach its full potential (for him to maximise earnings), and if the deal goes through, the two main decision makers from Sime Darby would be Wahid and Datuk Shahril who both work well with LKS.

In fact, all of what I am saying is not new. The report below by Macquarie bank explains what would the deal look like.

Now I hear you saying, this is an old report in February. Why should I care? The reason is because there is significant progress since the report was released. First of all, Wahid has a reputation of delivering on his promises, and he has promised that the demerger will complete by the end of the year. This means that this acquisition will also complete by then as Sime Darby would not want to list the property arm only to be acquired again. Frankly it is a waste of time and resources.

Secondly, and this is important, sources in the industry have verified that CIMB Investment Bank has been appointed as the deal team. CIMB's Corporate Finance division has already assembled a team to begin the due diligence and paperwork and it is only a matter of time before they complete their work.

So what is going to happen if EWB acquires Sime Darby Property ("SDP")? Currently according to the latest Kenanga Report, EWB has a total RNAV of RM11 billion and SD has an RNAV of RM26.6 billion.

If the deal goes through, the new listed entity would have an RNAV of RM37.6 billion. This new property behemoth will likely be priced at 0% discount to RNAV due to the new entity having extremely strong characteristics such as leadership (LKS & Wahid), branding, entrepreneurship, overseas experience, strong balance sheet and finally a sizable land bank.

With a market cap of RM37.6billion, the new entity would be part of the KLCI index leading to strong foreign and local institutional holdings. Most institutional would try to mirror 80-90% of their portfolio with the KLCI and use 10-20% to capture alpha. This means that there will be strong demand for the new EWB-SDP entity.

Today EWB's market cap is only RM4.5b. If they do acquire SDP, it would likely be at a 50% discount to RNAV or RM13.3 billion acquisition via issuance of new EWB shares. This would make the total proforma market cap of EWB-SDP to be RM17.8billion (RM4.5b+13.3b) which leaves RM19.8billion on the table (RM37.6 - 17.8b).

Therefore essentially your investment today would essentially increase by 111.2% (RM19.8/17.8b). This tags the target price for EWB to be RM3.27 verus the current RM1.55.

But why not buy SD instead of EWB? This is because SD will take the butt of the deal since all they have is land. Land is plentiful and EWB can do M&A with many other land owners. However there is only one LKS in this world.

If you don't believe me, I don't blame you. However when you read the deal on the news, I hope you won't regret your decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Nice story but to bet on property counter to take on M&A at this timing of the market.

Will large institution funds still invest in property counters at this juncture ? I heard quite the opposite

2017-10-01 21:45

I LOVE HENGYUAN, sexy babe RM21

Ecoworld alredi heavily gear. Their gearing will go even higher if acquire did happen. Thts dangerous. Unless a share swap deal happen . Wahid and LkS is super good long-term friends, they add value to each other when coklne together, they get things done. Thts what I like.

2017-10-02 10:23

I doubt it would materialize in short span of time for EWB + Sime Property. Sime Property going to demerge from Sime end of the year, post demerger immediately merge with EWB? It doesn't sound very feasible in my opinion.

Merging of SPSetia with Sime Property sound more realistic but it would not be in the picture in near term. SP have just swallowed I&P ( with strategic landbanks ) and need time to digest it.

2017-10-08 08:32

Alex Foo

how do you calculate RM3.27?

2017-10-01 11:34