Public Bank - An Amazing Opportunity

GreenTrade

Publish date: Tue, 13 Aug 2019, 07:24 PM

13/08/2019

PBB Current Price : RM 20.74

I used to work at Public Bank.

It feels quite sad to watch its stock price fall recently.

I was waiting for the day that it could overtake Maybank in terms of Market Cap.

First, here's why Pbb share price might be dropping recently.

1) Perceived exposure to Hong Kong. With the current protests and havoc ongoing in Hong Kong, stocks with exposure in that country are being fearfully sold off. However, Pbb's revenue from Hong Kong only accounts for 4.9% of the group's total revenue.

2) There is speculation for another BNM interest rate cut soon. This will negatively affect bank's profit margins.

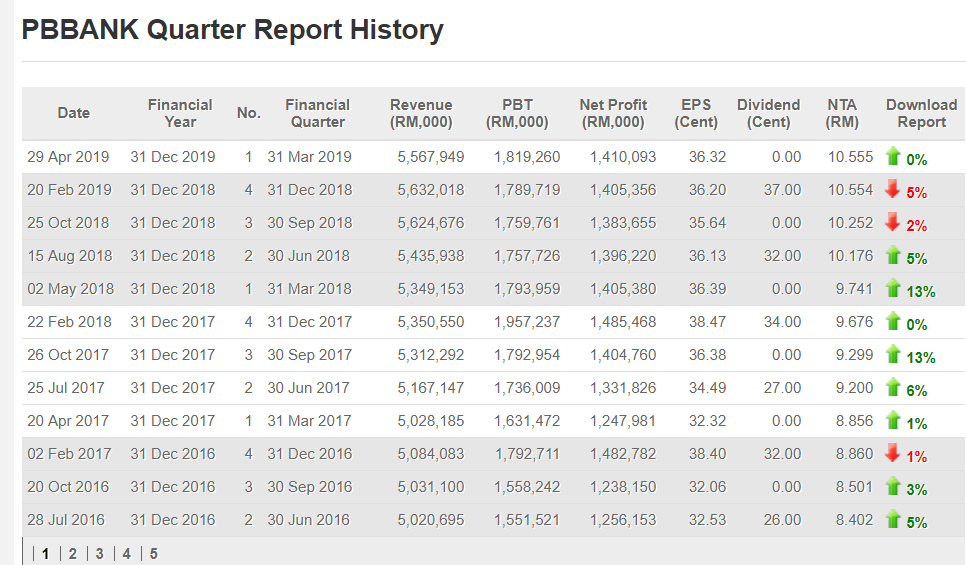

3) Its recent quarterly report earnings is not interesting. It is not growing much. When earnings are not interesting, its share price will...?

However, Public Bank has huge reputation and credentials.

1) It is known to be very conservative and has the lowest Non Performing loan record in the country.

2) Its loans are of strong asset quality due to the Group’s prudent credit culture and stringent underwriting standards.

Normally, blue chips with good reputation and fundamentals would not free fall all the way down.

There should be some rebounds in between.

Therefore, the immediate support and rebound level could be found based on the chart below.

(Do take note that the support is only valid for 5 days)

Why RM19.66?

Public Bankers should know the huge significance of this number.

If you are interested to learn more, kindly click HERE

Disclaimer: Trade at your own risk. The author will not be held liable for any losses or decisions made.

More articles on Weekly GreenTrades watchlist

Created by GreenTrade | Mar 12, 2020