HLBank Research Highlights

Trading idea: BIOHLDG – Metamorphosing into a regional health supplement group; Poised for a triangle breakout

HLInvest

Publish date: Mon, 11 Sep 2017, 09:55 AM

- An up-and-coming integrated health supplement company. Listed in April 2015, Bioalpha (BIOHLDG) is a home-grown integrated health supplements company, producing a variety of health supplements in herbal and non-herbal based. The group markets its products under house brands, Apotec and Nushine in Malaysia, as well as Alpha Health in Indonesia.

- The group owns the intellectual property rights to its proprietary liquid fermentation technology, which produces mycelium from medicinal mushrooms used in health supplement products (halal & non-halal). About 60% of group revenue is from house brands and its best sellers include tiger milk mushroom, cordyceps sinensis, tongkat ali and collagen beauty products.

-

To complement the production of its health supplement products, BIOHLDG ventures upstream into farming as well as downstream into retail pharmacy via its Constant pharmacy chain, rendering its position of an integrated health supplements company. At present, Constant pharmacy is operating 17 Constant outlets, with 30 new outlets targeted to be rolled out within the next 12 months.

-

Integrated Farming. As the operator of the largest herbal parks in Malaysia with approximately 1,300-acres in Pasir Raja, Terengganu and Desaru, Johor, BIOHLDG aims to be fully self-sufficient for herbal-based raw materials. To date, it had completed the Phase I development of its Pasir Raja herbal park where it planted more than 20 types of herbs over approximately 120 acres of land. Recently, the group has commenced the Phase 2 development of Pasir Raja covering a land area of seven times the size of Phase 1 (plan to complete planting over the next 36 months) to plant a total of some 100 types of herbs, up from the 20 types currently.

- Prospering into a regional health supplement group. As at 1H17, the local markets contirbuted about 46% to revenue whilst the rest were contributed mainly by Indonesia (31%) and China (23%). The group believes China and Indonesia export markets are set to lead export revenue growth.

- According to independent market researcher Smith Zander International Sdn Bhd, the health supplements industry of Malaysia, Indonesia, and China is expected to expand at double digit growth rates. In Malaysia, the size of health supplements manufacturing industry is expected to grow at a compound annual growth rate (CAGR) of 11.5% between 2016 and 2018, reaching a market size of RM1.38 trillion by 2018. Meanwhile in Indonesia and China, the health supplements market has a prospective CAGR of 12.7% and 33.5% to reach US$2.13trn and US$221bn, respectively.

- Limited downside amid undemanding valuations. At RM0.255, BIOHLDG is trading at consensus 11.8x FY18 P/E (about 25% below its peers FIG2). Excluding the 3.2 sen netcash/share, the underlying business is only valued at 10.3x, supported by strong EPS CAGR of 37% from FY17-19 (FIG1), providing a sufficient margin of safety to cushion further sharp downside risks in share price.

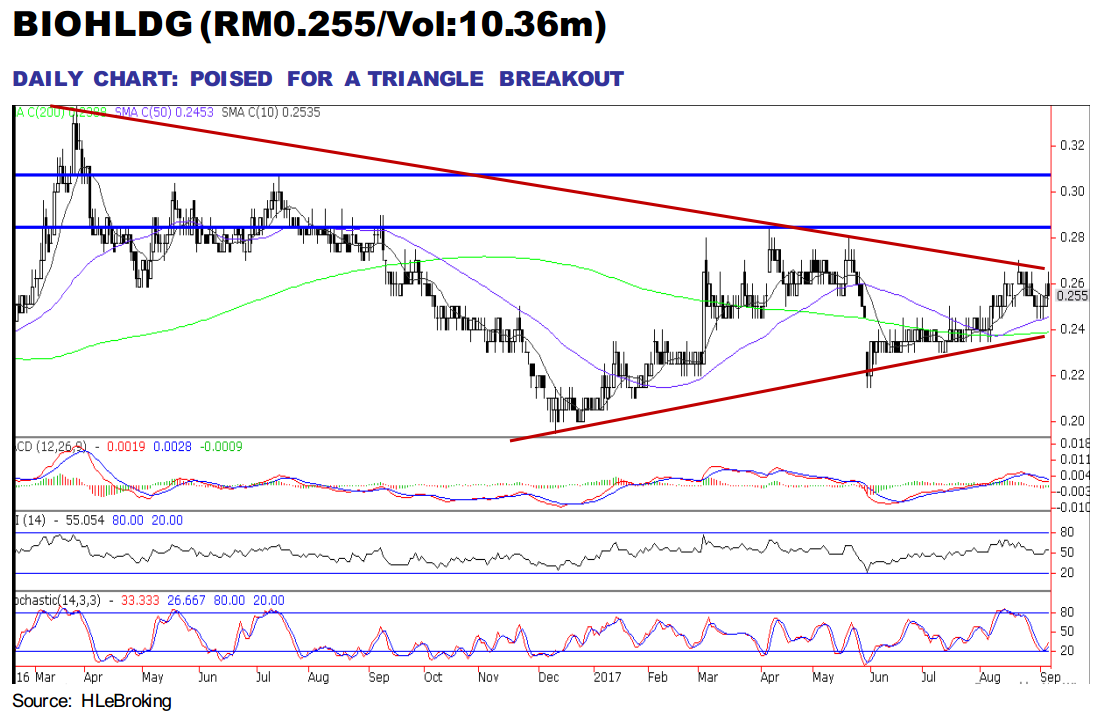

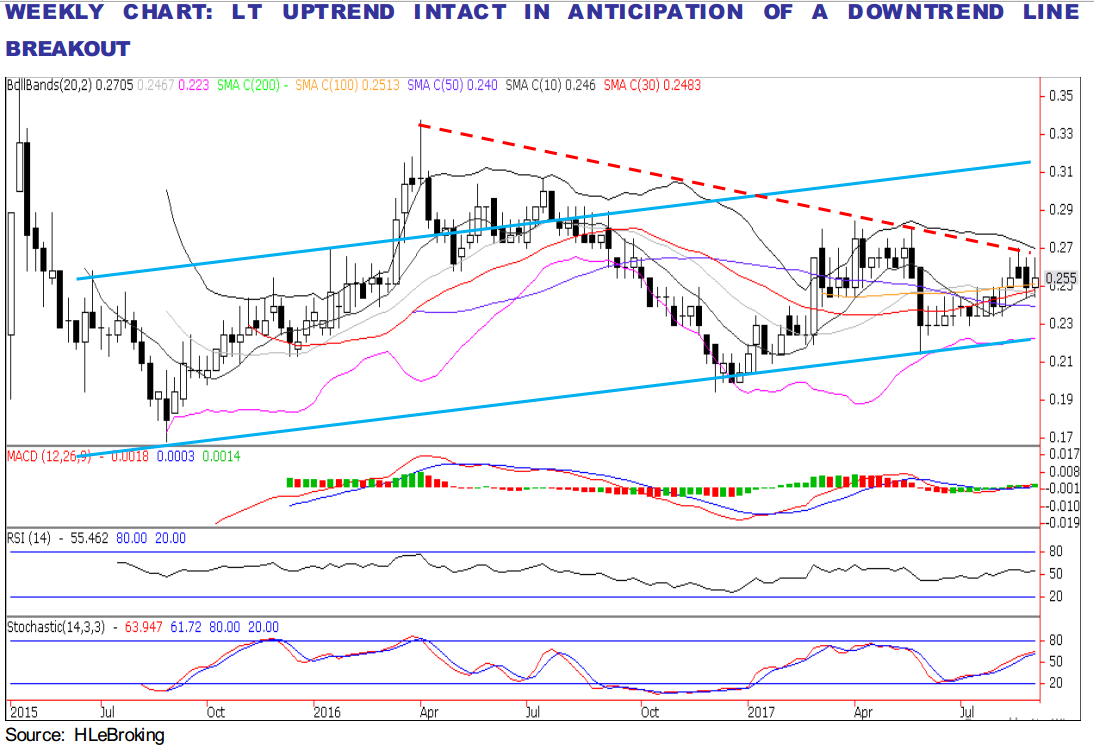

- Poised for a triangle breakout. After tumbling 41% from RM0.335 (28 Mar 2016) to a low of RM0.195 (9 Dec 2016), BIOHDLG’s share prices staged a relief rally and maintains its posture above the support trendline (near RM0.24) before ending at RM0.255 last Friday. We believe the stock is ripe for a downtrend resistance breakout soon, supported by hook-up in daily technical.

- A successful breakout above downtrend line near RM0.27 will likely to lift share prices higher towards RM0.285 (6 Apr 2017 high) before testing our LT objective at RM0.305 (15 July 2016 high). On the flip side, key supports are situated at RM0.245 (50-d SMA) and RM0.24. Cut loss at RM0.235.

Source: Hong Leong Investment Bank Research - 11 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments