HLBank Research Highlights

Trading Idea: LONBISC - Poised to break 52-week high of RM0.925 amid bullish breakout

HLInvest

Publish date: Mon, 20 Jul 2015, 11:08 AM

-

- The largest domestic manufacturer of assorted wafers and confectioneries: LONBISC (listed in Jan 02) is the largest domestic manufacturers of assorted cake confectionery, candy confectionery, wafers and an assortment of snack confectionery with manufacturing facilities located in Ulu Tiram and Pasir Gudang in Johor as well as in Seri Kembangan and Telok Panglima Garang in Selangor. The group also holds a 28.6% stake in another listed company, KHEESAN (acquired in 2007).

- Domestic and overseas sales account for almost 50% each to turnover. Its main overseas markets include China, Hong Kong, Macau, Indonesia, Singapore, Taiwan, Thailand, Vietnam and the Middle East. Domestic sales jumped 29% CAGR from FY12-FY14 to RM191m whilst export markets grew 10% to RM169m. We view that LONBISC’s ability to sustain its strong presence in local and overseas markets illustrates its well-managed and wide distribution network.

- LONBISC’s products range are as follow: 1) Cake Confectionery: Roll, Layer and Pie cakes; 2) Sweet & candies: Chewy, Deposited, Hard, Tablet Candies; Bubble gum and Chewing gum; 3) Wafers: Wafer bars and wafer cubes; 4) Snacks: Corn Snacks, Potato chips; Jellies & Puddings, Biscuit dips Chocolate. In FY14, Cake confectionery and Sweet & candies segments contributed over 70% to its turnover whilst the rest was shared by the Wafers and Snacks segments.

- Likely to rerate upwards amid undemanding valuations. We believe local F&B sector would stay resilient and defensive amid the challenging market environment. Hence, investors should scout out for small cap undemanding F&B companies such as LONBISC to tap into their steady growth in local and international markets. At RM0.84, LONBISC is trading at 9.8x FY15 P/E (36% lower than its peers) and 0.4x P/B (78% lower), probably to discount for its poor ROE. Nevertheless, the huge discounts are l ikely to reduce as LONBISC is reaping the rewards of its heavy capex over the past four years to help boost capacity, efficiency and productivity in order to offset the hike in raw materials, wages and utilities prices coupled with increased competition.

- Net gearing is likely to ease further. As the period of “heavy capex” is over, the group is committed to de-gear its balance sheet, illustrated by a reduction of net gearing from a high of 0.8x in FYE June13 to 0.6x in 9MFY15, thereby lowering its finance costs and correspondingly improving bottomline. Moreover, the group is launching new premium range of candies and sweets to yield higher profit margin and expanding its product range to capture bigger market shares.

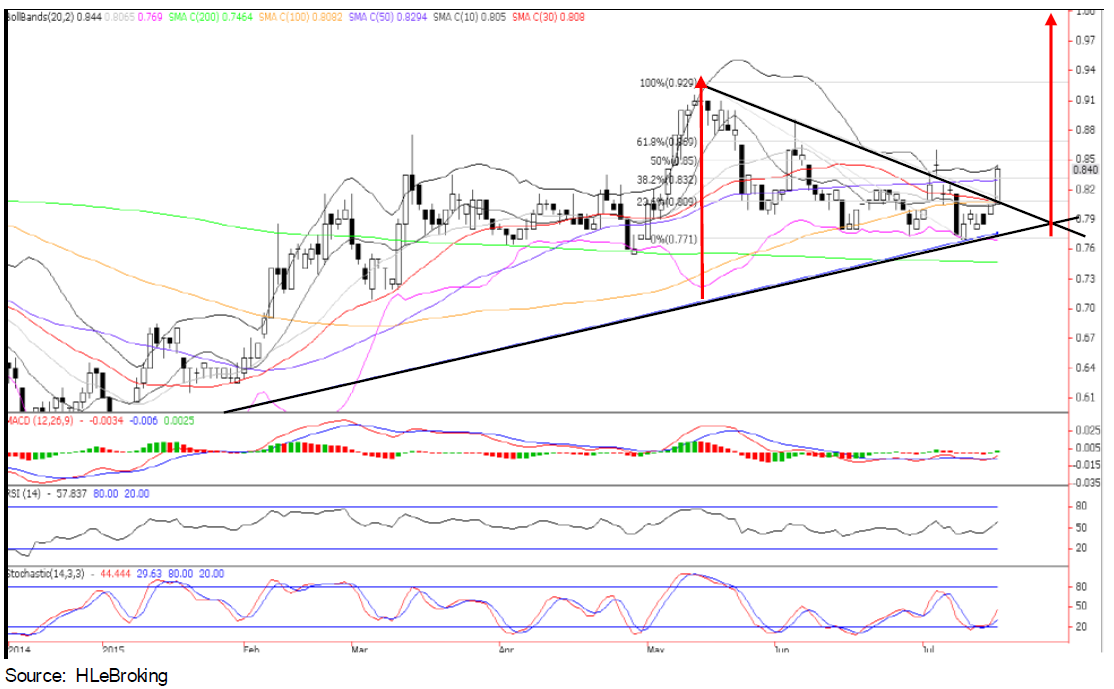

- Poised to break 52-week high of RM0.925. Following a 16.8% correction from 52-wk high of RM0.925 on 15 May to a low of RM0.77 on 9 July before ending at RM0.84 on 16 Jul, staging a bullish symmetrical breakout. Given the heavy volume of 2.06m on 16 Jul (467% higher against 1M average 363k and 138% higher than 3M average 864k shares) and bottoming up indicators, a resumption of uptrend in on the cards to move a tad higher towards immediate target of RM0.88 (76.4% FR and weekly higher Bollinger band). A decisive breakout above RM0.88 will spur prices higher to retest RM0.925 and our long term symmetrical breakout objective of RM1.02. Supports are RM0.80 and RM0.77. Cut loss below RM0.76.

Source: Hong Leong Investment Bank Research - 20 Jul 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments