HLBank Research Highlights

Trading Idea - Lay Hong: An established fully-integrated livestock farming players; Bottoming up to retest 52-week high at RM1.09

HLInvest

Publish date: Mon, 30 Oct 2017, 11:15 AM

- A reputable domestic integrated poultry player. Lay Hong is one of the leading fully-integrated livestock farming players in Malaysia. Bulk of the output from upstream segments (i.e. layer and broiler) will be processed into valued-added products (such as processed downstream food products, liquid eggs and functional eggs), which enjoy better profitability and less volatile selling prices vis-à-vis generic poultry products.

- HLIB institutional research has a BUY rating with SOP TP of RM01.24, or 21.6% upside. We expect Lay Hong to record a strong earnings CAGR of 47% from FY17-20, underpinned by capacity expansion for the upstream segment (i.e. layer and broiler segment), which will in turn be catered for the growing demand for downstream food products (i.e. pasteurized liquid egg, functional eggs, processed chicken products etc). This will be reinforced by its tie-up with Japan-based NH Foods to penetrate into the growing Halal food demand in Middle East region, Indonesia, Singapore, as well as catering for Olympics 2020 in Tokyo, Japan, by leveraging on NH Foods’ extensive R&D and marketing expertise in the regional markets.

- To recap, as part of its move to expand its presence in the frozen processed food product segment (in both local and overseas markets), Lay Hong had in Mar 2016 entered into a JV agreement with NH Foods Ltd (the largest food producer in Japan, by sales value) to form NHF Manufacturing (Malaysia) Sdn Bhd (NHFM, which Lay Hong owns a 49% stake while NH Foods owns the remaining 51% stake).

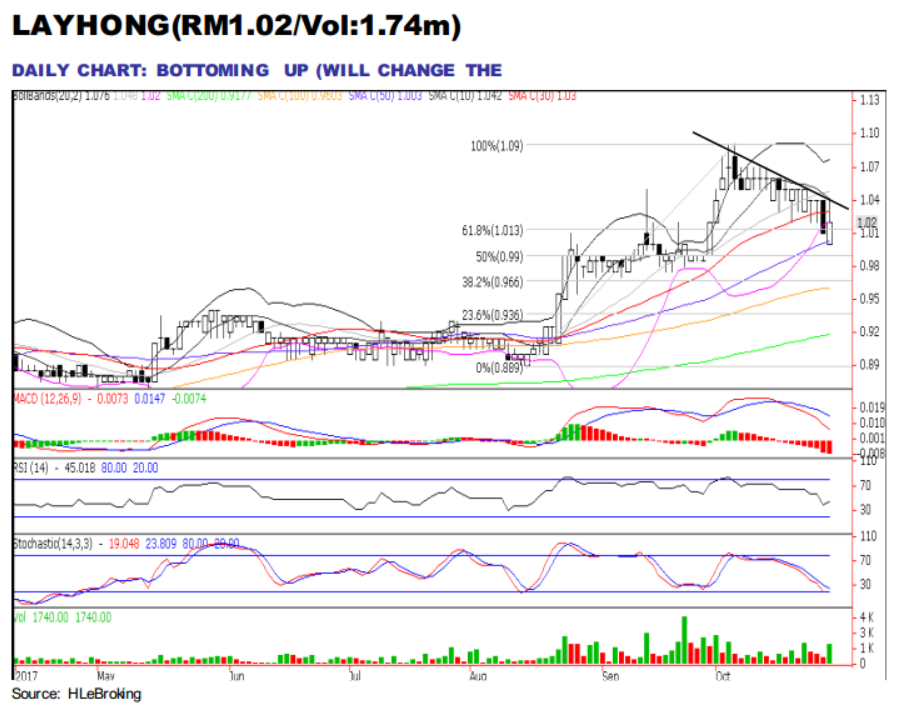

- Bottoming up. Boosted by the Government’s commitment in raising disposable income in the Budget 2018, LAYHONG’s share prices inched up 1% to RM1.02 last Friday (after falling to Oct low at RM1.00 from 52-week high of RM1.09), accompanied by a 74% surge in trading volume to 1.74m shares compared to 1M average of 1m. We opine LAYHONG is on the verge to stage a downtrend line breakout soon, supported by the bottoming up RSI and slow stochastic indicators. A successful breakout above RM1.04 will spur prices higher towards RM1.09 (5 Oct high) and RM1.13 (123.6% FP) before reaching our LT objective at RM1.19 (150% FP). Conversely, a breakdown below RM0.99 (50% FR) will trigger further selldown towards RM0.97 (61.8% FR) and RM0.935 (76.4% FR) zones. Cut loss at RM0.96.

Source: Hong Leong Investment Bank Research - 30 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments