Why did KANGER suffered losses in this quarter? (Answered)

skylimit88

Publish date: Wed, 01 Dec 2021, 03:18 AM

Why did KANGER suffered losses in this quarter? (Answered)

For those who followed this counter closely, I’m sure you have a good grasp on the underlying change of the group's structure into property development as well as construction. What’s more interesting is one of the key related person with Aset Kayamas had also emerged as a substantial shareholder for the company.

But why are they still making losses?

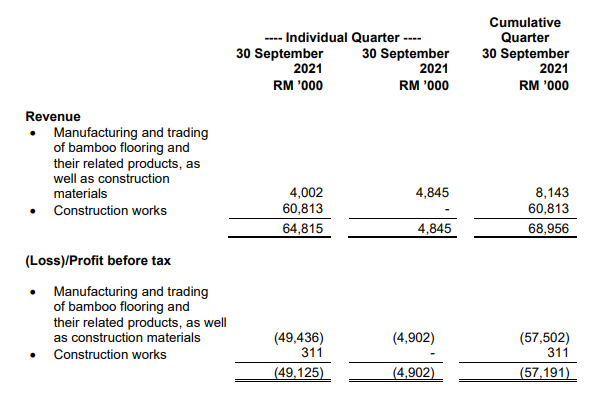

At first glance on the analysis of performance, one would notice on the massive losses after taxation. But if you were to look closely, the company actually made money in gross profit terms, and the loss after tax was largely due to RM50.42 million in administrative expense, which was increased by 10-fold as compared to the preceding year’s RM5.55 million. The increase in administrative expense were mainly caused by kitchen sinking activities by the group, which includes an impairment loss on inventories amounting to RM13.30 million, RM25.10 million on trade and other receivables, and finally RM4.70 million on property, plant and equipment.

And as we dig deeper, these impairments were mainly of the old bamboo flooring business, and in fact their newly acquired construction business had delivered pretty good results despite impacted by the MCO 3.0.

To recap, the contribution of the construction works were mainly from acquisition 51% of Sung Master Holdings S/B (SMH) in 26th April 2021. It is still pretty impressive for me, given that the SMH were badly impacted by MCO 3.0, and on a comparative figure, we know that there are multiple construction businesses that are making losses, which I do not wish to name them.

In short, KANGER is likely to have better numbers as a group as they had factored in most of the worst part into the accounts. The next question would be how are they going to do it?

Fortunately, the group had outlined some very clear and structured plans for their turnaround – in which I suspect also a tidy-up effect prior to Aset Kayamas’s potential reverse takeover. Here are the lists of growth/turnaround plans that the group would impose for 2022.

-

Expansion into new bamboo concession and processing plant in Jingzhou, the PRCin order to better manage raw material costs, as the new plant is surrounded by an estimated 18,200 metric tonnes standing stock of ready-to-harvest raw bamboo (translating to an estimated 435,000 square metres of bamboo flooring). This will be a steady source of raw material supply and key factor in the re-upscaling of our own bamboo products segment. The expansion in Jingzhou will allow the Group to focus not only on manufacturing of bamboo products but also processing of bamboo related foodstuff and bamboo eco-tourism in the near future;

-

Expansion of the Group’s flooring products with the launching of new series of bamboo flooring products;

-

Enhancing the Group’s flooring products to focus more on ‘green’ strand woven products;

-

Expansion of the Group’s product portfolio to include bamboo furniture marketed under the ‘KAR-ACE’ brand;

-

Expansion into wood flooring products by promoting Classen’s products in the PRC through the collaboration with Classen GmbH as the Group is the exclusive distributor for Classen’s products in the PRC. The COVID-19 pandemic and related lockdowns has had a significant impact on general business activity and there is always a risk of additional waves occurring in the future. As a result, the Group is currently in discussions with Classen on reducing the scope of the exclusivity from China-wide to perhaps focus on Guangdong province or the southern region where our main and sales offices are. The reason for this is to avoid incurring potential penalties in the future for not meeting minimum sales targets should the pandemic turn into a longer term problem;

-

Expansion of the Group’s presence by increasing the number of appointed dealers in its sales network and number of sales and marketing channels, for both its own and third party products;

-

Identifying candidates to be the Group’s master agents/distributors in countries such as Malaysia, Australia and New Zealand;

-

Intensifying efforts in the adoption and building out of a comprehensive omni-channel marketing strategy which is designed to cover all points of contact with existing and potential new customers. The Group is also cooperating closely with its dealers in implementing effective Online-to-Offline marketing and delivery channels. The online platforms include JD.com, Alibaba’s Taobao and various mini-programs offered by social media networks like WeChat;

-

Seeking opportunities to be able to involve in distribution of medical related products such as gloves, vaccine for COVID-19 and mask; and

- The acquisition of SMH is a horizontal acquisition by the Group to acquire its peer with the intention to expand its existing business activities of manufacturing and trading business and widen its product offerings, which include, amongst others, timber flooring, tiles, bulk cement, concrete, which are expected to enhance the revenue and earnings of the Group moving forward.The proposed acquisition of SMH is expected to augur well and is complementary with the Group's existing business in the property related segment and the construction business segment.

Putting the bamboo business aside, SMH is expected to generate a RM20.00 million profit after tax per year and based on the shareholding structure, KANGER would register RM10.00 million into their books. And don’t forget that the group had acquired a block of units on Genting Highlands for costs of RM142.90 million, take a 15% net margin from the sale of the properties and we would arrive at RM21.43 million on the earnings, this adds up to RM31.43 million in terms of potential earnings for financial year 2022 – 2023.

That pretty much means that the forward PER for KANGER is trading at 6.64 times, which is significantly cheaper than other construction cum developer peers. Hence, I expect people to absorb the loss making news, and KANGER will rebound to at least circa 5 cents level really soon.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Looking out for gems

Discussions

why not going down another 100% if the pandemic drag on for another years?

2021-12-05 17:46

MZM2511

Excerpt from the above article......... To recap, the contribution of the construction works were mainly from acquisition 51% of Sung Master Holdings S/B (SMH) in 26th April 2021.

---------

I want to differ.....

The contribution from Sung Master not yet recorded in this QR report as the Sung Master acquisition completed only on 30 September 2021.

Note: The 2QR 2022 ended on 30 Sept 2021.

Explaination:

1. On behalf of the Board, UOB Kay Hian wishes to announce that 769,513,179 new Kanger Shares and 713,157,273 new Kanger Shares issued pursuant to the Subscription and Acquisition respectively, were listed and quoted on the ACE Market of Bursa Securities with effect from 9.00 a.m. on Thursday, 30 September 2021, which marks the completion of the Proposals.

2. The contribution or revenue from Sung Master as a subsidiary which involved in building materials trader (if any) should not be classified as a revenue from construction.

3. The revenue from construction stated in the 2QR 2022, I think it is derived from its construction activities which started in June 2021.

The construction activities could be refered to a Genting Highland construction project contract with contract value RM478 million which involved Vengetta Champion Sdn. Bhd. and Kanger Ventures Sdn. Bhd. Earlier, the company announced that the Project is expected to commence in June 2021 and to be completed in 48 Months. The construction project contract under this collaboration agreement will start in June 2021.

2021-12-02 16:30