FPI - An U-Turning Great Opportunity Stock for last opportunity to grab!

gary5243

Publish date: Wed, 27 Nov 2019, 10:43 PM

FPI share price is under depressed recently due to PERMODALAN NASIONAL BERHAD is selling agreesively.

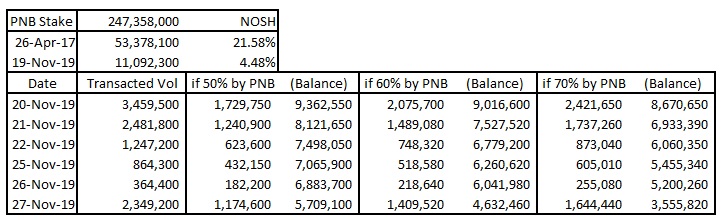

In fact, PNB has started to off load FPI shares since Apr 2017. During that time, PNB is holding as much as 21%+ stake which is represent of 53mil+ nosh.

Up to 19 Nov 2019, its share holding has been reduced to as low as 11mil+ nosh which is equal to 4.48%.

(FPI share price is on up trend from 2017 to 2019. PNB disposal is absorbing well by the market.)

For the subsequences dates (from 20-Nov to 27-Nov), the total transacted volume is 10.76mil nosh. If out of this transacted volume, 60% is throw out by PNB, their remaining share holding is left only 4.6mil nosh.

Yes... PNB is almost finish selling. What will happen to FPI share price afterward? I believe its fundamental figures and prospects will able to tell whether its share price will go north or further south.

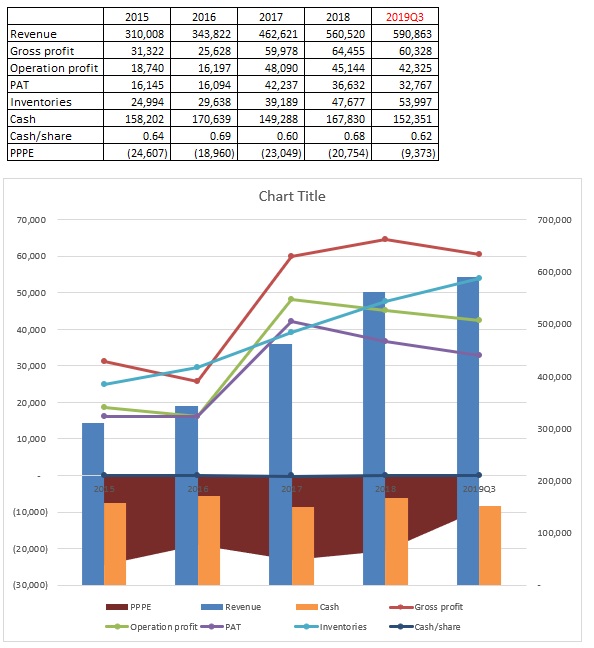

Accumulated 2019 3Q results, its eps is 13.20sen.

According to its business trend and also inventory level, I believe its coming 2019Q4 revenue will be better than last year 2018Q4.

Let's assume 2019Q4 only slightly better than last year and estimate eps is 2.8sen.

This will make its full year of 2019 to be at eps 16sen.

At today's closing share price @ RM1.50. Its PE is equal to 9.375 (<PE10)

If 2019 is going to give 10sen dividend as per last year, its DY = 6.7%!

If worse, dividend payout is 8sen, DY=5.3%, still pretty attractive. Anyhow, i believe its dividend payout won't less than 8sen because FPI has a lesser CAPEX in 2019 so far after manage to kick start their new factory in early of this year.

A zero debt company, cash per share at 62sen, historical high inventory level and revenue! Also at lesser CAPEX after pump in about 19-24mil CAPEX annually in the past 4 years for aggresive expansion.

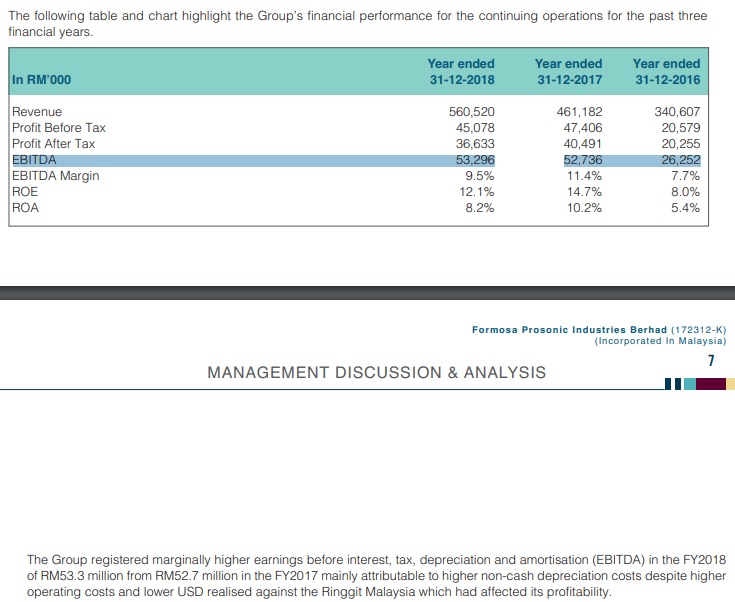

FPI share price is under consolidation for 2 years since its PAT hit its peak in 2017. If comparing EBITDA, 2018 is actually perform slightly better than 2017. Despite expansion has started to stablize in 2019, I believe its profit margin will slowly improve by giving more time for management to do cost improvement activities while getting more business arise from expansion effort in placed.

An impressive (possible to be greatest) financial performance reported by FPI in 2019 but its share price seem under depressed by known reason.

Found informative information from Q&A session during 2019 AGM. It is worth to take a look.

http://www.fp-group.com/prosonic/AGM%202019~Minutes~24.05.2019.pdf

I strongly believe coming days or weeks are the last chance to grab some FPI at offer price for mid to long term investment. It will be a great target for Fund managers to diversify their investment portfolio. I guess so...

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

cykoay

nice write up

2019-11-28 14:01