In my last post, I used Facebook's recent troubles to talk about the importance of corporate governance, and how we, as investors, have abandoned the power to change management at many younger tech companies in return for being able to invest in young tech companies, with growth potential and well-regarded founders. In this post, I will revisit Facebook's most recent earnings report, and argue that while it contained disappointing news on growth and profitability, the bad news was exaggerated by systematic inconsistencies in how accountants categorize expenses, skewing earnings and invested capital down in firms that don't fit the accounting prototype. That skewing can affect valuation and pricing judgments about these firms, and correcting accounting inconsistencies is a key step towards leveling the playing field.

Accounting 101

I am not an accountant, and have no desire to be one, but I have used their output (accounting statements) as raw material in valuation and corporate finance. As I look at accounting from the outside, I see the primary role of accounting as recording and reporting, in a consistent and standardized form, the answers to three basic questions:

- What does a business own? List out the assets that a business has invested in, and how much it spent on those investments and perhaps what these assets are worth today.

- What does the business owe? Specify the contractual commitments that a business has to meet, to stay in business. Simply put, this should include all borrowings, but is not restricted to those

- How much money did the business make? Measure the profitability of the business, both with accounting judgments on expenses, and based upon cash in and cash out, over the period of measurement (quarter, year).

It is in pursuit of answering these questions that accountants generate financial statements, and the three most basic are:

- The balance sheet, which summarizes what a firm owns and owes at a point in time, as well as an estimate of what equity is worth (through accounting eyes).

- The income statement, which reports on how much a business earned in the period of analysis, while providing detail on revenues and expenses.

- The statement of cash flows, which reports on cash inflows and outflows to the firm during the period of analysis and allows for a measure of cash earnings (as opposed to accounting earnings) and cash flows.

- Operating expenses are expenses associated with generating the revenues reported by a business during a period. Thus, it includes not only the direct costs of producing the product or service the firm sells, but also other expenses associated with operations, including S, G & A expenses and marketing costs.

- Financing expenses are expenses associated with the use of non-equity financing, and in most firms, it takes the form of interest expenses on debt, short term and long term.

- Capital expenses are expenses that provide benefits over many years. For a manufacturing company, these can take the form of plant and equipment. For non-manufacturing companies, they can take on less conventional and tangible forms (and as well argue in the next section, accounting has never been good at dealing with these).

Accounting Inconsistencies and Pricing Consequences

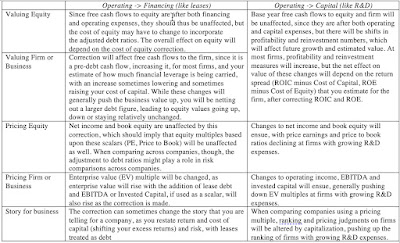

In my introductory accounting class, I was told that accountants were scrupulous about expense classification, and that misclassifying financing expenses or capital expenses as operating expenses occurred rarely. In the years since, I have concluded that this is not true and that expense mis-categorization is not only common, but that it varies widely across sectors, making it difficult to compare accounting numbers or ratios across firms.

1. Financing Expenses treated as Operating Expenses

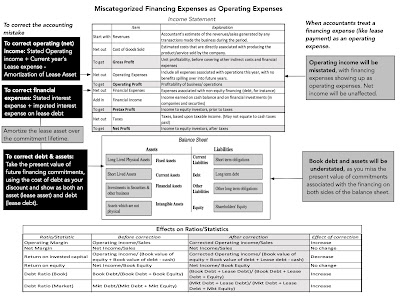

When a financing expense is treated as an operating expense, that mistake plays out across the financial statements. In the income statement, this classification error moves an expense that should be below the operating income line, to above it, reducing operating income. The misclassification also means that the balance sheet recording of debt will not include the financing that gave rise to the mis-categorized expense:

As you can see, treating a financing expense as an operating expense has no effect on net income, but its effects will ripple through elsewhere affecting operating income (usually lowering it) and understating the borrowing on the balance sheet. To the extent that these numbers are used in computing financial ratios, it will affect your measures of operating income and return on invested capital. Until accountants came to their senses in 2019, they routinely treated a large segment of leases as debt, with questionable reasons, and skewed operating margins, returns on capital and debt ratios in lease-heavy sectors like retailing and restaurants. However, leases are only one of many other contractual commitments that meet the "debt" criteria, and require similar corrections. Thus, the content commitments at Netflix, representing contractual commitments on content that Netflix has obtained rights to, from other studios, as well as some purchase commitments at companies may require the same corrective treatment as leases.

2. Capital Expenses treated as Operating Expenses

Treating a capital expense as an operating expense also plays out across the financial statements, and we will use R&D, which is the most widely mis-categorized cap ex, to illustrate. When R&D is expensed, it pushes down both operating and net income for companies with growing R&D expenses over time; in the rarer case of declining companies where R&D has been dropping over time, it will have the opposite effect. In addition, the mistreatment of R&D as an operating expense will mean that the expense will not create an asset on the balance sheet, as capital expenses should, with consequences for your measures of book equity and capital invested:

- Exploration costs at natural resource companies, since even if successful, the reserves found will not add to revenues or income until years into the future.

