HLBank Research Highlights

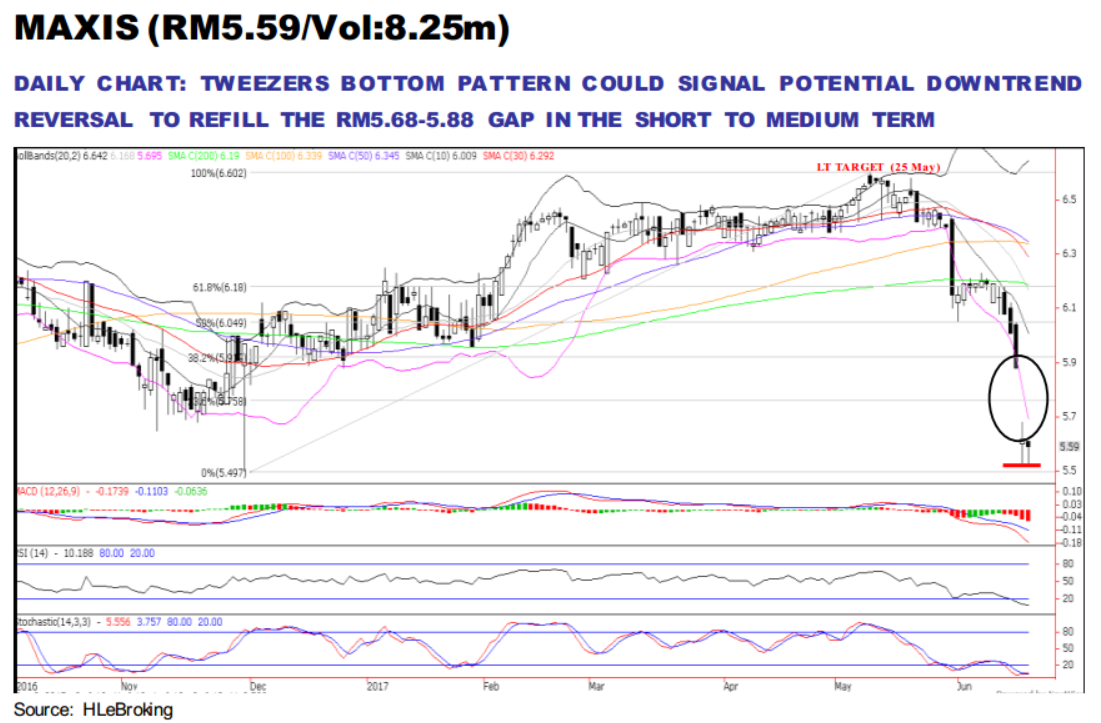

Trading idea: Maxis – Poised for a rebound after recent slide

HLInvest

Publish date: Thu, 22 Jun 2017, 09:05 AM

- Recent selldown could have priced in the negatives. Maxis share prices plunged 16.2% from 52-week high of RM6.60 (11 May) to a low of RM5.53 (20 & 21 June) before inching up to close at RM5.59 (11.7% below our HLIB institutional TP) yesterday. The sluggish performance was mainly driven by: 1) Highly competitive operating environment given the continued price wars being waged by its peers; 2) The lower placement price of RM5.52/share (raised RM1.656m via the placement of 300m shares) which is 9.2% lower to the 5-days VWAP and 3) The risk that prospective dividend payouts may be lowered on higher-than expected capex or spectrum fees.

- Currently, Maxis is trading at 20.4x FY18 P/E (15% below its 10-year average P/E of 24x), supported by a decent DY of ~4% for FY17-18. We believe such valuations and steeply oversold positions (daily and weekly charts) coupled with the fixing of RM5.52 placement price have priced in most of the negatives, providing sufficient margin of safety to cushion further plunge in share prices. Moreover, the placement exercise is not expected to have a significant impact to its EPS as the interest cost savings at ~5% from the proceeds would mostly offset the dilution arising from the 4% expansion of Maxis’ share base.

- Ripe for downtrend reversal? Given the formation of Tweezers bottom pattern and hammer candlestick formation in daily chart, we expect prices to slowly inch up further in the near term. A decisive breakout above the immediate resistance of RM5.68 (20 June high) will likely to lift share prices higher towards RM5.88 (16 June low) before reaching our LT target at RM6.05 (50% FR). On the flip side, key supports are RM5.53 and RM5.47 (monthly low Bollinger band). Cut loss at RM5.44.

Source: Hong Leong Investment Bank Research - 22 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments