HLBank Research Highlights

Momentum Idea: Bottoming up - KOMARK (RM0.635/Vol:3.01m)

HLInvest

Publish date: Wed, 17 Feb 2016, 11:31 AM

-

Business profile: KOMARK is principally engaged in manufacturing of selfadhesive labels and stickers and trading of related products. The self-adhesive labels and stickers manufactured are paper-based and film based, catering to global group of energy & petrochemical companies, personal care, food & confectionary, beverages, pharmaceutical and health care sectors. After three consecutive losses in FY13-15, the company is likely to chalk up a maiden profit after netting RM2.6m in 6MFY16.

-

Diversified markets. Apart from Malaysia, the group has operating subsidiaries in China, Thailand, Singapore, and Indonesia. In 6MFY16, China contributed 62% of total revenue. Other markets include Thailand, Indonesia, Philippines, Singapore, Sri Lanka and India. The diversified markets put KOMARK in a position to mitigate any impact of economic slowdown.

-

KOMARK’s par value reduction and fund raising exercises completed. KOMARK’s propos ed 75sen par value reduction to 25s en was completed in Dec 14, its proposed 1 right @ RM0.30 (40.63m) and 1 free warrant (40.63m) for every two KOMARK shares were subsequently listed on 29 Jan.

-

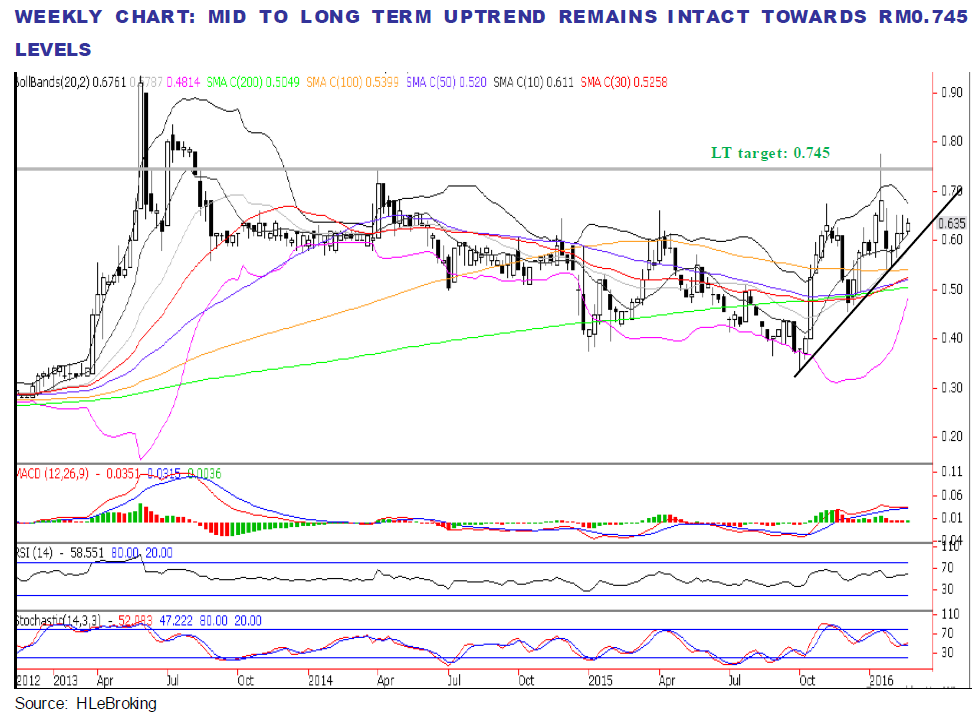

Likely to bottom up. KOMARK’s share prices corrected 31% from 52-week high of RM0.775 on 15 Jan to a low of RM0.535 on 21 Jan before ending at RM0.635 yesterday. We see limited severe downside risks and potential reversal to upside, as share prices are trading above multiple key SMAs amid bottoming up indicators.

-

A decisive breach above immediate resistance of RM0.655 (50% FR) is likely to spur prices higher towards RM0.685 (61.8% FR) before reaching our long term objective of RM0.745 (refer weekly chart). Key supports are situated at RM0.625 (38.2% FR) and RM0.615 (10-d/20-d//30-d SMAs). Cut loss at RM0.595.

-

Positive risk to reward ratio with 17.3% upside against 11.5% downside. All in, we see a favourable risk to reward ratio for investor with a theoretical entry price of RM0.635 given that the downside to the cut loss zone of RM0.595 is 11 sen (-0%) while the upside to the LT target of RM0.745 is 11 sen (+17.3%).

Source: Hong Leong Investment Bank Research - 17 Feb 2016

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments