WHY PALM OIL PRICES HAVE OUTPERFORMED SOYOIL PRICES

TheAlphaTrader

Publish date: Sat, 24 Aug 2024, 10:26 AM

The eagerly awaited US presidential is just around the corner and traders already can be seen placing their bets on the outcome in November. Soybean prices, along with corn and wheat hit multi year lows last week on the Chicago Board of Trade (CBOT). Soybean is trading below the pivotal USD10.00 per bushel, down 22% year-to-date, a level not seen since 2020. Soybean oil futures are also trading down 17% for the year at 38.69 US cents per lb. Palm oil (CPO), although down 1%, has outperformed its rival soybean oil by a country mile for reasons which we will discuss. Soybean oil and CPO prices tend to move in tandem as they are substitutes in the vegetable oil market.

REASONS FOR THE CURRENT MULTI-YEAR LOW GRAIN PRICES IN THE USA

1) USDA BALANCE SHEET AND FAVOURABLE WEATHER

The US Department of Agriculture (USDA)’s August WASDE report showed an upward revision in the soybean crop forecast, further pressuring prices. Chinese imports in June 2024 were down 10% vs the same period in 2023.

For the 2024 growing season, weather has been very favourable in the Midwest region. Overall weather during the critical growing months which “make the crops”, have been extremely good with no adverse heat that typically pose as a threat between the June to July period.

2) TRUMP’S PROTECTIONISM POLICIES

We can all recall what Trump’s protectionism policies did to the farmers in America. The former US president placed tariffs on billions of dollars’ worth of goods around the world, targeting China in particular. Soybean prices plummeted to USD8.00 per bushel, wreaking havoc in the agriculture futures markets. So it is unsurprising that this time round, markets seemed to price in another round of ‘Make America Great Again’ policies should Trump come into power again.

According to the USDA latest WASDE report, Brazilian exports to China increased by 9.68% by June 2024 vs the same period in 2023, taking away market share from the US. This was the similar trend during Trump’s last reign as President, where soybean exports from South America increased tremendously.

