FGV 's Rising Comeback! Selamat Hari Raya

GreenTrade

Publish date: Wed, 29 May 2019, 07:17 PM

FGV Holdings Bhd

Current Price 1.16

* This opinion is only for 10 days.

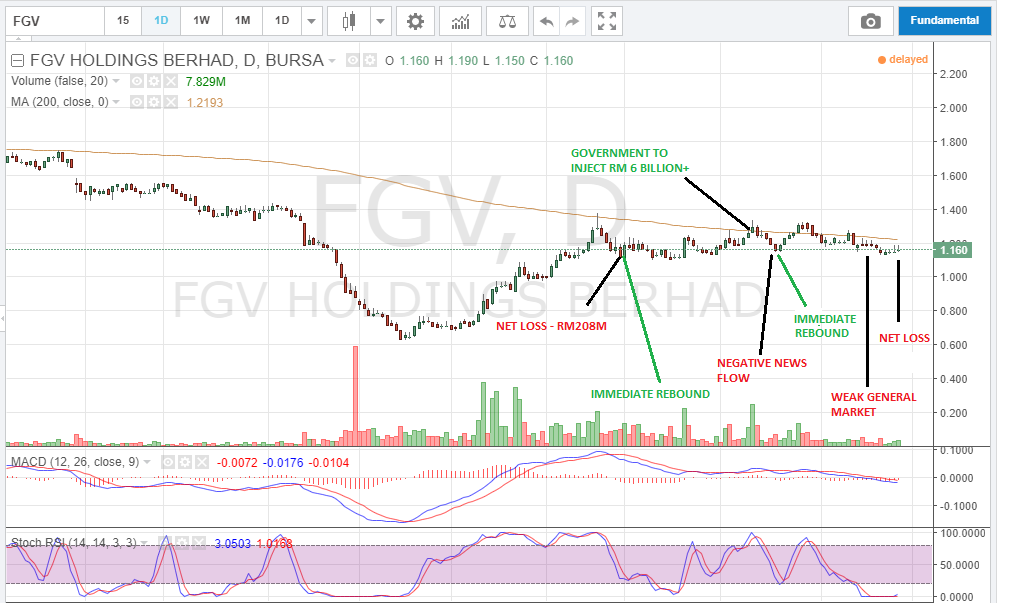

Based on the chart, the following can be noted.

1) 200 day moving average remains the key resistance.

2) After negative news flow, there seems to be an immediate rebound after it.

3) If "they" wanted to sell-off to the 1.00 level, they easily could during the Quarterly Report in February 2019. But no, "they" did not.

WHY? It may be due to the fact that FGV's performance is slowly improving in the long run. (+RM205 million net profit QOQ ) At this rate of improvement, there could even be a NET PROFIT in the next quarter.

Executive Summary

1) Government Injection of RM 6 Billion +

2) New management making immediate positive impacts to the group.

3) Weak Ringgit good for Palm oil companies

4) FGV seems to be well supported despite the bad news.

If It Can't go down, It will go.............................?

Greentrades would like to wish all Muslim Readers Selamat Berpuasa , Selamat Hari Raya and Let's go make some Duit Raya.

Greentrade$

https://www.facebook.com/Greentrades/

DISCLAIMER

Trade at your own risk. This article is not an investment recommendation in any way. The author will not be responsible for any losses or decisions made.

More articles on Weekly GreenTrades watchlist

Created by GreenTrade | Mar 12, 2020