ICAPITAL.BIZ BHD: How much are the fees of closed-end fund and mutual funds? Examine their costs.

James Ng

Publish date: Tue, 10 Oct 2017, 01:13 PM

It is a fact that the fund managers of closed-end fund and mutual funds are super rich. Why? Let us examine their fees and charges:

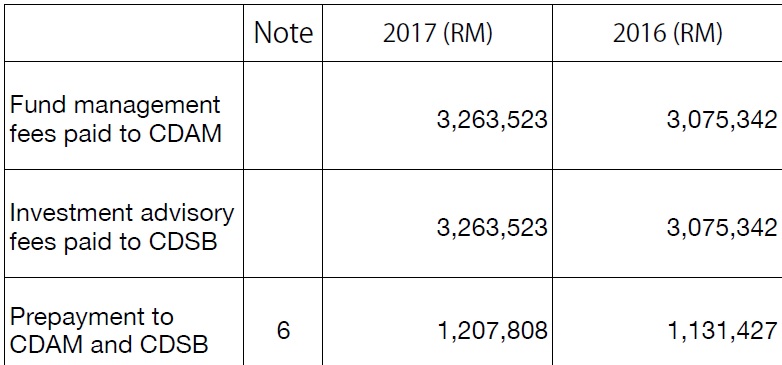

Above is in the page 45 of Icap 2017 annual report. Capital Dynamics Asset Management Sdn Bhd. (“CDAM”) is acting as Fund Manager to Icap. It is responsible for managing Icap’s investment. Capital Dynamics Sdn. Bhd. (“CDSB”) is acting as Investment Adviser to Icap. It is responsible for providing investment research and analysis to Icap. To put into table format:

Icap management fees and investment advisory fees:

| Year | Fund management fees RM | Investment advisory fees RM | Total |

| 2006 | 638479 | 638479 | 1276958 |

| 2007 | 1363494 | 1363494 | 2726988 |

| 2008 | 2055442 | 2055442 | 4110884 |

| 2009 | 1747606 | 1747606 | 3495212 |

| 2010 | 2018555 | 2018555 | 4037110 |

| 2011 | 2552673 | 2552673 | 5105346 |

| 2012 | 2894863 | 2894863 | 5789726 |

| 2013 | 3089891 | 3089891 | 6179782 |

| 2014 | 3109491 | 3109491 | 6218982 |

| 2015 | 3187354 | 3187354 | 6374708 |

| 2016 | 3075342 | 3075342 | 6150684 |

| 2017 | 3263523 | 3263523 | 6527046 |

| Total | from 2006 to 2017 | 57993426 |

The NAV of Icap = 140000000 shares x 3.47 per share = RM485.8m. The portion of total fees of RM58m is already about 12% of its current NAV! Read this https://klse.i3investor.com/blogs/general/134192.jsp and justify for yourselves if the fees are worthwhile.

