HLBank Research Highlights

Trading Idea: KRONO – Gaining traction within Asia region with Quantum Storage

HLInvest

Publish date: Wed, 11 Oct 2017, 10:45 AM

- Company profile. Kronologi Asia Berhad (Krono) is involved in two main businesses, namely i) Enterprise Data Management (EDM) infrastructure technology and ii) EDM managed services, which provides comprehensive data storage services. Also, KRONO supports the process of data backup, storage, recovery, restoration, remote monitoring and disaster recovery services.

- Data storage on the upward cycle. Krono has been on an acquisition spree after acquiring in Quantum Storage India (QSI) during FY16, where QSI is able to contribute US$1m per annum towards the bottom-line on the back of profit guarantee basis. With the notable increase in earnings, Krono continues to lookout for opportunities in Hong Kong and Taiwan by acquiring stakes in Quantum Storage Hong Kong (QHK), with a profit guarantee of US$1.2m in FY17.

- EPS accretive progress. Riding on the data storage boom in the upcoming years, we opine that the addition of both business units are EPS accretive and Krono should be able to deliver a positive growth moving forward as QSI has shown a strong growth in FY17.

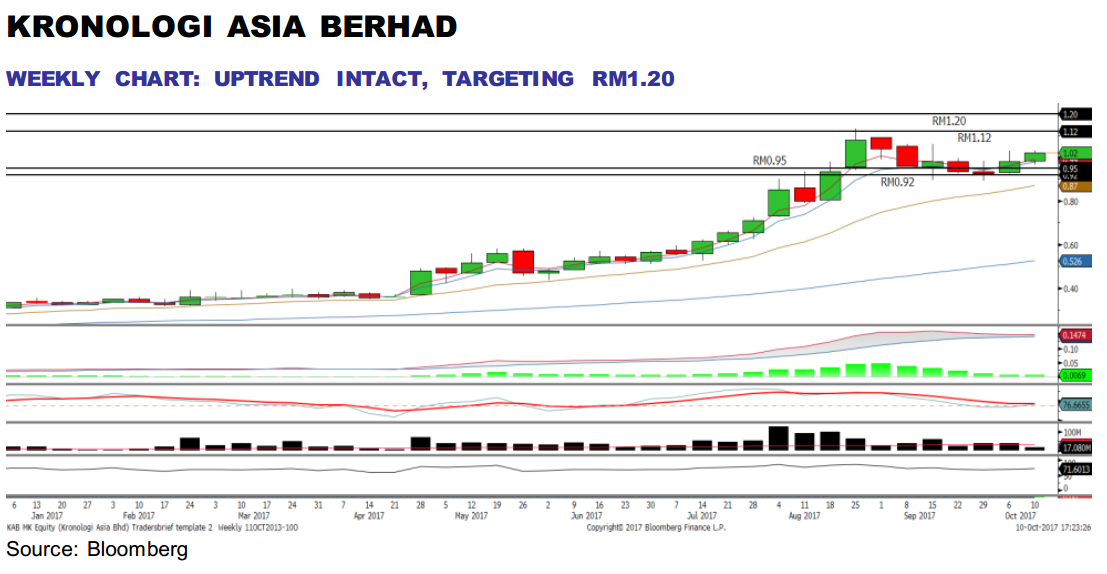

- Technical outlook. Krono share price has rebounded twice from the support of RM0.905 over the past month. Price recovered above RM1.00 recently with a flag formation breakout, accompanied by rising volumes. The MACD Indicator has issued a “Buy” signal, while the RSI is trending higher. We think the uptrend is intact and may revisit the RM1.06-RM1.12 levels and the LT target is envisaged around RM1.20. Meanwhile, support will be set around RM0.95-0.96. Cut loss will be at RM0.925.

Source: Hong Leong Investment Bank Research - 11 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments