HLBank Research Highlights

Trading idea: KUB: Transformation bears fruits; Pending a downtrend line breakout

HLInvest

Publish date: Mon, 18 Sep 2017, 09:24 AM

- Transformed into a leaner outfit. Listed in 1997, KUB has a diverse range of businesses in Liquified Petroleum Gas (LPG), Agro, ICT, food, property, power, construction and engineering. It also has a 40% interest in KUB-Berjaya Enviro Sdn Bhd (KUB -BE) which will build, operate, maintain and manage the Bukit Tagar sanitary landfill over a 40-year concession period. In 2014, KUB-BE was also awarded a 30-year concession (expiring in 2044) to handle municipal solid waste and other non-toxic waste for the Central region of Selangor and KL.

- After undergoing restructuring over the past 5 years in an effort to turn around the company, KUB is starting to show tangible results since 2015, via its core businesses i.e. LPG, ICT and Agro coupled with KUB -BE, cumulatively contributing on average 80-90% to the group PBT.

- Undemanding valuation. As management has started to demonstrate sharper strategic focus and deliver a more convincing turnaround story in the company, via the disposals of non-performing assets to pave the way for expansions in LPG and Agro segments, downside should be limited with risks largely priced in, cushioned by a 10sen netcash/share. The stock is currently trading at 0.97x P/B and 10.3x trailing P/E (ex-cash 8.3x).

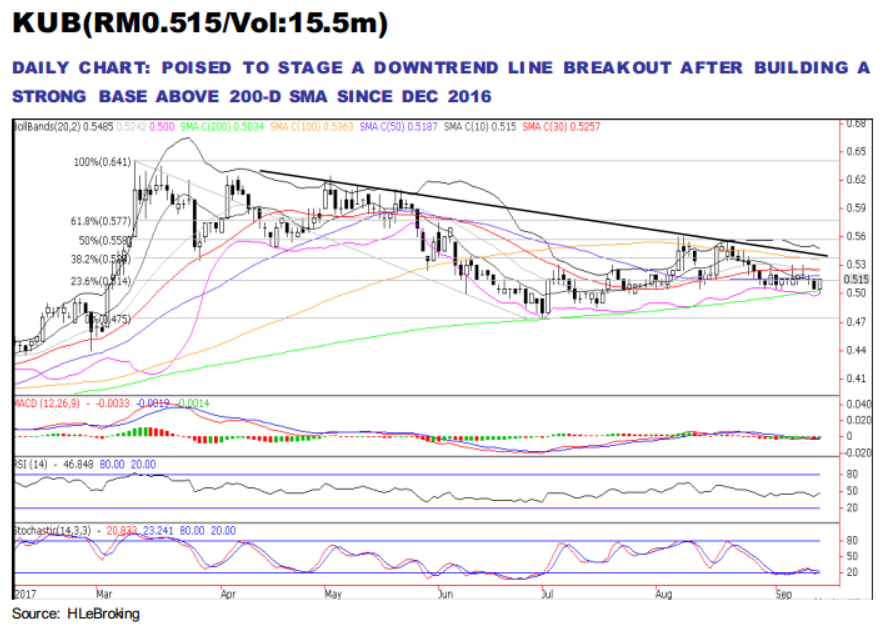

- Building a strong base above 200-d SMA, pending a downtrend line breakout to retest RM0.575-0.60. After hitting 52-week high of RM0.64 (10 March), share prices corrected 26.6% on a healthy profit taking pullback to a low of RM0.475 (3 July) before ending at RM0.515 on 15 Sep. As technical are on the mend, we remain optimistic of a potential downtrend line breakout (near RM0.535) soon as share prices are able to maintain its posture above 200-d SMA (now at RM0.50) since Dec 2016.

- Should resistance level of RM0.535 be genuinely broken, it may continue to lift price higher to the subsequent resistance levels towards RM0.575 (61.8% FR) and our LT objective at RM0.60 (76.4% FR). Key supports are RM0.50 and RM0.485 (17 July low). Cut loss at RM0.475.

Source: Hong Leong Investment Bank Research - 18 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments