HLBank Research Highlights

Trading Idea - DESTINI : Values emerged after fierce selldown; Ripe for a downtrend reversal

HLInvest

Publish date: Wed, 01 Nov 2017, 11:16 AM

- A leading MRO service provider. Destini is an integrated engineering solutions provider with diverse interest in the aviation, marine, land transport as well as O&G sectors. With a core business in ensuring safety and survival equipment efficiency in these industries, the Group excels in being one of the leading maintenance, repair and overhaul (MRO) service provider, covering the Asian, Australian, Middle East and European regions.

- In FY16, the marine divisions contributed 55% to revenue while the rest were from aviation (30%), O&G (10%) and land & transport (5%). Currently, Destini’s single largest shareholder is Dato’ Rozabil Abdul Rahman (Group MD) with a 24% stake, followed by Aroma Teraju (17%), a wholly-owned subsidiary of the Ministry of Finance.

- Values emerged after recent slide in share prices. Destini’s share prices nosedived 45% from YTD high of RMRM0.84 (20 Mar) to a low of RM0.465 (25 Oct) before ending at RM0.485 on 31 Oct following the sluggish 2Q17 results. According to Bloomberg consensus, Destini is currently trading at undemanding 11x FY18 P/E (38% below its average 10-year P/E of 18x) and 1.13 P/B (18% lower than 10-year average of 1.38x), supported by a strong FY16-18 EPS CAGR of 23% and healthy orderbook over RM1bn (able to last the group for 2 years).

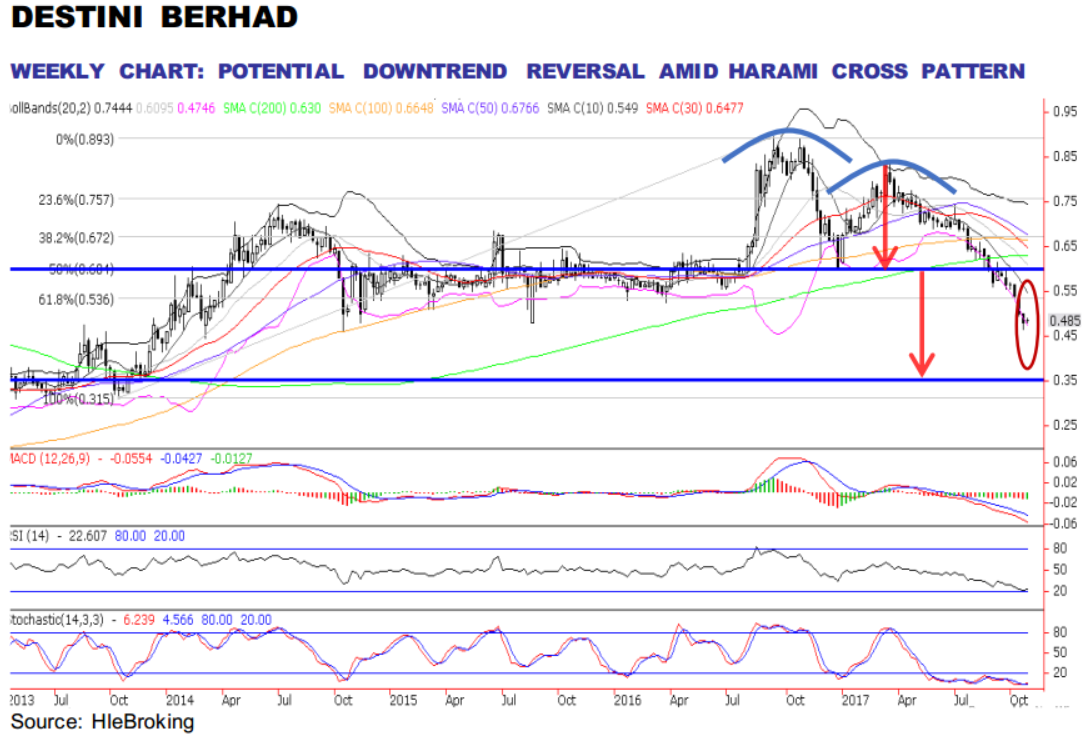

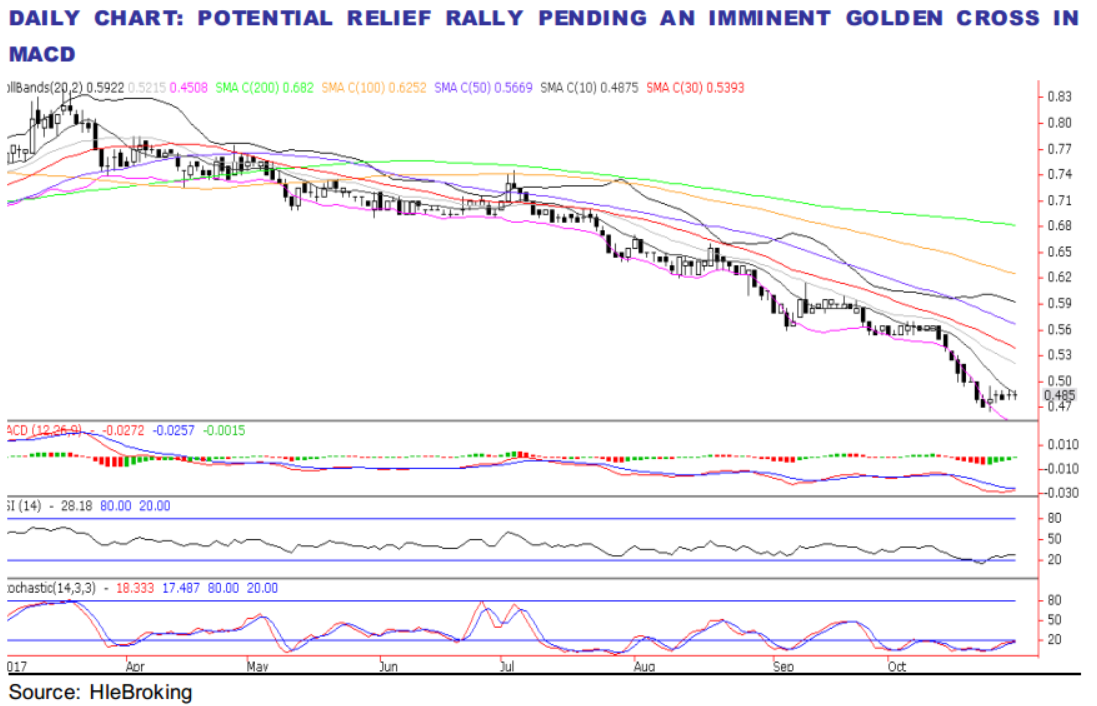

- Poised for a potential downtrend reversal. Technically, the positive Harami cross in its weekly chart and potential MACD golden cross formation in daily chart could signal a downtrend reversal after recent slump. Moreover, significant downside risks are limited amid steeply oversold indicators. A decisive breakout above RM0.50 psychological barrier may spur share prices higher towards RM0.54 (30-d SMA) before reaching our LT objective at RM0.60 (50% FR).

- Conversely, immediate supports are RM0.465 and RM0.455 (76.4% FR). A decisive break down below RM0.455 will trigger further selldown towards RM0.36 (the double top reversal objective) zones. Cut loss at RM0.445.

Source: Hong Leong Investment Bank Research - 1 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Technical tracker - HLIB Retail Research –19 July 2024 (Short-Selling)

Created by HLInvest | Jul 19, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments