Is DC Healthcare on the Path to Recovery?

raizalmyinvests

Publish date: Sun, 01 Sep 2024, 12:47 AM

First of All, Share Price Performance

Figure 1.0: Share Price Chart of DCHCARE

As the broader Malaysian market faces selling pressure, DC Healthcare Holdings Berhad (KLSE: DCHCARE) is no exception.

The company has experienced similar challenges, reflected in its recent share price movements.

However, despite the market's overall downturn, the fundamentals of DCHCARE show signs of improvement compared to the previous quarter.

Financial Performance

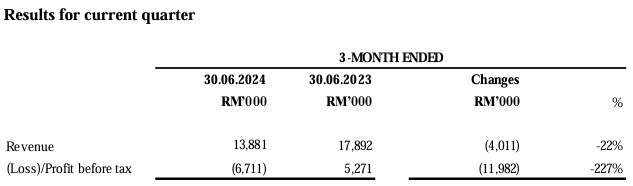

Figure 2.0: YoY QR Results of DCHCARE

For Q2 FY2024, DCHCARE reported a revenue of RM13.9 million, down from RM17.9 million in the previous quarter.

This decline is primarily attributed to a lower redemption rate for aesthetic services.

It's worth noting that DCHCARE has shifted its business model from charging customers as services are rendered to collecting upfront payments, particularly for bundled services.

A closer examination reveals that contract liabilities—representing outstanding services yet to be redeemed by clients—have increased to RM13.7 million this quarter.

This indicates a strong pipeline of future services, providing a buffer against short-term revenue fluctuations.

Despite the positive revenue outlook, DCHCARE reported a Loss Before Tax (LBT) of RM6.7 million for the quarter.

This loss was driven largely by higher administrative expenses, which rose to RM9.5 million.

The increase in costs includes RM1.6 million in additional marketing expenses, RM1.9 million in operational and maintenance costs, RM1.1 million in depreciation of rental outlets, and RM1.4 million in professional fees related to corporate exercises.

On a brighter note, the company’s losses have narrowed by approximately 15.15% compared to Q1 FY2024, thanks to a substantial revenue growth of 46.83%.

Huge Expansion Game

Some may view the numbers with concern, but it’s essential to recognize the company’s aggressive expansion strategy. DCHCARE now operates 21 outlets, nearly doubling from 12 outlets in Q2 FY2023. This expansion highlights the company’s commitment to growth and its ability to scale its operations.

Additionally, under its subsidiary Ten Doctors Sdn. Bhd., DCHCARE is launching a new brand, NewB, which focuses on premium ageless and hydration beauty products. This strategic move could be a game-changer, given the expanded sales channels now available to the company.

Figure 3.0: Sample Product Snippet of DCHCARE's NewB

Conclusion

In conclusion, while the recent decline in share price may cause concern among investors, DCHCARE's underlying business fundamentals remain strong. The company's strategic expansions and revenue growth suggest that it is well-positioned for future success. At its current discounted price, DCHCARE may present a compelling buying opportunity for investors who believe in its long-term potential.

Disclaimer

The information provided in this article is for educational and informational purposes only and should not be considered financial advice. Investing in stocks involves risks, including the loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author holds no responsibility for any investment decisions made based on the information provided.

More articles on Eyes on Bursa

Created by raizalmyinvests | Jul 20, 2024

Will this truly be a buying opportunity for SYNERGY?

Created by raizalmyinvests | Jul 08, 2024

My two cents on this hot IPO in the market.

Created by raizalmyinvests | May 27, 2024

What is going on with DCHCARE? Do you know the TRUTH?!

Created by raizalmyinvests | May 22, 2024

My observation on the recent emerging glove industry!

Created by raizalmyinvests | May 19, 2024

A deep value study on EcoFirst Consolidated Berhad!

Created by raizalmyinvests | May 19, 2024

The Bursa Malaysia Transportation & Logistics Index has recently shown a robust upward trend, capturing the attention of investors. But what exactly is driving the strong performance and fund flow int