WHY CRUDE PALM OIL PRICES HAS OUTPERFORMED

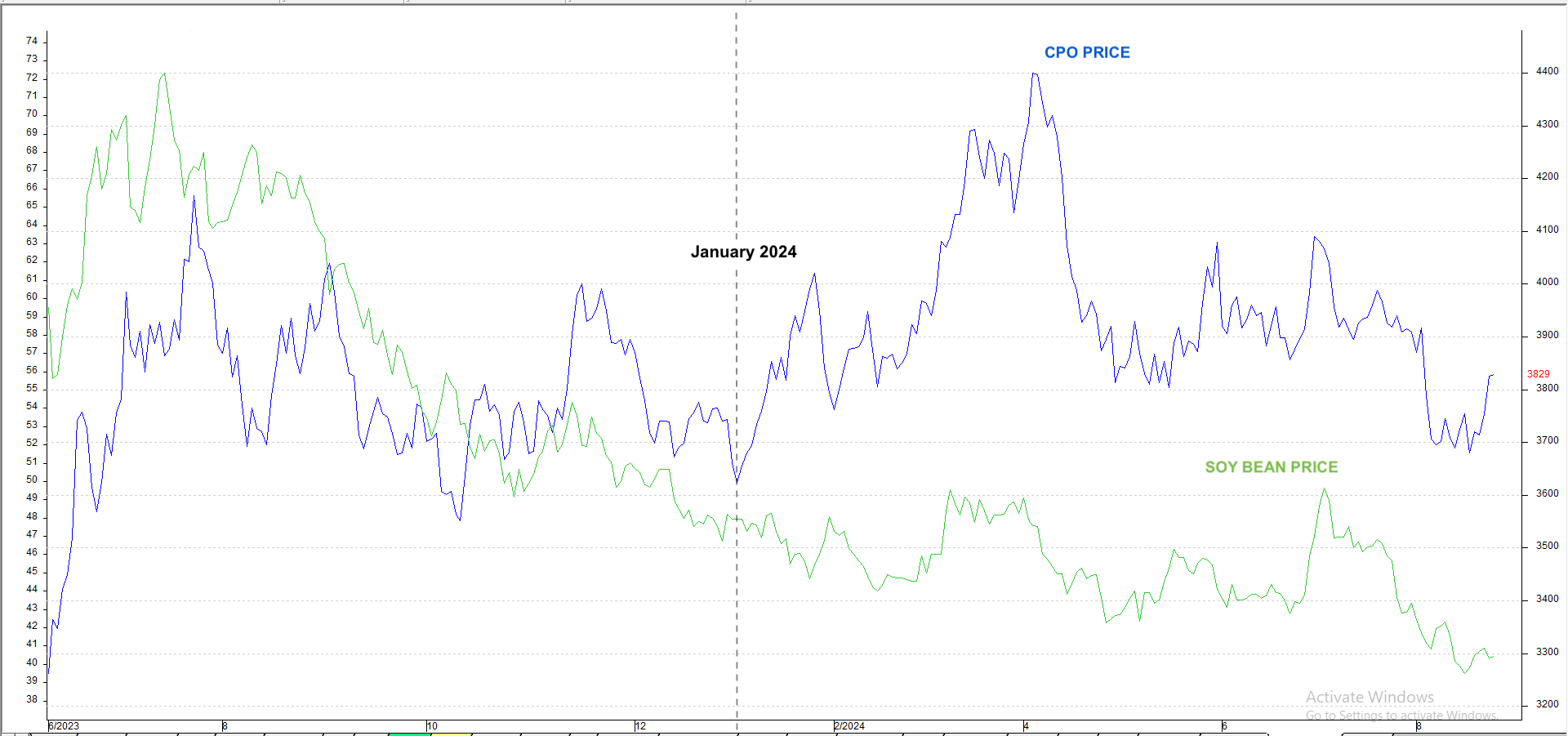

Performance of soybean oil vs palm oil since June 2023

Hence, it is inevitable that CPO prices will also be directly affected by the drop in soybean oil prices given its’ role as a substitute vegetable oil. However, the outperformance of CPO has clearly been in place since November 2023. Comparing the valuations of CPO versus soybean oil, we see the USD differential between the 2 products shrinking tremendously from a soybean oil premium of USD200 premium over CPO in November 2023 to only a USD10 premium today. This can be attributed to the tighter balance sheet of palm oil compared to soybean oil. Furthermore, palm oil’s exports mainly go to India and China, escaping Trump’s protectionism policies.

Recent data released by Malaysian Pam Oil Board showed that stocks fell 1.73 million tonnes in July from 1.83 million tonnes in June, despite being in the high production cycle. Indonesia’s production also declined to 22.1 million tonnes in January to May 2024 vs 22.9 million tonnes in the same period in 2023.

Indonesia’s aggressive biodiesel policies are also seen to be bullish in the long term for CPO prices. According to the agriculture ministry, the nation aims to increase the mix of palm-based biofuels with diesel to 50%. The current blend is 35% (known as B35) and Indonesia plans to expand this to B40 the following year.

CONCLUSION

Going forward, it is highly unlikely that CPO prices will see the Covid all-time-highs of RM7,100 per tonne in the near future. However, should Trump wins, the recent outperformance of CPO vs soybean oil is expected to continue with the possibility of CPO trading at a premium to soybean oil, a phenomenon last seen in 1997.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

More articles on The Alpha Trader

Created by TheAlphaTrader | Nov 20, 2024

Created by TheAlphaTrader | Nov 01, 2024

Created by TheAlphaTrader | Oct 01, 2024

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Discussions

Did the author now what is the different between soy bean price and soy bean oil price?

Is palm kernal price and palm kernal oil price the same?

2024-08-25 13:22

Soybean Meal 306.50 USD per Ton 8/23/24 02:20 PM

Soybeans 9.53 USD per Bushel 8/23/24 02:20 PM

Soybean Oil 0.41 USD per lb. 8/23/24 02:20 PM

2024-08-25 13:44

Soybean Oil 0.41 USD per lb equal

0.41x 2204.62= USD 903.89 per MT

Myr 903.89 x 4.3746 = RM 3954 per MT

2024-08-25 13:51

Month Palm oil Price (US Dollars per Metric Ton) Soybean Oil Price (US Dollars per Metric Ton) Palm oil ROC Soybean Oil ROC Palm oil / Soybean Oil Price Ratio

Jul 2019 543.88 748.17 - - 0.7269

Aug 2019 586.12 793.21 7.77% 6.02% 0.7389

Sep 2019 580.30 779.25 -0.99% -1.76% 0.7447

Oct 2019 591.35 770.80 1.90% -1.08% 0.7672

Nov 2019 683.38 774.91 15.56% 0.53% 0.8819

Dec 2019 769.93 820.59 12.66% 5.89% 0.9383

Jan 2020 834.85 873.66 8.43% 6.47% 0.9556

Feb 2020 728.81 800.41 -12.70% -8.38% 0.9105

Mar 2020 636.25 747.80 -12.70% -6.57% 0.8508

Apr 2020 608.88 679.98 -4.30% -9.07% 0.8954

May 2020 576.56 684.78 -5.31% 0.71% 0.8420

Jun 2020 656.49 755.71 13.86% 10.36% 0.8687

Jul 2020 694.16 821.11 5.74% 8.65% 0.8454

Aug 2020 760.30 866.94 9.53% 5.58% 0.8770

Sep 2020 796.22 905.86 4.72% 4.49% 0.8790

Oct 2020 819.27 914.77 2.89% 0.98% 0.8956

Nov 2020 917.81 973.88 12.03% 6.46% 0.9424

Dec 2020 1,016.37 1,026.20 10.74% 5.37% 0.9904

Jan 2021 990.27 1,098.67 -2.57% 7.06% 0.9013

Feb 2021 1,019.86 1,123.50 2.99% 2.26% 0.9078

Mar 2021 1,030.48 1,284.81 1.04% 14.36% 0.8020

Apr 2021 1,078.05 1,386.35 4.62% 7.90% 0.7776

May 2021 1,136.46 1,574.67 5.42% 13.58% 0.7217

Jun 2021 1,004.42 1,518.16 -11.62% -3.59% 0.6616

Jul 2021 1,062.99 1,468.34 5.83% -3.28% 0.7239

Aug 2021 1,141.82 1,433.94 7.42% -2.34% 0.7963

Sep 2021 1,181.38 1,398.75 3.46% -2.45% 0.8446

Oct 2021 1,310.25 1,483.52 10.91% 6.06% 0.8832

Nov 2021 1,340.65 1,442.96 2.32% -2.73% 0.9291

Dec 2021 1,270.29 1,411.21 -5.25% -2.20% 0.9001

Jan 2022 1,344.79 1,469.56 5.86% 4.13% 0.9151

Feb 2022 1,522.36 1,595.74 13.20% 8.59% 0.9540

Mar 2022 1,776.96 1,956.88 16.72% 22.63% 0.9081

Apr 2022 1,682.74 1,947.51 -5.30% -0.48% 0.8640

May 2022 1,716.92 1,962.88 2.03% 0.79% 0.8747

Jun 2022 1,501.10 1,751.76 -12.57% -10.76% 0.8569

Jul 2022 1,056.64 1,533.40 -29.61% -12.47% 0.6891

Aug 2022 1,025.95 1,598.78 -2.90% 4.26% 0.6417

Sep 2022 909.32 1,548.32 -11.37% -3.16% 0.5873

Oct 2022 888.99 1,575.90 -2.24% 1.78% 0.5641

Nov 2022 945.74 1,651.60 6.38% 4.80% 0.5726

Dec 2022 940.39 1,409.24 -0.57% -14.67% 0.6673

Jan 2023 941.97 1,351.77 0.17% -4.08% 0.6968

Feb 2023 949.98 1,243.01 0.85% -8.05% 0.7643

Mar 2023 972.06 1,113.19 2.32% -10.44% 0.8732

Apr 2023 1,005.24 1,029.97 3.41% -7.48% 0.9760

May 2023 934.06 988.32 -7.08% -4.04% 0.9451

Jun 2023 816.97 1,007.12 -12.54% 1.90% 0.8112

Jul 2023 878.50 1,135.74 7.53% 12.77% 0.7735

Aug 2023 860.82 1,126.53 -2.01% -0.81% 0.7641

Sep 2023 829.60 1,111.63 -3.63% -1.32% 0.7463

Oct 2023 804.26 1,133.87 -3.05% 2.00% 0.7093

