HLBank Research Highlights

Trading idea: DRBHCOM – Anticipate better days ahead

HLInvest

Publish date: Tue, 05 Sep 2017, 09:34 AM

- HLIB institutional research maintains BUY rating with RM2.26 target price (+34.5% upside) after ascribing a higher holding company discount rate of 30% to sum-of-parts valuation, given the higher risk assumed by DRB in taking over GOVCO’s RM1.5bn RCCPS to Proton . Following the entry of Geely as Proton’s FSP, DRB’s share prices hit 52-week high of RM1.86 before closing lower at RM1.68 yesterday, in line with the broader market consolidation.

- Despite assuming Proton’s RCCPS, we remain sanguine on DRB benefiting from Proton partnering Geely and a LT re-rating catalyst on DRB’s valuation, as Geely agreed to support Proton’s turnaround plan with its technology, platform and skillset. Furthermore, DRB‘s forward earnings will improve drastically from reduced stake exposure to Proton’s immediate loss and discontinued exposure to Lotus’s loss (full disposal). DRB also benefits from retaining part of Proton’s valuable non-core assets (including Shah Alam plant and land), cash proceeds of UK£100m (RM560m) from Lotus disposal and RM566.7m payments from Proton.

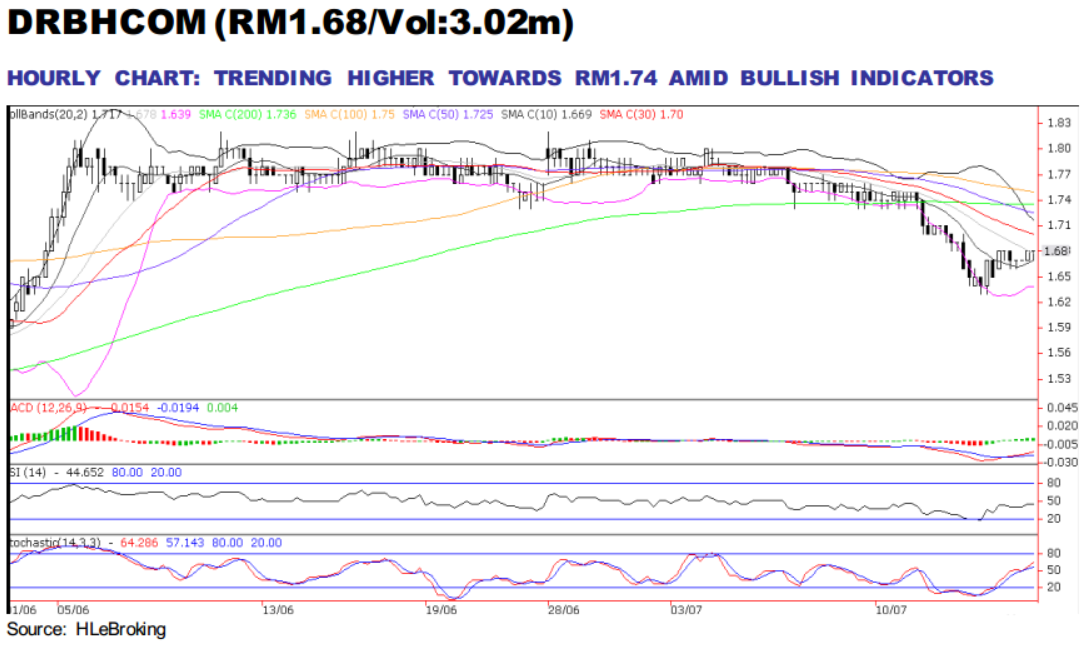

- Bottoming up to retest RM1.74-1.86 zones. Despite recent selling pressures, DRB has maintained a strong support well above the RM1.52 (38.2% FR) support. On the back of positive hourly chart and bottoming up daily indicators coupled with the bullish Harami pattern, share prices are likely to test immediate resistances at RM1.74 (200-d SMA) and RM1.86 in the short to medium term. A decisive break above RM1.86 could potentially signal that the next leg up towards our LT objective at RM1.99. Key supports are RM1.63 (12 July low) and RM1.58 (50% FR). Cut loss at RM1.56.

Source: Hong Leong Investment Bank Research - 5 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments