HLBank Research Highlights

Trading Idea: HIBISCS – Trading interest may pick up amid firmer recovery in crude oil prices

HLInvest

Publish date: Fri, 15 Sep 2017, 09:50 AM

- Company profile. Hibiscus Petroleum Berhad (HIBISCUS) started as a special purpose acquisition company SPAC to qualify as an oil and gas production and development company. After the completion of the acquisition of Anasuria Cluster in UK during 2016, HIBISCUS managed to turnaround its business into profit in 1QFY16. Following that, HIBISCUS was also given a greenlight by Petronas to acquire 50% stake of the North Sabah Enhanced Oil Recovery (EOR) PSC and has the production rights until 2040.

- Firmer recovery of crude oil prices. Most of the traders may look into weekly stockpiles to determine the direction of the near term crude oil prices. However, with the IEA revising the demand outlook higher by 1.7% to 1.6m barrel per day, we believe that the crude stockpiles may gradually reduce and the Brent crude oil prices may maintain its upward move for the near term above the US$50 level.

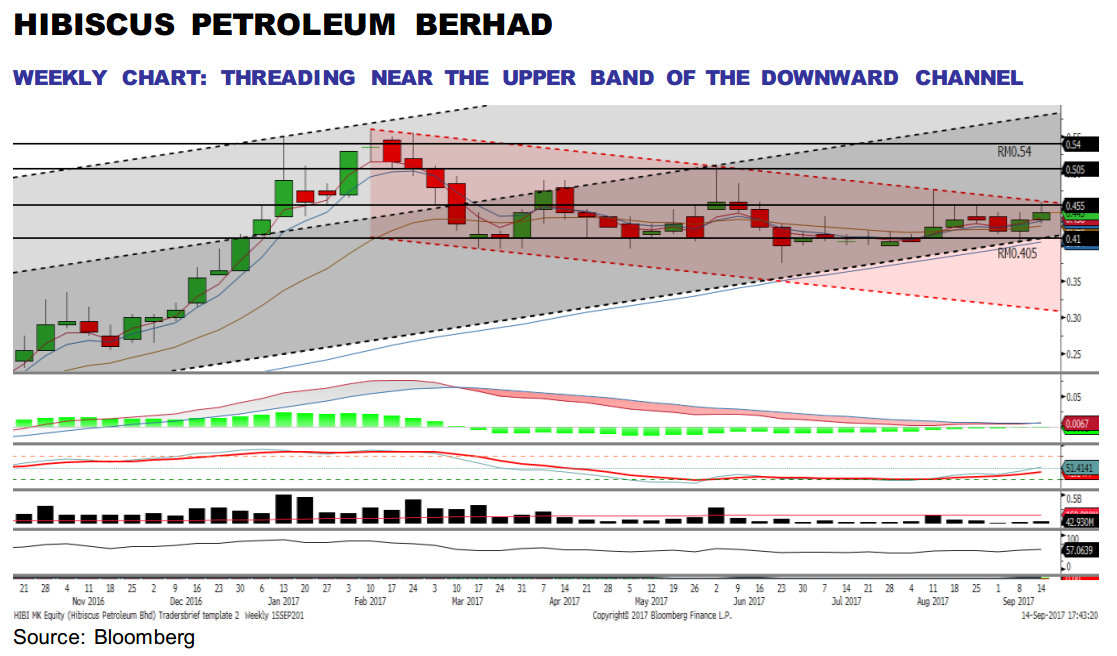

- Technical outlook. HIBISCUS has rebounded off the SMA200 level early this month, forming a higher low position vs. the trough of RM0.375 in June. The MACD Indicator has turned positive after the recent crossover signal, while the RSI is hovering near the 50 zone. Should there be a trendline breakout above the RM0.455 level, next resistance will be envisaged around RM0.475-0.505, followed by a LT target of RM0.54. Meanwhile, support will be pegged around RM0.41-0.42, with a cut loss set at RM0.405.

Source: Hong Leong Investment Bank Research - 15 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments