How Dayang Will Rediscover Itself

abang_misai

Publish date: Tue, 19 Mar 2019, 10:39 AM

Kenanga Steven Chan's yesteday report is notorious for telling the market a half-baked story on Dayang, and his previous reports on other stocks were no exception. This Kenanga's young boy acted like a contra player and is happy to sell to make a few cents. Go google to see his CV. If he has a good investment sense, it shouldn't have been a sell call given Dayang's ability to deliver profit growth quarter after quarter.

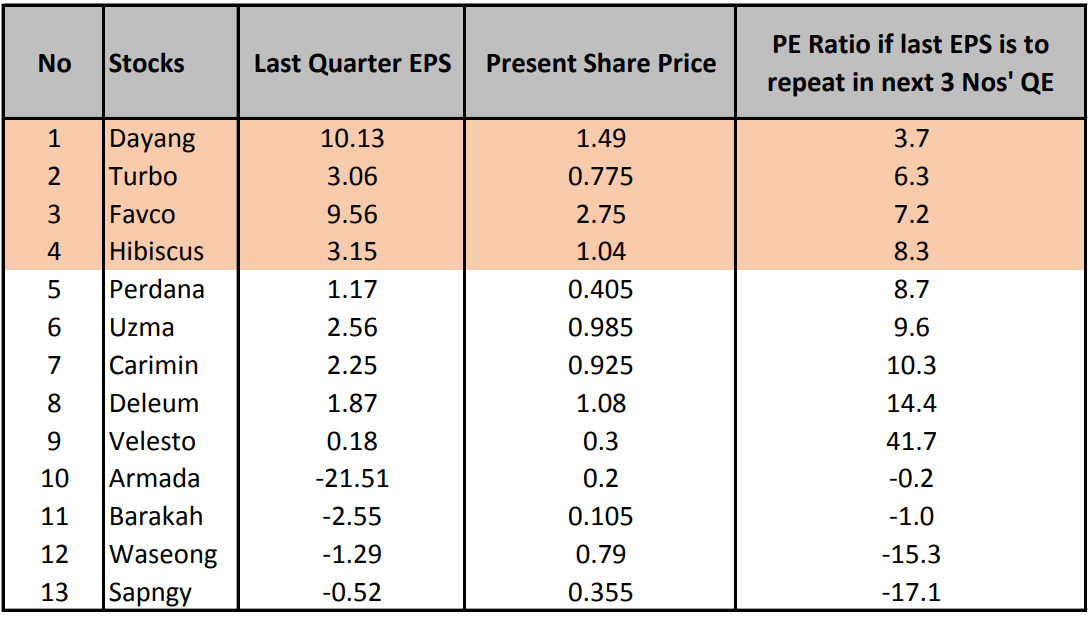

And so we are left with some obvious questions: Has Dayang still have what it takes to achieve the TP 4.00? Will it come back after a sell-down today? And, utlimately, tell me which current O&G stock is able to beat Dayang's earning?

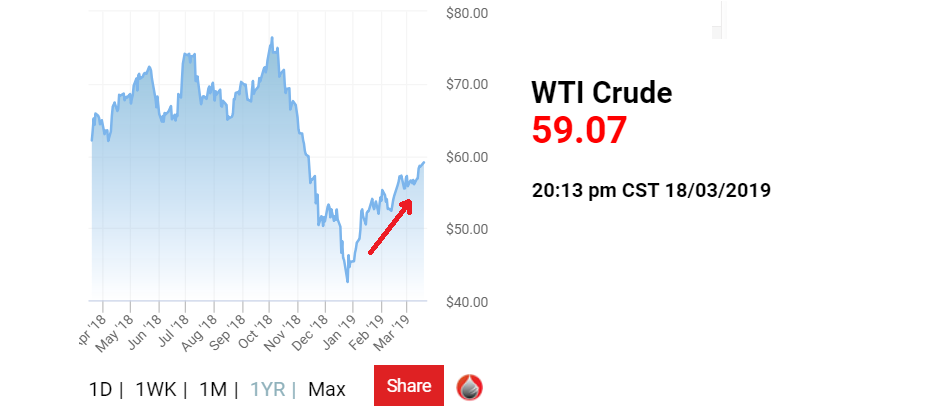

There is a weight of evidence that suggests Dayang will recover. Oil price rebound is sustained by supply cut by OPEC and this business environment is absolutely favouring Dayang.

Petronas commited to roll out more capex this year than last year.

Dayang's share price of Rm1.49 is being traded at an attractive prospective PE of 3.7 is clearly still the cheapest O&G Stock in the KLSE.

More articles on Misai's World of Investing

Created by abang_misai | Aug 11, 2021

Created by abang_misai | Apr 01, 2021

Beary

The oldman says lock in profit first.

Later can buy back at cheaper price.

2019-03-19 11:38