- Advertising expenses to build brand name at consumer product companies, and especially so at companies (like Coca Cola) that are dependent on brand name for both growth and pricing power. Note that not all business advertising is for building brand name, and capitalizing brand-name advertising will require separating advertising expenses into portions intended to sustain and increase current sales (operating expense) and for building brand name (capital expense).

- Use/Subscriber acquisition costs at user or subscriber based firms, at companies that have built their value propositions around user or subscriber numbers. Note that the capitalization effect will depend on how long an acquired subscriber or user will stay with the business, with longer customer lives creating a bigger impact, from correction.

- Employee recruiting and training expenses at consulting and human-capital driven firms, since their growth depends, in large part, on their employee quality and retention. Here again, the effect of capitalizing employee-related expenses will depend on employee tenure, with longer tenure creating a bigger effect, when the correction is made.

Facebook: Cleaning up the Accounting

As you take a look at the most recent quarterly earnings report from Facebook, it is worth drawing on the discussion about accounting inconsistencies. Without contesting the basic conclusion that Facebook had a bad operating quarter, after its earnings report for the third quarter of 2022, let's review the accounting numbers to see how bad it truly was, and why.

The R&D Effect

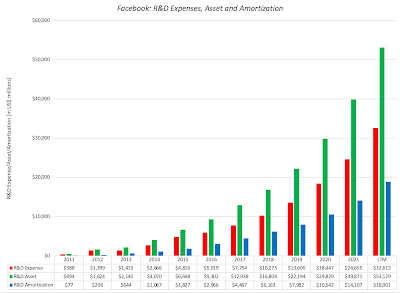

As a technology company with billions of users on its platform, and increasing calls for respecting data privacy, Facebook needs to spend on R&D, and it has done so heavily all of its corporate life. In the chart below, I report on Facebook's R&D spending each year from 2011 to the last twelve months (ending September 2022):

To correct earnings (net and operating income) each year, I add back that year's R&D expense and net out the amortization of R&D in that year, and I report this restated income from 2011 to 2022 in the graph below:

Since R&D capitalization also pushes up the book value of equity, and by extension, the invested capital in the firm, I looked at the effect of capitalizing R&D on invested capital and return on invested capital, over time:

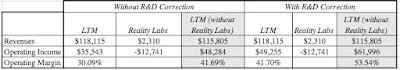

The Metaverse Investment

In the last few years, Facebook has been supplementing its R&D investments with substantive investments in the Metaverse, and it has been open about its plans to invest huge amounts in the future. The extent of Facebook's Metaverse bet, and its effects on the bottom line, are visible in this excerpt from the most recent quarterly report filed by the company:

|

| Facebook 10Q, 2022 Third Quarter |

- Profitability: There is no denying that Facebook's revenues have flattened out, though a stronger dollar and slowing economic growth are partially responsible. However, the drop in operating and net margins that you saw in the most recent earnings report should not be taken as a sign that the profitability of the company's online has imploded. In fact, correcting for R&D and the Reality Lab investment, you can see that the online advertising business remains a money machine, generating sky-high margins. In fact, almost all of the drop in profitability is coming from Facebook's R&D and Metaverse investments, and if a large portion of that expenditure were treated as capital expense, that drop would have been far smaller.

- Pricing: As Facebook's market cap has declined to approximately $250 billion, some have noted that the company now trades at about 8 times earnings, if you use the net income of $28.8 billion assessed by accountants. However, if you are comparing Facebook's PE ratio to the PE ratios of non-tech companies, for consistent comparisons, you should be using the adjusted net income of $42.5 billion, which results in an adjusted PE ratio of about 6. I don't use PE or EV to EBITDA multiples as my primary stock picking tool, but if you do, Facebook looks far cheaper, relative to other companies, after you have adjusted for its misclassified capital expenditures (R&D and Metaverse).

- Valuation: From a valuation perspective, you care about cash flows, and since R&D and the Metaverse investments are cash outflows, Facebook's investments in these will lower cash flows. The value effect, though, will depend upon whether you think these investments will pay off in future revenue growth and higher cash flows in the future, and investors, at least at the moment, are not only not giving Facebook the benefit of the doubt, but seem to be actively building in the presumption that this is essentially wasted money, with no payoffs at all. As I will argue more extensively in my next post, I assign a great deal of blame for this investor mistrust to Facebook, because the company seems to have made almost no effort to explain its business model for generating revenues and profits from the Metaverse. In short, the only thing that Facebook has been clear about is that they will invest tens of billions of dollars in the Metaverse, while being opaque about how it plans to make money in that space. Remember that even if we all buy Facebook VR glasses and spend half our lives in the virtual world, for Facebook to make money, it has to either collect money from us (subscriptions or transactions) or show us advertising.

- META Lesson 1: Corporate Governance

- META Lesson 2: Accounting Inconsistencies and Consequences

- META Lesson 3: The Importance of Narrative