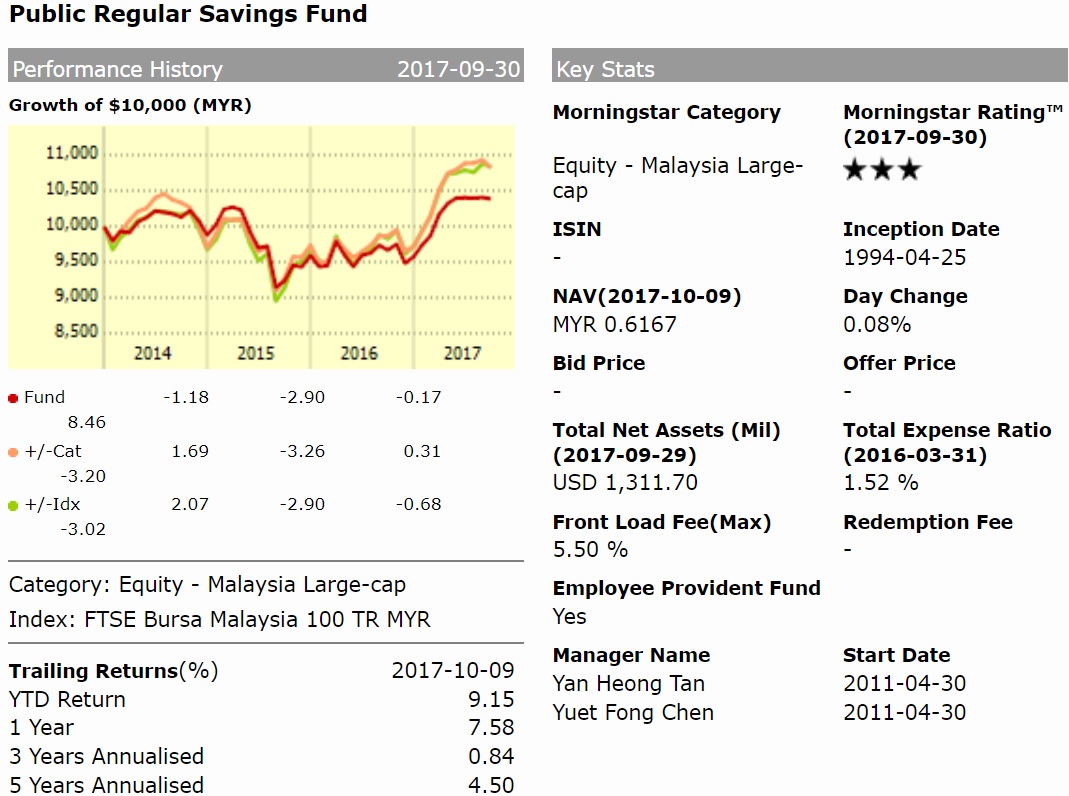

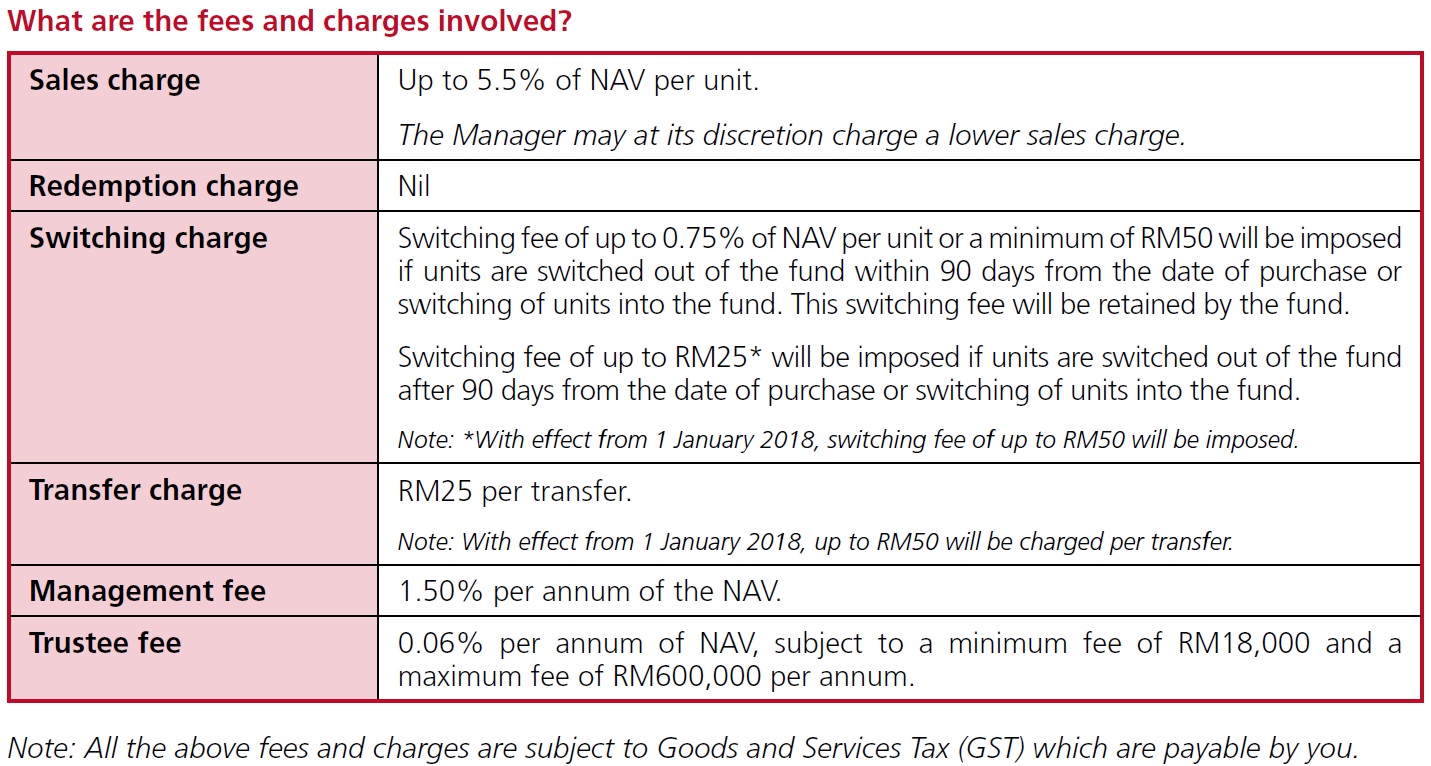

Now let us examine Public Regular Savings Fund:

The size is $USD1.3b = RM5.5b. Note the Front load Fee is 5.5%, If you invest RM1m, you only get 94.5% of 1m = RM945000, RM5500 is the "entry fee".

1.5% of management fee = RM83m! 0.06% of Trustee fee = RM3m! Its 3 years annualised is only 0.84%, you are better to put your money in FD!

http://www.thisismoney.co.uk/money/markets/article-4262170/Billionaire-Buffett-attack-sky-high-hedge-fund-fees.html

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on James的股票投资James Share Investing

Created by James Ng | Aug 21, 2024

Created by James Ng | Aug 14, 2024

Created by James Ng | Aug 07, 2024

Created by James Ng | Jul 30, 2024

Created by James Ng | Jul 23, 2024

Created by James Ng | Jul 16, 2024

Created by James Ng | Jul 09, 2024

Created by James Ng | Jul 02, 2024

Created by James Ng | Jun 25, 2024

Created by James Ng | Jun 18, 2024

.png)