Nov 2023 830.47 1,118.39 3.26% -1.37% 0.7426

Dec 2023 813.51 1,062.48 -2.04% -5.00% 0.7657

Jan 2024 844.90 971.46 3.86% -8.57% 0.8697

Feb 2024 856.93 911.90 1.42% -6.13% 0.9397

Mar 2024 942.92 964.95 10.03% 5.82% 0.9772

Apr 2024 935.69 958.56 -0.77% -0.66% 0.9761

Soyabean oil prices usually much higher than palm oil.

look at second figure from left

2024-08-25 13:59

planting soyabean oil is much more profitable due to high mechanization.

even though land yield is lower, land prices are cheap in US

2024-08-25 14:02

Palm tree, one fruit, two different oil (CPO, PKO), many thousands of posibilities/products and million of opportunities.

In facts palm oil plantation empower rural/local communities with gainful employment, brought in the much need economy activities and social facilities to local communities and contributed much needed foeign currency to the country and tax to the government.

know how many people benefited from season oil crop?

Land owner, bankers, seed suppliers and fertiliser suppliers. As not much employment opportunities and economy activities are created to benefit the local communities

By Anis Zalani

Wednesday, 21 Aug 2024 1:43 PM MYT

KUALA LUMPUR, Aug 21 — Plantation and Commodities Minister Datuk Seri Johari Abdul Ghani underscored the critical role of his ministry in driving the national economy today, revealing that it contributes nearly RM160 billion in exports.

He said that palm oil alone accounted for over RM100 billion of that total.

Johari also highlighted that the palm oil sector sustains more than 1.25 million jobs across the country, including 550,000 smallholders.

In terms of palm oil production, he said Malaysia manages 1.5 million hectares of land cultivated by smallholders, compared to 4.2 million hectares by the private sector.

2024-08-25 14:38

You cannot stop progress

palm oil without palm tree will come sooner than most people expect.

will be just like a catalytic tower of bacteria.

https://www.nytimes.com/2024/03/09/climate/palm-oil-lab-startup.html

How is your product made?

SHARA TICKU We make an oil that looks and functions just like a palm oil, but we make it from yeast, not from trees. We think of it as bio-designed. It is natural. It’s grown in a lab, only the way beer or wine is grown in a lab.

CHRIS CHUCK We can take food waste, a carbohydrate source, and process it very simply and then feed that to the yeast.

TOM KELLEHER These yeast, if you overfeed them with a lot of sugar, they put on fat. We overfeed them and they swell into a round ball that is almost entirely oil.

The technology is exactly like beer. 😁

We have already done that.

2024-08-25 14:44

the most horrifying thing is that the above sound exactly like human cells.

Maybe MikeCheatYouCrazy is just like that with bouncing fat as he walks. 😯

just cut some off to sell as cooking oil.

2024-08-25 14:49

If you look into past 5 years Malaysia CPO production of less than 20 million and Indonesia production of less than 50 million. It can only mean no more new planting (deforestation) was allowed any more.

The average per hectare yield of 3-5 MT is still very low compare to palm tree potential of 10-20 MT. So what needed is the West to work together on seedling R&D and best plantation practices to increase the production yield without anymore need for addition land or even better to return plantation land to forest if only those Scientist can increase the yield.

2024-08-25 15:02

MM already making cocoa butter subsitute from palm and also milk fat POP from palm.

2024-08-25 15:05

soya bean oil historically always more expensive due to higher demand since it has a slightly higher smoke point. 453-493°F

since many caucasians set oven temperature at 450F, they dun use palm oil smoke point 450F, no margin of error and palm oil usually smokes and food gets weird smell.

simple reason, there is no conspiracy, Area 51 or bans etc

2024-08-25 20:37

The best kept secret is this

Palm oil palmitic content is 44% which is 400% better than soyoil palmitic acid content

Palmic acid is used in

1. Senior Citizen Milk Formula like Ensure Milk

2. In 80% to 90% of all infant formula for growth

3 In pet food

So the West is still buying this byproduct from palm oil which offer the most solid life growth supporting ingredient

see

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6331788/#:~:text=As%20shown%20in%20Table%201,5%2C7%2C16%5D.

2024-08-25 20:49

One main reason why palm oil palmic acid is used in Infant milk formula is due to the mother's milk content which has up to 25% or more of palmic acid

and that is why USA has to import Palmic acid from Spore after banning Simedarby and others from Malaysia

there is no enough palmic acid content from soyoil

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7071444/#:~:text=Palmitic%20acid%20(C16%3A0),milk%20during%20lactation%20%5B9%5D.

2024-08-25 20:57

Are you sure, Calvin? The claim about the USA importing palmitic acid from Singapore after banning imports from Malaysia is partially misleading. The United States does import palm oil derivatives, including palmitic acid, but these are sourced from multiple countries, including Malaysia and Indonesia. The idea that the USA would need to import specifically from Singapore due to bans on Malaysian products is not substantiated. While there have been some import restrictions on palm oil from Malaysia due to concerns over labor practices, these do not broadly affect all palm oil products.

2024-08-25 21:31

https://klse.i3investor.com/blogs/Sslee_blog/2019-02-02-story-h1457009258-Love_our_Palm_Oil_Part_I_Palm_Oil.jsp

Soyoil is not heat stable (oxidized easily) due to the present of high polyunstaturated C18" and C18'"

Wherease palm oil is heat stable due to high only high monounsaturated C18' and low in polyunsaturated C18"

Palmatic acid is used as animal feed for milk cow as feed supplement/formulation to induce high milk production

Milk fat is high on POP triglyceride palmatic-oleic-palmatic.

POP fat can be manufactured by esterification of 2 molecule palmatic acid + 1 molecule of oleic acid with 1 molecule ofvglycerin to 1 molecule of POP fat.

2024-08-25 21:57

Engineering profit

See the news when Usa banned Simedarby plant and Fgv import

See

https://themalaysianreserve.com/2021/06/29/us-cbps-inquiry-in-labour-practice-could-hurt-iois-valuation/

2024-08-26 02:26

calvintaneng

Well done

clap

Clap

CLAP

Plus add these

1. Malaysia and Indonesia have banned further conversion of forest lands into palm oil or other uses. As such no more growth or increasing production of palm oil

2. On the other hand all palm oil lands in suitable locations are now being converted

Palm oil = Data Center

Palm oil = Solar farm

Palm oil = Industrial Park

Palm oil = New Townships

As such supply is ever decreasing while demand is constant

And Indonesia intends to turn B35 to B100 eventually and that will take up 77% of all Cpo produced leaving a mere 23% for local consumption like cooking oil

What will be the future price of palm oil then?

2024-08-24 20:36